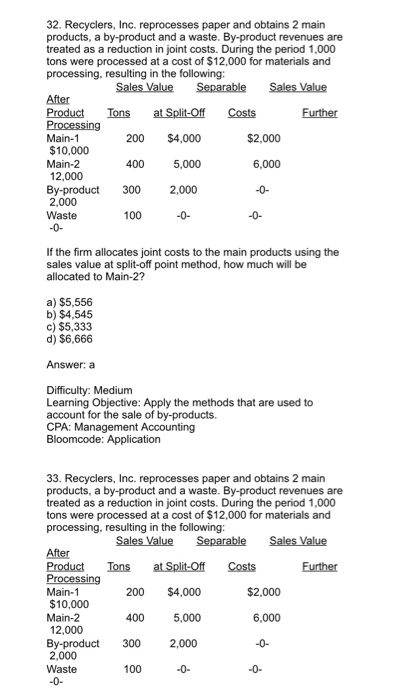

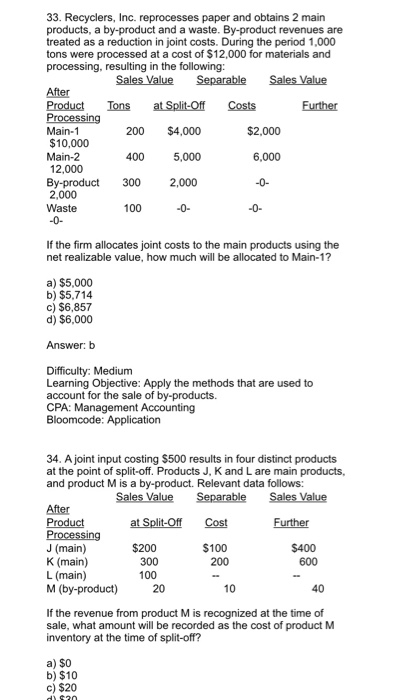

32. Recyclers, Inc. reprocesses paper and obtains 2 main products, a by-product and a waste. By-product revenues are treated as a reduction in joint costs. During the period 1,000 tons were processed at a cost of $12,000 for materials and processing, resulting in the following After Product Ions at Split-Off Costs Further Main-1 $10,000 Main-2 12,000 By-product 300 2,000 Waste 200 $4,000 400 5,000 2,000 $2,000 6,000 100 If the firm allocates joint costs to the main products using the sales value at split-off point method, how much will be allocated to Main-2? a) $5,556 b) $4,545 c) $5,333 d) $6,666 Answer: a Difficulty: Medium Learning Objective:Apply the methods that are used to account for the sale of by-products. CPA: Management Accounting 33. Recyclers, Inc. reprocesses paper and obtains 2 mairn products, a by-product and a waste. By-product revenues are treated as a reduction in joint costs. During the period 1,000 tons were processed at a cost of $12,000 for materials and processing, resulting in the following: After Product Tons at Split-Off Costs Further Main-1 $10,000 Main-2 12,000 By-product 300 2,000 2,000 Waste 200 $4,000 $2,000 5,000 6,000 100 33. Recyclers, Inc. reprocesses paper and obtains 2 main products, a by-product and a waste. By-product revenues are treated as a reduction in joint costs. During the period 1,000 tons were processed at a cost of $12,000 for materials and processing, resulting in the following: After Product Tons at Split-Off Costs Further Main-1 $10,000 Main-2 12,000 By-product 300 2,000 Waste $2,000 200 $4,000 5,000 2,000 6,000 100 If the firm allocates joint costs to the main products using the net realizable value, how much will be allocated to Main-1 a) $5,000 b) $5,714 c) $6,857 d) $6,000 Answer: b Difficulty: Medium Learning Objective: Apply the methods that are used to account for the sale of by-products. CPA: Management Accounting 34. A joint input costing $500 results in four distinct products at the point of split-off. Products J, K and L are main products, and product M is a by-product. Relevant data follows: Product Further Processingat Sali.Off Cost J (main) K (main) L (main) M (by-product) $100 200 $400 600 100 20 10 40 If the revenue from product M is recognized at the time of sale, what amount will be recorded as the cost of product M inventory at the time of split-off? a) $O b) $10 c) $20