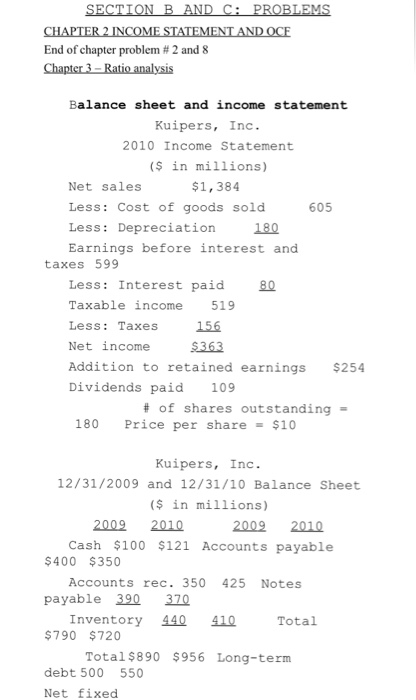

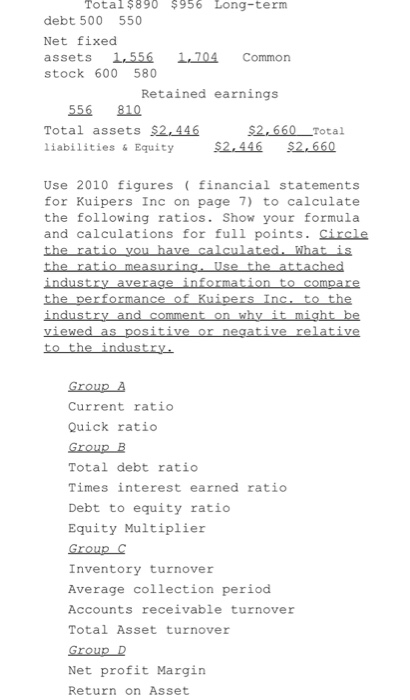

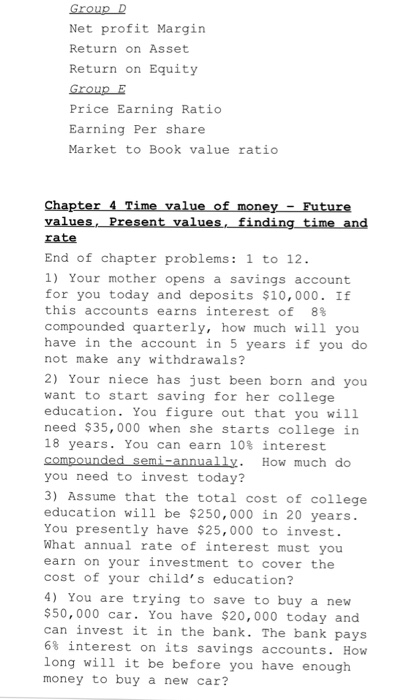

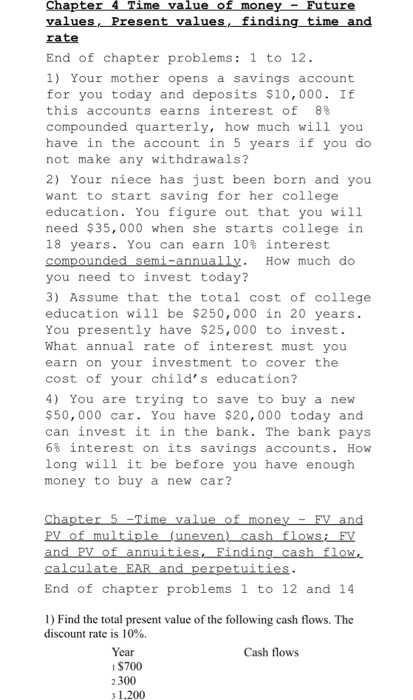

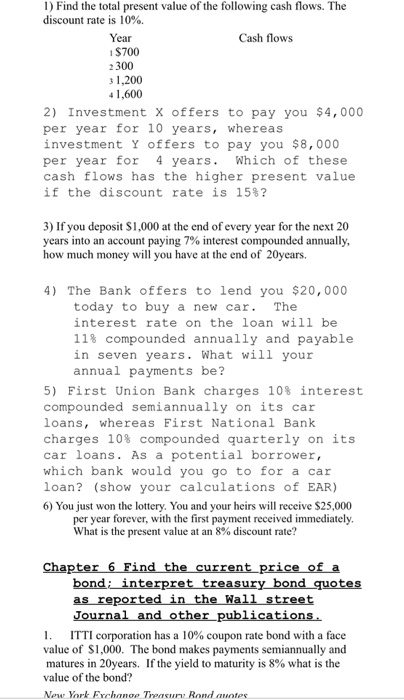

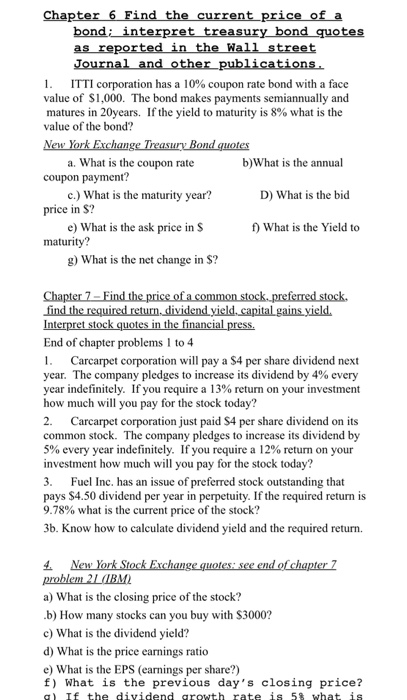

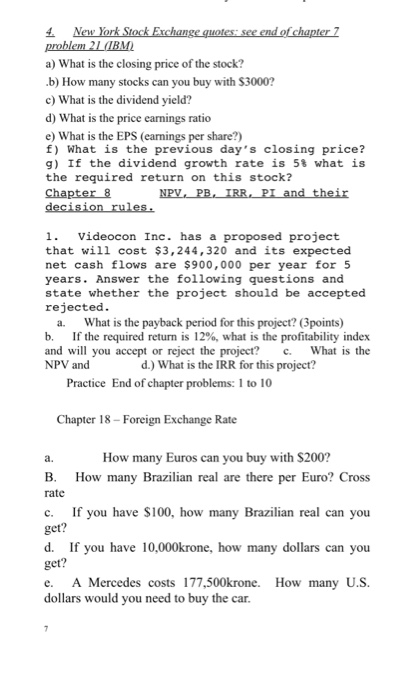

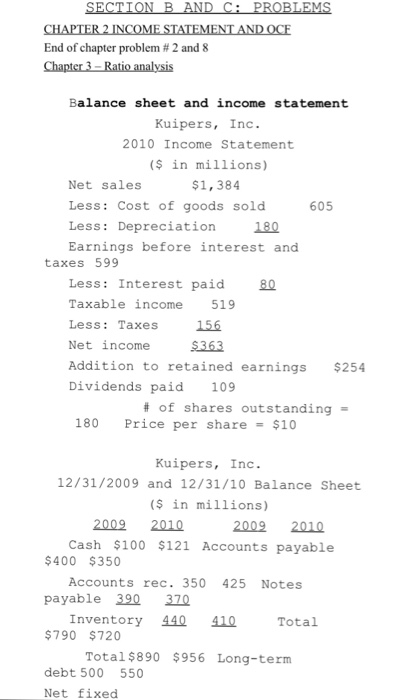

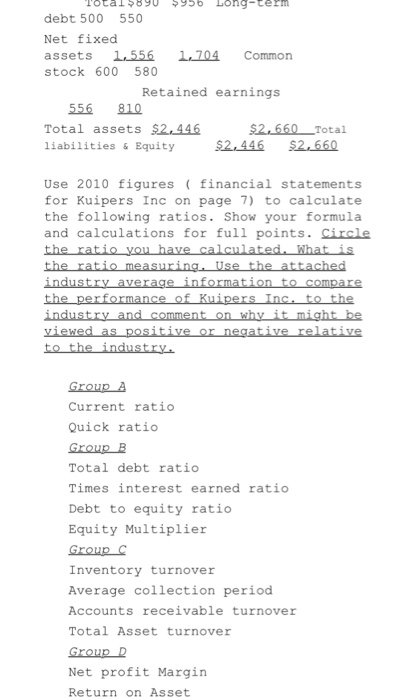

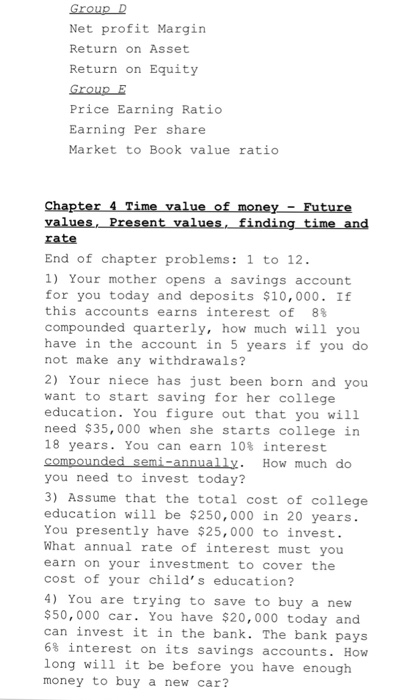

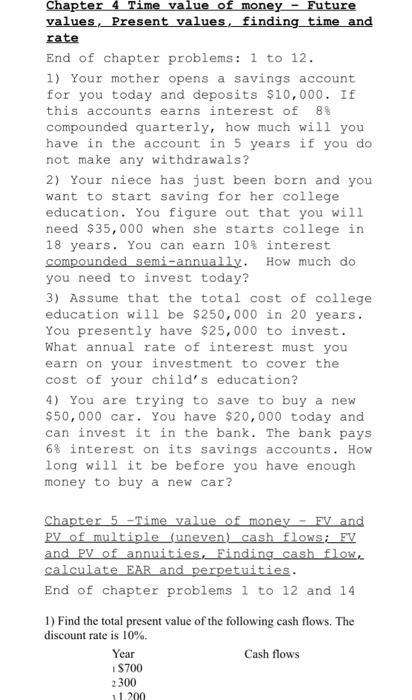

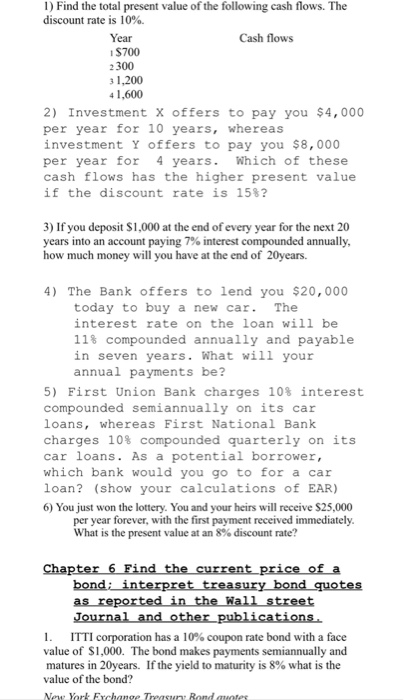

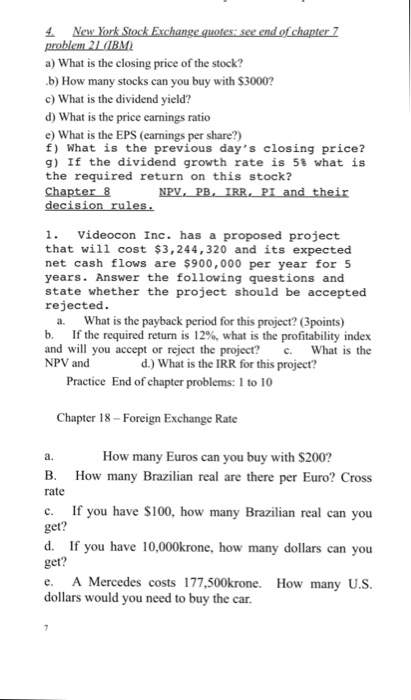

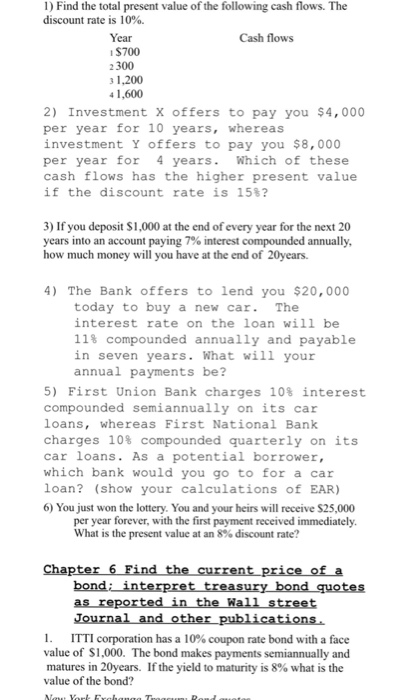

End of chapter problem # 2 and 8 Balance sheet and income statement Kuipers, Inc. 2010 Income Statement ($ in millions) Net sales Less: Cost of goods sold Less: Depreciation Earnings before interest and $1,384 605 180 taxes 599 Less: Interest paid 80 Taxable income 519 Less: Taxes Net income Addition to retained earnings Dividends paid 109 156 $363 $254 # of shares outstanding 180 Price per share-$10 Kuipers, Inc. 12/31/2009 and 12/31/10 Balance Sheet ($ in millions) 2009 2010 2009 2010 Cash $100 $121 Accounts payable $400 $350 Accounts rec. 350 425 Notes payable 390 310 Inventory 440 410 Total $790 $720 Total$890 $956 Long-term debt 500 550 Net fixed Total$890 $956 Long-term debt 500 550 Net fixed assets 1556 1,704 Common stock 600 580 Retained earnings 556 810 Total assets $2,446 liabilities&Equity $2,660 Total S2.446 S2.660 Use 2010 figures financial statements for Kuipers Inc on page 7) to calculate the following ratios. Show your formula and calculations for full points. Circle Group A Current ratio Quick ratio GrOUr B Total debt ratio Times interest earned rati Debt to equity ratio Equity Multiplier Group C Inventory turnover Average collection period Accounts receivable turnover Total Asset turnover GrOUr D Net profit Margin Return on Asset Net profit Margin Return on Asset Return on Equity GroupE Price Earning Ratio Earning Per share Market to Book value ratio rate End of chapter problems: 1 to 12 1) Your mother opens a savings account for you today and deposits $10,000. If this accounts earns interest of 8% compounded quarterly, how much will you have in the account in 5 years if you do not make any withdrawals? 2) Your niece has just been born and you want to start saving for her college education. You figure out that you will need $35,000 when she starts college in 18 years. You can earn 10% interest compounded semi-annually. How much do you need to invest today? 3) Assume that the total cost of college education will be $250, 000 in 20 years. You presently have $25,000 to invest. What annual rate of interest must you earn on your investment to cover the cost of your child' s education? 