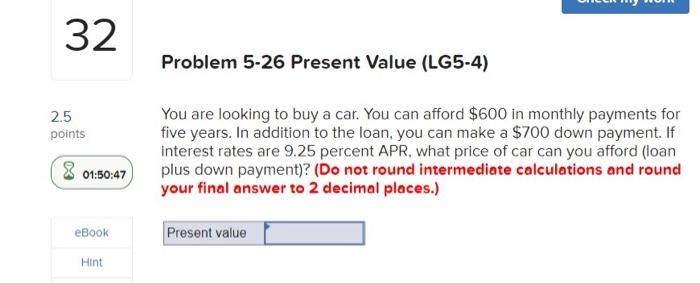

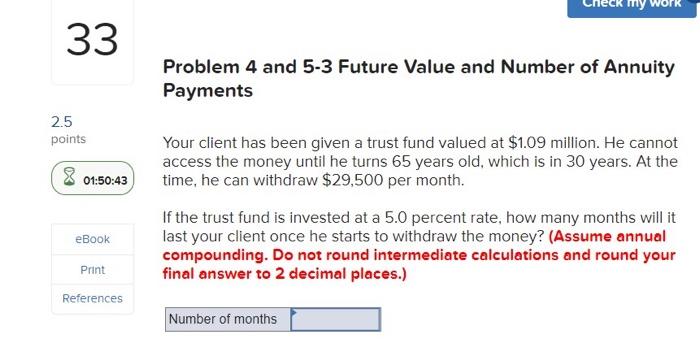

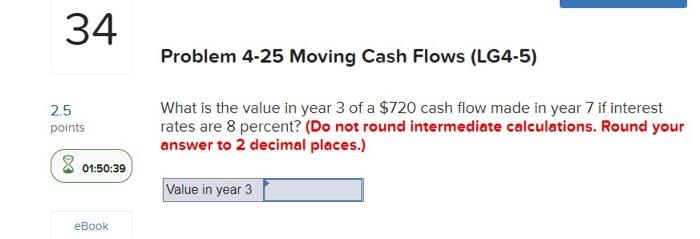

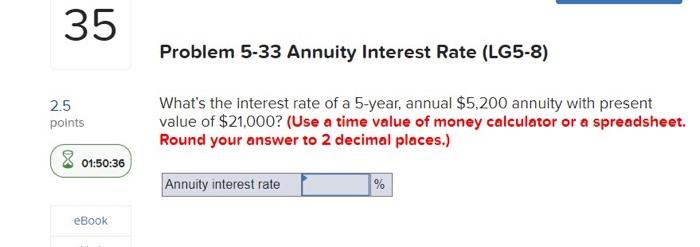

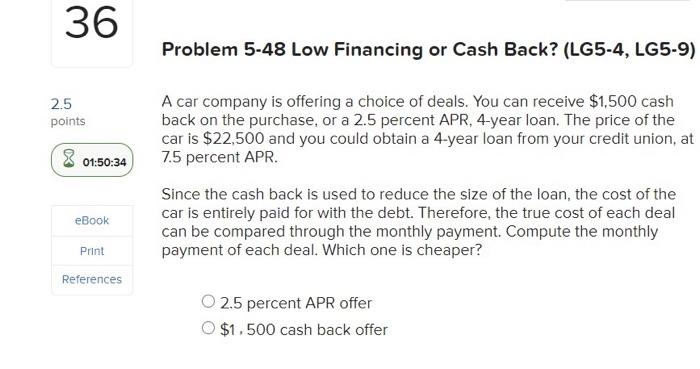

32 Problem 5-26 Present Value (LG5-4) 2.5 points You are looking to buy a car. You can afford $600 in monthly payments for five years. In addition to the loan, you can make a $700 down payment. If interest rates are 9.25 percent APR, what price of car can you afford (loan plus down payment)? (Do not round intermediate calculations and round your final answer to 2 decimal places.) 2 01:50:47 eBook Present value Hint my 33 Problem 4 and 5-3 Future Value and Number of Annuity Payments 2.5 points 01:50:43 Your client has been given a trust fund valued at $1.09 million. He cannot access the money until he turns 65 years old, which is in 30 years. At the time, he can withdraw $29,500 per month. If the trust fund is invested at a 5.0 percent rate, how many months will it last your client once he starts to withdraw the money? (Assume annual compounding. Do not round intermediate calculations and round your final answer to 2 decimal places.) eBook Print References Number of months 34 Problem 4-25 Moving Cash Flows (LG4-5) 2.5 points What is the value in year 3 of a $720 cash flow made in year 7 if interest rates are 8 percent? (Do not round intermediate calculations. Round your answer to 2 decimal places.) 2 01:50:39 Value in year 3 eBook 35 Problem 5-33 Annuity Interest Rate (LG5-8) 2.5 points What's the interest rate of a 5-year, annual $5,200 annuity with present value of $21,000? (Use a time value of money calculator or a spreadsheet. Round your answer to 2 decimal places.) 01:50:36 Annuity interest rate % eBook 36 Problem 5-48 Low Financing or Cash Back? (LG5-4, LG5-9) 2.5 points A car company is offering a choice of deals. You can receive $1,500 cash back on the purchase, or a 2.5 percent APR. 4-year loan. The price of the car is $22,500 and you could obtain a 4-year loan from your credit union, at 7.5 percent APR. 01:50:34 eBook Since the cash back is used to reduce the size of the loan, the cost of the car is entirely paid for with the debt. Therefore, the true cost of each deal can be compared through the monthly payment. Compute the monthly payment of each deal. Which one is cheaper? Print References O 2.5 percent APR offer $1.500 cash back offer