Answered step by step

Verified Expert Solution

Question

1 Approved Answer

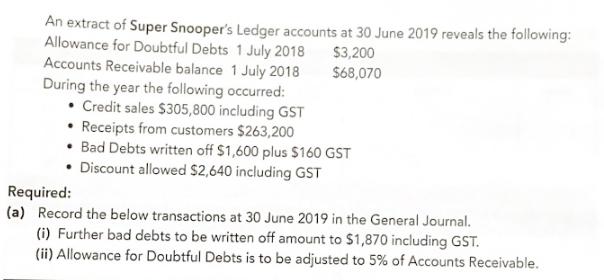

$3,200 $68,070 An extract of Super Snooper's Ledger accounts at 30 June 2019 reveals the following: Allowance for Doubtful Debts 1 July 2018 Accounts

$3,200 $68,070 An extract of Super Snooper's Ledger accounts at 30 June 2019 reveals the following: Allowance for Doubtful Debts 1 July 2018 Accounts Receivable balance 1 July 2018 During the year the following occurred: Credit sales $305,800 including GST Receipts from customers $263,200 Bad Debts written off $1,600 plus $160 GST Discount allowed $2,640 including GST Required: (a) Record the below transactions at 30 June 2019 in the General Journal. (i) Further bad debts to be written off amount to $1,870 including GST. (ii) Allowance for Doubtful Debts is to be adjusted to 5% of Accounts Receivable.

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

General Journal Entries at 30 June 2019 i Bad Debts Written Off Allowance for Doubtful Debts Dr 1870 Accounts Receivable Cr 1700 GST Input Tax Credit Cr 170 ii Adjustment of Allowance for Doubtful Deb...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started