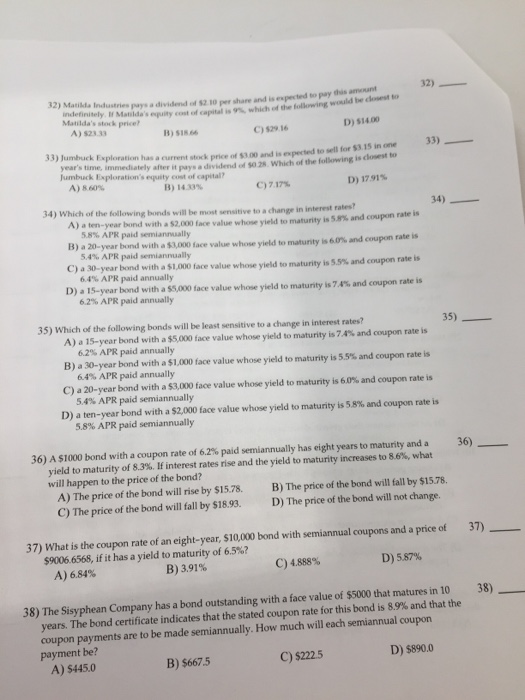

32) Matilda Industries pays a dividend of $2. 10 per share and is expected to pay this amount indefinitely " Matilda s epiity ( Matilda's stock price cost of capital is 9% which ed the following would be clone to A) 523.33 B) 518.66 ) siste C)$29.16 D) $14.00 k Exploration has a current stock price of $3.00 and is expected to sell for $3.15 in one 33) vears time, immediately after it pays a dividend of $0 28. Which of the following is closest teo Jumbuck Exploration's equity cost of capital? A)860% B) 1433% C)717% D) 17.91% 34) Which of the following bonds will be most sensitive to a change in interest rates 34) A) a ten-year bond with a $2.00 face value whose yield to maturity is 58% and E) a 20-year C) a 30-year bond with a $1,000 face value whose yield to maturity is 55% and coupon rate is D) a 15-year bond with a SS000 face value whose yield to matunty is 7.4% and coupon rate is coupon rate is 58% APR paid senianually 5.4% APR paid semiannually 64% APR paid annually 62% APR paid annually bond with a $3,000 face value whose yield to maturity is 60% and coupon rate is 35) Which of the following bonds will be least sensitive to a change in interest rates? A) a 15-year bond with a $5,000 face value whose yield to maturity is 7.4% and coupon rate is B) a 30-year bond with a $1,000 face value whose yield to maturity is 55% and coupon rate is C) a 20-year bond with a 53,000 face value whose yield to maturity is 60% and coupon rate is D) a ten-year bond with a $2.000 face value whose yield to maturity is 58% and coupon rate is 62% APR paid annually 64% APR paid annually 5.4% APR paid semiannually 5.8% APR paid semiannually 36) A $1000 bond with a coupon rate of 6.2% paid semiannually has eight years to matunty and a 36) yield to maturity of 8.3%. If interest rates rise and the yield to maturity increases to 86%, what will happen to the price of the bondi A) The price of the bond will rise by $15.78. C) The price of the bond will fall by $18,93. B) The price of the bond will fall by $15.78. D) The price of the bond will not change. 37) What is the coupon rate of an eight-year, $10,000 bond with semiannual coupons and a price of 37) $90066568, if it has a yield to maturity of 6.5%? A) 684% B) 3.91% C) 4.888% D)557% 38) 38) The Sisyphean Company has a bond outstanding with a face value of $5000 that matures in 10 years. The bond certificate indicates that the stated coupon rate for this bond is 8.9% and that the coupon payments are to be made semiannually. How much will each semiannual coupon payment be? A) $445.0 B) $667.5 C) s2225 D) 5890.0