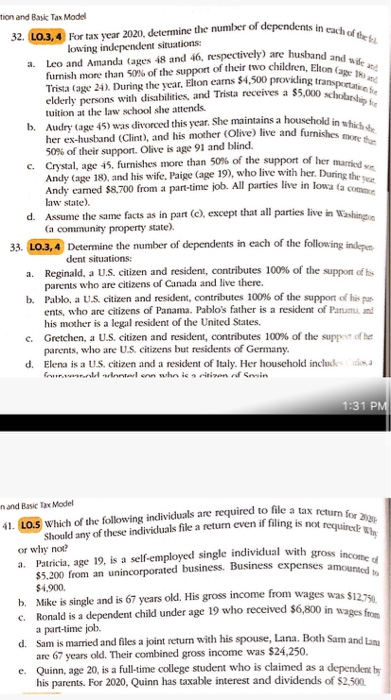

32. LO.3, 4 For tax year 2020, determine the number of dependents in each of the a. Leo and Amanda Cages 18 and 46, respectively) are husband and wide furnish more than 50% of the support of their two children, Elton Cape elderly persons with disabilities, and Trista receives a $5,000 schope Trista (age 24). During the year, Elton earns $4,500 providing transpare b. Audry (age 45) was divorced this year. She maintains a household in which her ex-husband (Clint), and his mother (Olive) live and furnishes moto 41. L0.5 Which of the following individuals are required to file a tax return for Should any of these individuals file a return even if filing is not required the a. Patricia, age 19. is a self-employed single individual with gross income of $5.200 from an unincorporated business Business expenses amounted tion and Basks Tax Model lowing independent situations: tuition at the law school she attendis. 50% of their support. Olive is age 91 and blind c. Crystal, age 45. furnishes more than 50% of the support of her married sa Andy cage 18), and his wife, Paige (age 19), who live with her. During the Andy camed $8,700 from a part-time job. All parties live in lowa ta commence law state). d. Assume the same facts as in part (c), except that all parties live in Washington Ca community property State) 33. L0.3, 4 Determine the number of dependents in each of the following indepen. dent situations: a. Reginald, a U.S. citizen and resident, contributes 100% of the support of his parents who are citizens of Canada and live there. b. Pablo, a U.S. citizen and resident, contributes 100% of the support of his par ents, who are citizens of Panama. Pablo's father is a resident of Panam. and his mother is a legal resident of the United States. c. Gretchen, a U.S. citizen and resident, contributes 100% of the support of her parents, who are U.S. citizens but residents of Germany. d. Elena is a US citizen and a resident of Italy. Her household includes Curstel en who is a citiren fin 1:31 PM nand Basic Tax Model or why not? $4.900 5. Mike is single and is 67 years old. His gross income from wages was $1253 c. Ronald is a dependent child under age 19 who received $6,800 in wages from a part-time job. d. Sam is married and files a joint return with his spouse, Lana. Both Sam and Lane are 67 years old. Their combined gross income was $24,250. e. Quinn, age 20, is a full-time college student who is claimed as a dependent by his parents. For 2020, Quinn has taxable interest and dividends of $2,500 32. LO.3, 4 For tax year 2020, determine the number of dependents in each of the a. Leo and Amanda Cages 18 and 46, respectively) are husband and wide furnish more than 50% of the support of their two children, Elton Cape elderly persons with disabilities, and Trista receives a $5,000 schope Trista (age 24). During the year, Elton earns $4,500 providing transpare b. Audry (age 45) was divorced this year. She maintains a household in which her ex-husband (Clint), and his mother (Olive) live and furnishes moto 41. L0.5 Which of the following individuals are required to file a tax return for Should any of these individuals file a return even if filing is not required the a. Patricia, age 19. is a self-employed single individual with gross income of $5.200 from an unincorporated business Business expenses amounted tion and Basks Tax Model lowing independent situations: tuition at the law school she attendis. 50% of their support. Olive is age 91 and blind c. Crystal, age 45. furnishes more than 50% of the support of her married sa Andy cage 18), and his wife, Paige (age 19), who live with her. During the Andy camed $8,700 from a part-time job. All parties live in lowa ta commence law state). d. Assume the same facts as in part (c), except that all parties live in Washington Ca community property State) 33. L0.3, 4 Determine the number of dependents in each of the following indepen. dent situations: a. Reginald, a U.S. citizen and resident, contributes 100% of the support of his parents who are citizens of Canada and live there. b. Pablo, a U.S. citizen and resident, contributes 100% of the support of his par ents, who are citizens of Panama. Pablo's father is a resident of Panam. and his mother is a legal resident of the United States. c. Gretchen, a U.S. citizen and resident, contributes 100% of the support of her parents, who are U.S. citizens but residents of Germany. d. Elena is a US citizen and a resident of Italy. Her household includes Curstel en who is a citiren fin 1:31 PM nand Basic Tax Model or why not? $4.900 5. Mike is single and is 67 years old. His gross income from wages was $1253 c. Ronald is a dependent child under age 19 who received $6,800 in wages from a part-time job. d. Sam is married and files a joint return with his spouse, Lana. Both Sam and Lane are 67 years old. Their combined gross income was $24,250. e. Quinn, age 20, is a full-time college student who is claimed as a dependent by his parents. For 2020, Quinn has taxable interest and dividends of $2,500