4) You are trying to save to buy a new $50,000 car. You have $20,000 today and can invest it in the bank. The bank pays 6% interest on its savings accounts. How long will it be before you have enough money to buy a new car? rate End of chapter problems: 1 to 12. 1) Your mother opens a savings account for you today and deposits $10,000. If this accounts earns interest of 8% compounded quarterly, how much will you have in the account in 5 years if you do not make any withdrawals? 2) Your niece has just been born and you want to start saving for her college education. You figure out that you will need $35,000 when she starts college in 18 years. You can earn 10% interest compounded semi-annually. How much do you need to invest today? 3) Assume that the total cost of college education will be $250,000 in 20 years. You presently have $25,000 to invest. What annual rate of interest must you earn on your investment to cover the cost of your child's education? 4) You are trying to save to buy a new $50,000 car. You have $20,000 today and can invest it in the bank. The bank pays 6% interest on its savings accounts. How long will it be before you have enough money to buy a new car? End of chapter problems 1 to 12 and 14 I) Find the total present value of the following cash flows. The discount rate is 10%. Cash flows ear $700 2300 1,200 1) Find the total present value of the following cash flows. The discount rate is 10%. Cash flows ear $700 2 300 1,200 4 1,600 2) Investment X offers to pay you $4,000 per year for 10 years, whereas investment Y offers to pay you $8,000 per year for 4 years. Which of these cash flows has the higher present value if the discount rate is 15% 3) If you deposit $1,000 at the end of every year for the next 20 years into an account paying 7% interest compounded annually. how much money will you have at the end of 20years. 4) The Bank offers to lend you $20,000 today to buy a new car The interest rate on the loan will be 11% compounded annually and payable in seven years. What will your annual payments be? 5) First Union Bank charges 10% interest compounded semiannually on its car loans, whereas First National Bank charges 10% compounded quarterly on its car loans. As a potential borrower, which bank would you go to for a car loan? (show your calculations of EAR) 6) You just won the lottery. You and your heirs will receive $25,000 per year forever, with the first payment received immediately What is the present value at an 8% discount rate? Chapt bond: interp as re quotes I, ITTI corporation has a 10% coupon rate bond with a face value of S1,000. The bond makes payments semiannually and matures in 20years. If the yield to maturity is 8% what is the value of the bond? New York Erchanoe Treasu Rond auotes bond: interpret treasury bond quotes as repo ITTI corporation has a 10% coupon rate bond with a face value of S1,000. The bond makes payments