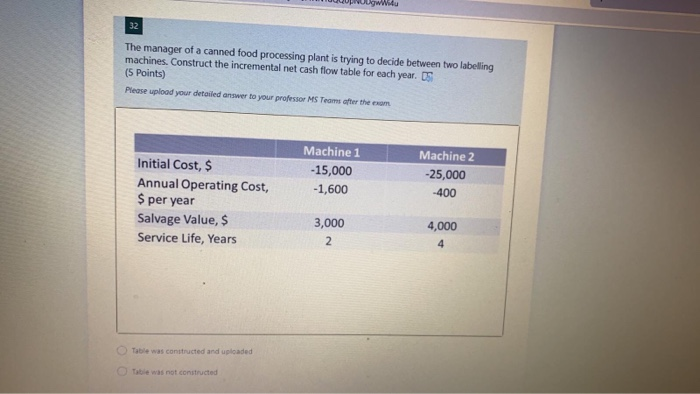

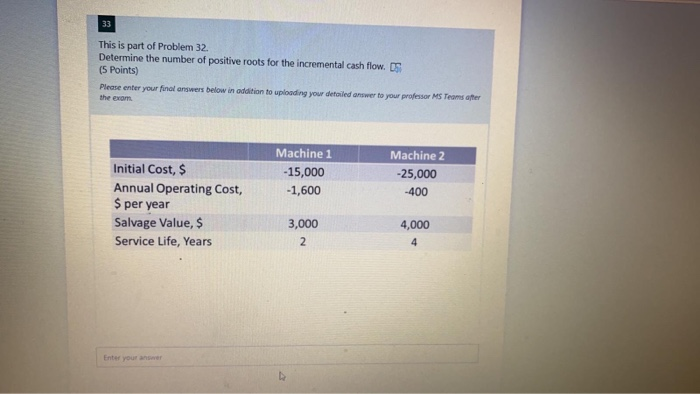

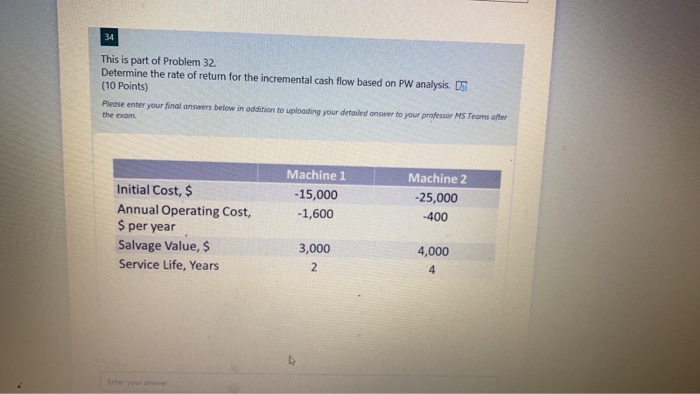

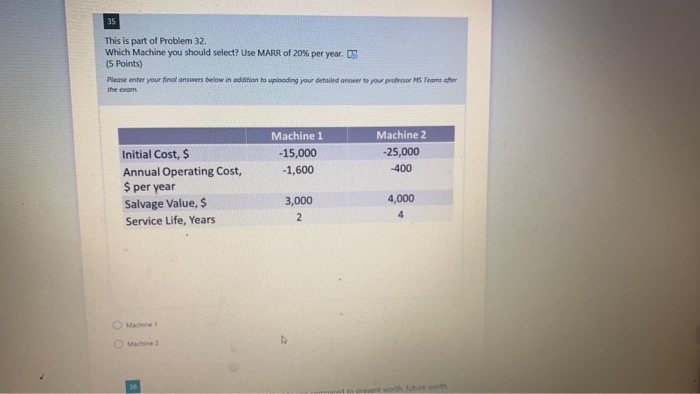

32 The manager of a canned food processing plant is trying to decide between two labelling machines. Construct the incremental net cash flow table for each year. 05 (5 Points) Please upload your detailed answer to your professor MS Teams after the com Machine 1 -15,000 -1,600 Machine 2 -25,000 -400 Initial Cost, $ Annual Operating cost, $ per year Salvage Value, $ Service Life, Years 3,000 2 4,000 4 Table was constructed and uploaded Table was not constructed 33 This is part of Problem 32. Determine the number of positive roots for the incremental cash flow. OS (5 Points) Please enter your final answers below in addition to uploading your detailed answer to your professor MS Toms after the exam Machine 1 -15,000 -1,600 Machine 2 -25,000 -400 Initial Cost, $ Annual Operating cost, $ per year Salvage Value, $ Service Life, Years 3,000 2 4,000 4 Enter your answer 34 This is part of Problem 32. Determine the rate of return for the incremental cash flow based on PW analysis. DS (10 Points) Please enter your final answers below in addition to uploading your detailed answer to your professor MS Teams after the exam Machine 1 -15,000 -1,600 Machine 2 -25,000 -400 Initial Cost, $ Annual Operating cost, $ per year Salvage Value, $ Service Life, Years 3,000 2 4,000 4 35 This is part of Problem 32. Which Machine you should select? Use MARR of 20% per year. DS (5 Points) Please enter your final answers below in addition to uploading your detailed answer to your professor MS Teomt after the exom Machine 1 -15,000 -1,600 Machine 2 -25,000 -400 Initial Cost, $ Annual Operating cost, $ per year Salvage Value, $ Service Life, Years 4,000 3,000 2 4 Machines Machine 3 32 The manager of a canned food processing plant is trying to decide between two labelling machines. Construct the incremental net cash flow table for each year. 05 (5 Points) Please upload your detailed answer to your professor MS Teams after the com Machine 1 -15,000 -1,600 Machine 2 -25,000 -400 Initial Cost, $ Annual Operating cost, $ per year Salvage Value, $ Service Life, Years 3,000 2 4,000 4 Table was constructed and uploaded Table was not constructed 33 This is part of Problem 32. Determine the number of positive roots for the incremental cash flow. OS (5 Points) Please enter your final answers below in addition to uploading your detailed answer to your professor MS Toms after the exam Machine 1 -15,000 -1,600 Machine 2 -25,000 -400 Initial Cost, $ Annual Operating cost, $ per year Salvage Value, $ Service Life, Years 3,000 2 4,000 4 Enter your answer 34 This is part of Problem 32. Determine the rate of return for the incremental cash flow based on PW analysis. DS (10 Points) Please enter your final answers below in addition to uploading your detailed answer to your professor MS Teams after the exam Machine 1 -15,000 -1,600 Machine 2 -25,000 -400 Initial Cost, $ Annual Operating cost, $ per year Salvage Value, $ Service Life, Years 3,000 2 4,000 4 35 This is part of Problem 32. Which Machine you should select? Use MARR of 20% per year. DS (5 Points) Please enter your final answers below in addition to uploading your detailed answer to your professor MS Teomt after the exom Machine 1 -15,000 -1,600 Machine 2 -25,000 -400 Initial Cost, $ Annual Operating cost, $ per year Salvage Value, $ Service Life, Years 4,000 3,000 2 4 Machines Machine 3