Answered step by step

Verified Expert Solution

Question

1 Approved Answer

32. Net income 33. Accounts receivable, 12/31/2020 34. Cash and cash equivalents, 12/31/2020 35. Inventory, 12/31/2020 36. Cost of goods sold 37. Selling and administrative

32. Net income

33. Accounts receivable, 12/31/2020

34. Cash and cash equivalents, 12/31/2020

35. Inventory, 12/31/2020

36. Cost of goods sold

37. Selling and administrative expenses

38. Total liabilities, 12/31/2020

39. Ordinary share capital, 12/31/2020

40. Retained earnings, 12/31/2020

41. Property, plant and equipment, 12/31/2020

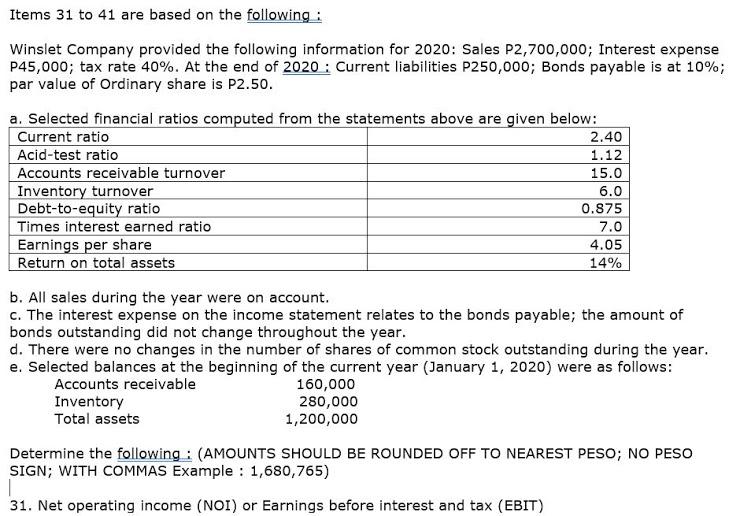

Items 31 to 41 are based on the following: Winslet Company provided the following information for 2020: Sales P2,700,000; Interest expense P45,000; tax rate 40%. At the end of 2020 : Current liabilities P250,000; Bonds payable is at 10%; par value of Ordinary share is P2.50. a. Selected financial ratios computed from the statements above are given below: Current ratio 2.40 Acid-test ratio 1.12 Accounts receivable turnover 15.0 Inventory turnover 6.0 Debt-to-equity ratio 0.875 Times interest earned ratio 7.0 Earnings per share 4.05 Return on total assets 14% b. All sales during the year were on account. c. The interest expense on the income statement relates to the bonds payable; the amount of bonds outstanding did not change throughout the year. d. There were no changes in the number of shares of common stock outstanding during the year. e. Selected balances at the beginning of the current year (January 1, 2020) were as follows: Accounts receivable 160,000 Inventory 280,000 Total assets 1,200,000 Determine the following: (AMOUNTS SHOULD BE ROUNDED OFF TO NEAREST PESO; NO PESO SIGN; WITH COMMAS Example : 1,680,765) 31. Net operating income (NOI) or Earnings before interest and tax (EBIT)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started