semiannually and matures in 20years. If the yield to maturity is 8% what is the value of the bond? a. What is the coupon rate c.) What is the maturity year? e) What is the ask price in S g) What is the net change in S? b)What is the annual coupon payment? price in S? maturity? D) What is the bid What is the Yield to End of chapter problems1 to 4 Carcarpet corporation will pay a $4 per share dividend next year. The company pledges to increase its dividend by 4% every r indefinitely. If you req ure a 13% return on your investment yca how much will you pay for the stock today? 2. Carcarpet corporation just paid S4 per share dividend on its common stock. The company pledges to increase its dividend by 5% every year indefinitely. If you require a 12% return on your investment how much will you pay for the stock today? 3. Fuel Inc. has an issue of preferred stock outstanding that pays $4.50 dividend per year in perpetuity. If the required return is 9.78% what is the current price of the stock? 3b. Know how to calculate dividend yield and the required return. problem2LIBM a) What is the closing price of the stock? b) How many stocks can you buy with $3000? c What is the dividend yield? d) What is the price earnings ratio e) What is the EPS (earnings per share?) f) What is the previous day's closing price? If the dividend growth rate is 5% what is a) What is the closing price of the stock? b) How many stocks can you buy with $3000? c) What is the dividend yield? d) What is the price earnings ratio e) What is the EPS (earnings per share?) f) What is the previous day's closing price? g) If the dividend growth rate is 5% what is the required return on this stock? Chapter 8 1. Videocon Inc. has a proposed project that will cost $3,244,320 and its expected net cash flows are $900,000 per year for 5 years. Answer the following questions and state whether the project should be accepted rejected a. What is the payback period for this project? (3points) b. If the required return is 12%, what is the profitability index and will you accept or reject the project?c. What is the NPV and d.) What is the IRR for this project? Practice End of chapter problems: to 10 Chapter 18- Foreign Exchange Rate How many Euros can you buy with $200? a. B. How many Brazilian real are there per Euro? Cross rate c. If you have $100, how many Brazilian real can you get d. If you have 10,000krone, how many dollars can you get e. A Mercedes costs 177,500krone. How many U.S. dollars would you need to buy the car End of chapter problem # 2 and 8 Balance sheet and income statement Kuipers, Inc. 2010 Income Statement ($ in millions) Net sales Less: Cost of goods sold Less: Depreciation Earnings before interest and $1,384 605 taxes 599 Less: Interest paid 80 Taxable income 519 Less: Taxes 156 Net income $363 Addition to retained earnings $254 Dividends paid 109 # of shares outstanding- 180 Price per share = $10 Kuipers,Inc. 12/31/2009 and 12/31/10 Balance Sheet ($ in millions) 2009 2010 Cash $100 $121 Accounts payable 2009 2010 $400 $350 Accounts rec. 350 425 Notes payable 390 370 Inventory 440 410 Total $790 $720 Total $890 $956 Long-term debt 500 550 Net fixed debt 500 550 Net fixed assets 1.556 1704 Common stock 600 580 Retained earnings 556 810 Total assets $2,446 liabilities& Equity $2,446 $2,660 Use 2010 figures financial statements for Kuipers Inc on page 7) to calculate the following ratios. Show your formula and calculations for full points. irale Group A Current ratio Quick ratio Group E Total debt ratio Times interest earned ratio Debt to equity ratio Equity Multiplier Group C Inventory turnover Average collection period Accounts receivable turnover Total Asset turnover Group D Net profit Margin Return on Asset Group D Net profit Margin Return on Asset Return on Equity GrOupE Price Earning Ratio Earning Per share Market to Book value ratio rate End of chapter problems: 1 to 12. 1) Your mother opens a savings account for you today and deposits $10,000. If this accounts earns interest of 8% compounded quarterly, how much will you have in the account in 5 years if you do not make any withdrawals? 2) Your niece has just been born and you want to start saving for her college education. You figure out that you will need $35,000 when she starts college in 18 years. You can earn 10% interest ow muc you need to invest today? 3) Assume that the total cost of college education will be $250,000 in 20 years. You presently have $25,000 to invest. What annual rate of interest must you earn on your investment to cover the cost of your child's education? 4) You are trying to save to buy a new $50,000 car. You have $20,000 today and can invest it in the bank. The bank pays 6% interest on its savings accounts. How long will it be before you have enough money to buy a new car? rate End of chapter problems: 1 to 12. 1) Your mother opens a savings account for you today and deposits $10,000. If this accounts earns interest of 8% compounded quarterly, how much will you have in the account in 5 years if you do not make any withdrawals? 2) Your niece has just been born and you want to start saving for her college education. You figure out that you will need $35, 000 when she starts college in 18 years. You can earn 10% interest you need to invest today? 3) Assume that the total cost of college education will be $250,000 in 20 years. You presently have $25,000 to invest. What annual rate of interest must you earn on your investment to cover the cost of your child' s education? 