Question: 32. The value of a bond is calculated * 1 point using the present value of discounted cash flows. What is the discount rate? A.

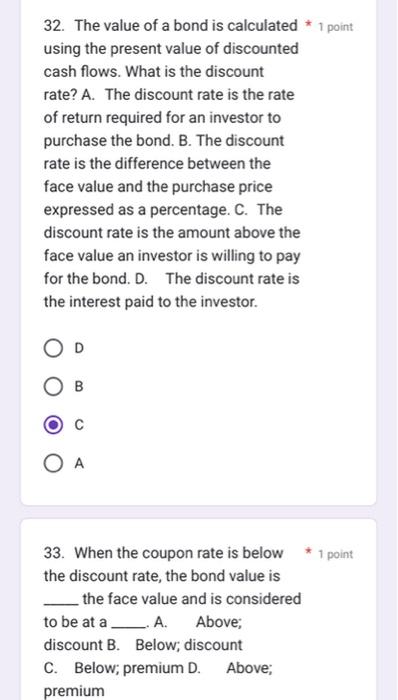

32. The value of a bond is calculated * 1 point using the present value of discounted cash flows. What is the discount rate? A. The discount rate is the rate of return required for an investor to purchase the bond. B. The discount rate is the difference between the face value and the purchase price expressed as a percentage. C. The discount rate is the amount above the face value an investor is willing to pay for the bond. D. The discount rate is the interest paid to the investor. D B C A 33. When the coupon rate is below * 1 point the discount rate, the bond value is the face value and is considered to be at a A. Above; discount B. Below; discount C. Below; premium D. Above; premium

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts