Answered step by step

Verified Expert Solution

Question

1 Approved Answer

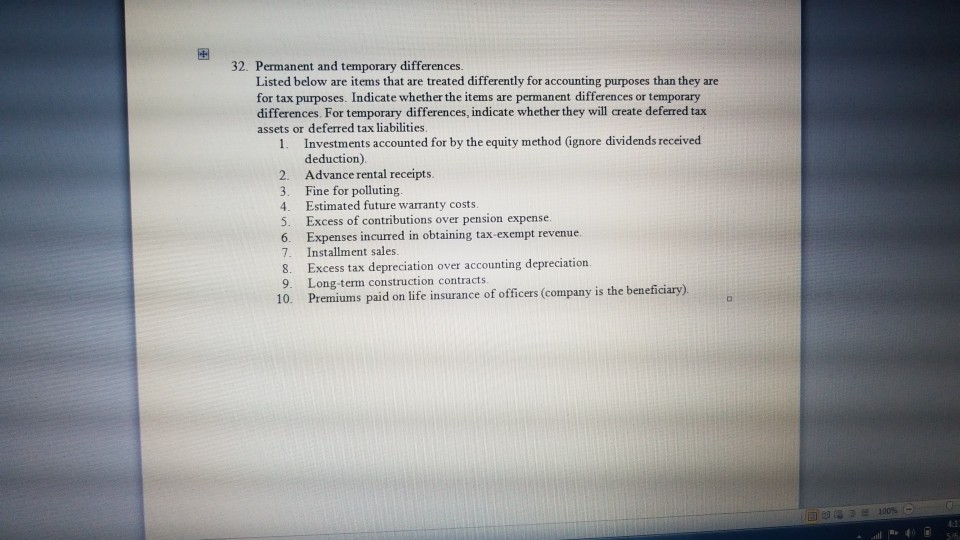

32. Permanent and temporary differences Listed below are items that are treated differently for accounting purposes than they are for tax purposes. Indicate whether the

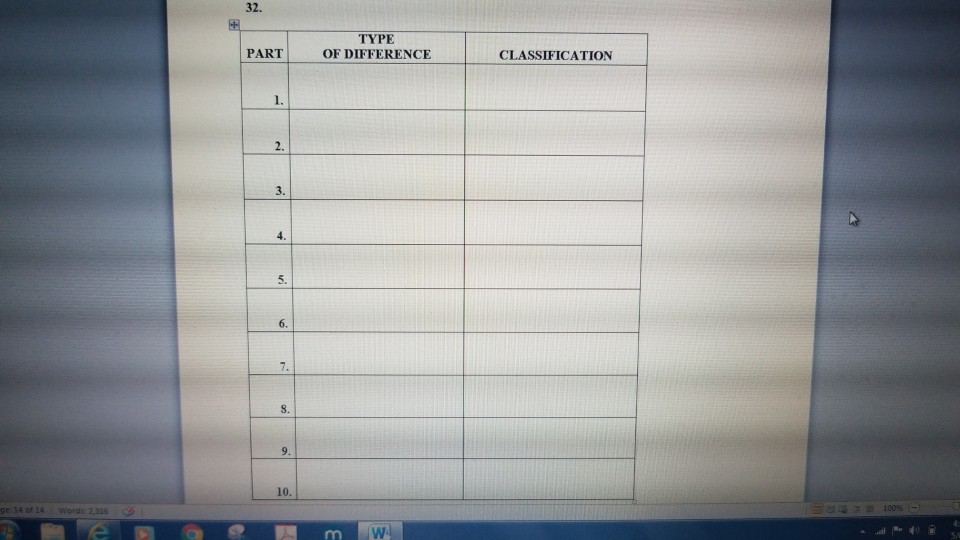

32. Permanent and temporary differences Listed below are items that are treated differently for accounting purposes than they are for tax purposes. Indicate whether the items are permanent differences or temporary differences. For temporary differences, indicate whether they will create deferred tax assets or deferred tax liabilities 1. Investments accounted for by the equity method Ggnore dividends received deduction) 2. Advance rental receipts. 3. Fine for polluting 4. Estimated future warranty costs. 5. Excess of contributions over pension expense 6. Expenses incurred in obtaining tax exempt revenue. 7. Installment sales 8. Excess tax depreciation over accounting depreciation. 9. Long-term construction contracts 10. Premiums paid on life insurance of officers (company is the beneficiary). 13

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started