4) You are trying to save to buy a new 50,000 car. You have $20,000 today and can invest it in the bank. The bank pays 6% interest on its savings accounts. How long will it be before you have enough money to buy a new car? End of chapter problems 1 to 12 and 14 1) Find the total present value of the following cash flows. The discount rate is 10%. Year I$700 2 300 1.200 Cash flows 1) Find the total present value of the following cash flows. The discount rate is 10%. Cash flows ear 1$700 2300 1,200 4 1,600 2) Investment X offers to pay you $4,000 per year for 10 years, whereas investment Y offers to pay you $8,000 per year for 4 years. Which of these cash flows has the higher present value if the discount rate is 15%? 3) If you deposit $1,000 at the end of every year for the next 20 years into an account paying 7% interest compounded annually how much money will you have at the end of 20years. 4) The Bank offers to lend you $20,000 today to buy a new car. The interest rate on the loan will be 11% in seven years. What will your annual payments be? compounded annually and payable 5) First Union Bank charges 10% interest compounded semiannually on its car loans, whereas First National Bank charges 10% compounded quarterly on its car loans. As a potential borrower, which bank would you go to for a car loan? (show your calculations of EAR) 6) You just won the lottery. You and your heirs will receive $25,000 per year forever, with the first payment received immediately. What is the present value at an 8% discount rate? Chapt as re ITTI corporation has a 10% coupon rate bond with a face value of S1,000. The bond makes payments semiannually and matures in 20years. If the yield to maturity is 8% what is the value of the bond? as re 1 ITTI corporation has a 10% coupon rate bond with a face value of S1,000. The bond makes payments semiannually and matures in 20years. If the yield to maturity is 8% what is the value of the bond? a. What is the coupon rate c.) What is the maturity year? e) What is the ask price in S g) What is the net change in S? b)What is the annual coupon payment? price in S? maturity? D) What is the bid f) What is the Yield to End of chapter problems 1 to 4 Carcarpet corporation will pay a S4 per share dividend next year. The company pledges to increase its dividend by 4% every r indefinitely. Ifyou require a 1 3% return today? on your investment yea how much will you pay for the stock 2. Carcarpet corporation just paid $4 per share dividend on its common stock. The company pledges to increase its dividend by 5% every year indefinitely. If you require a 12% return on your investment how much will you pay for the stock today? 3. Fuel Inc. has an issue of preferred stock outstanding that pays $4.50 dividend per year in perpetuity. If the required return is 9.78% what is the current price of the stock? 3b. Know how to calculate dividend yield and the required return. problem 2LIBM a) What is the closing price of the stock? .b) How many stocks can you buy with $3000? c) What is the dividend yield? d) What is the price earnings ratio e) What is the EPS (earnings per share?) f) What is the previous day's closing price? 1) Find the total present value of the following cash flows. The discount rate is 10%. Cash flows car $700 2 300 1,200 41,600 2) Investment X offers to pay you $4,000 per year for 10 years, whereas investment Y offers to pay you $8,000 per year for 4 years. Which of these cash flows has the higher present value if the discount rate is 15%? 3) If you deposit $1,000 at the end of every year for the next 20 years into an account paying 7% interest compounded annually, how much money will you have at the end of 20years. 4) The Bank offers to lend you $20,000 today to buy a new car. The interest rate on the loan will be 11% compounded annually and payable in seven years. What will your annual payments be? 5) First Union Bank charges 10% interest compounded semiannually on its car loans, whereas First National Bank charges 10% compounded quarterly on its car loans. As a potential borrower, which bank would you go to for a car loan? (show your calculations of EAR) 6) You just won the lottery. You and your heirs will receive $25,000 per year forever, with the first payment received immediately What is the present value at an 8% discount rate? Cha bond: interpret treasury bond quotes 1, ITTI corporation has a 10% coupon rate bond with a face value of S1,000. The bond makes payments semiannually and matures in 20years. If the yield to maturity is 8% what is the value of the bond? bond: interpret treasury bond quotes 1. ITTI corporation has a 10% coupon rate bond with a face value of S1,000. The bond makes payments semiannually and matures in 20years. If the yield to maturity is 8% what is the value of the bond? a. What is the coupon rate c.) What is the maturity year? e) What is the ask price in S g) What is the net change in S? b)What is the annual coupon payment? price in S? maturity? D) What is the bid f) What is the Yield to End of chapter problems 1 to 4 Carcarpet corporation will pay a $4 per share dividend next year. The company pledges to increase its dividend by 4% every year indefinitely. If you require a 13% return on your investment how much will you pay for the stock today? 2. Carcarpet corporation just paid S4 per share dividend on its common stock. The company pledges to increase its dividend by 5% every year indefinitely. If you require a 12% return on your investment how much will you pay for the stock today? 3. Fuel Inc. has an issue of prefered stock outstanding that pays S4.50 dividend per year in perpetuity. If the required return is 9.78% what is the current price of the stock? 3b. Know how to calculate dividend yield and the required return. problem2LIBM a) What is the closing price of the stock? .b) How many stocks can you buy with $3000? c) What is the dividend yield? d) What is the price earnings ratio e) What is the EPS (earnings per share?) f) What is the previous day's closing price? problem 2LIBM a) What is the closing price of the stock? b) How many stocks can you buy with $3000? c What is the dividend yield? d) What is the price earnings ratio e) What is the EPS (earnings per share?) E) What is the previous day's closing price? g) If the dividend growth rate is 5% what is the required return on this stock? Chapter 8 1. Videocon Inc. has a proposed project that wi1l cost $3,244,320 and its expected net cash flows are $900,000 per year for 5 years. Answer the following questions and state whether the project should be accepted rejected. a. What is the payback period for this project? (3points) b. If the required return is 12%, what is the profitability index and will you accept or reject the project? c What is the NPV and d. What is the IRR for this project? Practice End of chapter problems: 1 to 10 Chapter 18- Foreign Exchange Rate How many Euros can you buy with $200? a. B. How many Brazilian real are there per Euro? Cross rate c. If you have S100, how many Brazilian real can you get d. If you have 10,000krone, how get e. A Mercedes costs 177,500krone. How many dollars would you need to buy the car. many dollars can you U.S 1) Find the total present value of the following cash flows. The discount rate is 10%. Year 1$700 2 300 1.200 4 1,600 Cash flows 2) Investment X offers to pay you $4,000 per year for 10 years, whereas investment Y offers to pay you $8,000 per year for 4 years. Which of these cash flows has the higher present value if the discount rate is 15%? 3) If you deposit S1,000 at the end of every year for the next 20 years into an account paying 7% interest compounded annually, how much money will you have at the end of 20years. 4) The Bank offers to lend you $20,000 today to buy a new car. The interest rate on the loan will be 11% compounded annually and payable in seven years. What will your annual payments be? 5) First Union Bank charges 10% interest compounded semiannually on its car loans, whereas First National Bank charges 10% compounded quarterly on its car loans. As a potential borrower, which bank would you go to for a car loan? (show your calculations of EAR) 6) You just won the lottery. You and your heirs will receive $25,000 per year forever, with the first payment received immediately. What is the present value at an 8% discount rate? Chap I, ITTI corporation has a 10% coupon rate bond with a face value of S1,000. The bond makes payments semiannually and matures in 20years. If the yield to maturity is 8% what is the value of the bond