The task is to apply the accounting principles and prepare a full set of annual report including Directors Report, Directors Declaration, Audit Report, Financial Statements

The task is to apply the accounting principles and prepare a full set of annual report including ‘Director’s Report’, ‘Director’s Declaration’, ‘Audit Report’, ‘Financial Statements (excluding Statement of Cash Flows’ and ‘Note to the Financial Statements’.

Additional information: Note: Unless otherwise indicated the events and transactions outlined below have already been accounted for in the balances above if required.

a) One item of land was sold during the period. Prior to sale, this was being used in operations and had been recorded at cost.

(b) Included in the amount of ‘Other Expenses’ in the trial balance above are:

• $63,800,000 for salaries and wages.

• $14,000,000 for rental of various retail outlets

• General operating and maintenance expenses of $6,594,000.

• Marketing expenses of $7,480,000.

• $1,450,000 payment to auditors for audit work undertaken.

• $3,400,000 insurance expense. Prepaid expense relates to insurance paid in advance.

• Interest expense. The company borrowed $20,000,000 on the 1 January 2020 to partly finance the purchase of land and buildings. This loan is for 5 years. Interest at 7% per annum is payable ½ yearly on 30 June and 31 December each year. The principle of $20,000,000 is repayable in full on 31 December 2025. In addition, a further $68,000 in interest expense was accrued and paid in relation to the bank overdraft. All interest accrued for the year ending 30 June 2021 has been paid by the company.

• $1,100 for costs of providing coffee & tea to staff.

• Annual leave expense of $740,000. The balance of the provision for annual leave as at 30 June 2020 was $463,000.

• Warrantees expense of $57,000. The company provides a 1-year warranty on a range of its products.

• Depreciation on buildings of $2,700,000

• Depreciation expense for vehicles of $230,000.

• Depreciation expense for machinery of $1,420,000.

• Amortisation expense for patent of $2,000,000.

• Doubtful debts expense for the period of $264,000.

• Expenses relating to legal cases. The company has 2 legal actions against it that are currently pending.

o The first relates to a claim lodged in February 2019 against the company by a former director who was dismissed from the company. A provision of $20,000,000 (and related expense) was originally recognised by the company in the year ending 30 June 2020. However, in February 2021 the company’s lawyers advised that the amount expected to be paid had increased to $22,000,000. The case is expected to be decided in court in December 2021.

o The second relates to a claim against the company for breach of another company’s patent in July 2020. Following legal advice, the company is expectedto reach a settlement agreement in September 2021 and is expected to have to pay $14,000,000 at that time.

(Note: The above dot points do does not detail all expenses included in the total of ‘Other expenses’ in the trial balance above –You should classify the remaining expenses as ‘other’ or ‘miscellaneous’)

(c) Other revenues/income is comprised of:

• Services revenue of $81,144,000

• $420,000 in royalties. These were earned by the company allowing (for this fee) another entity to use the patent that it owns.

• $214,000 received from a court order. In February 2019, a company employee had committed fraud and stolen $480,000 from the company. The company had disclosed this in the financial report for that year and recognised an expense for the loss and had not anticipated that any of these amounts would be recovered. However, following a court judgment this amount was recovered from the employee and repaid to the company in May 2021.

• Rent of $615,000. This related to the item of land that was sold during the period. Part of this land was rented to another company.

• $141,000 interest earned by the company during the year. The proceeds from the sale of land were invested for a short period before being used to purchase another item of land and buildings.

d) In October 2020, the company contracted with its auditors for the auditors to undertake consulting work. The auditors were paid $980,000 for this consulting (and this is included as consulting expenses in the trial balance above). Part of this consulting work related to trying to manage credit risk. The company was concerned that its bad debts were increasing but also concerned about the impact any tightening of credit policy would have on sales revenues.

As a result of this consulting the company changed its credit arrangements. Tighter credit checks were undertaken, and this reduced the number of customers allowed credit. However, to encourage sales, those customers that were allowed credit were given extra time to pay (from the previous 14 days required to months in some cases). These changes were implemented and had little impact on overall sales revenues but did result in the incidence of bad debts decreasing. Hence the directors have decided that the allowance for doubtful debts should now be estimated as 1% of the balance of accounts receivable (previously this was estimated at 5% of accounts receivable).

(e) Revenue received in advance relates to deposits received for special orders. Where customers order goods that are not items that the company usually supplies, it requires a 20% deposit to be paid. Accrued revenue relates to service revenues where work has been completed but not yet invoiced.

(f) On 8 September 2020, the company paid a dividend of $198,000. This dividend had been declared on 29 June 2020. This dividend was not subject to further authorisation or approval. In lieu of an interim dividend the company made a bonus share issue on 12 February 2021 from retained earnings of one ordinary share for each 12 shares held, issued and fully paid to $7.20.

(g) Prior to 1 July 2020 the company had 3 issues of shares. These were:

• 300,000 ordinary shares at an issue price of $4.50 were issued in March 2016. These are fully paid. In relation to this issue $8,000 share issue costs were incurred, and these were paid by the company in May 2016.

• 700,000 ordinary shares at an issue price of $6.00 were issued in September 2017. These are fully paid. In relation to this issue $32,000 share issue costs were incurred, and these were paid by the company in October 2017.

• 800,000 ordinary shares at an issue price of $7.00 were issued in January 2019. These are called and paid to $4.80 as at 30 June 2019. In relation to this issue $26,000 share issue costs were incurred, and these were paid by the company in February 2020.

• On 1 September 2020, the company made a first and final call for the remaining uncalled/unpaid portion of the share issue price for the shares issued in January 2019. All call money was received by the 1 June 2021. Hence these shares are now fully paid.

Unless otherwise indicated the following events/transactions are not reflected in the trial balance above. You will need to make appropriate adjustments if required.

(h) On 1 March 2021, an employee of the company is suing the company for negligence and requesting damages of $220,000. The employee was involved in an accident whilst working for the company in May 2020 and as a result suffered a back injury. Legal advice has indicated that if the case went to court there is only a 20% likelihood that the company would be found liable and if this was the case, then the damages payable would amount to $85,000. The first court hearing is scheduled on 15 August 2021.

- On 30 June 2021, the directors decided to create a general reserve by transferring $9,000,000 from retained earnings to a general reserve account.

(j) On 7 July 2021, the directors declared a final dividend of 12c per share from retained earnings. This is not subject to further authorisation or approval.

(k) On 3 July 2021, the company was advised by a customer that a bulk order of a particular item was incomplete. The order had been shipped on the 20 June 2021 and the company had recorded this transaction (as an increase in sales AND accounts receivable of $1,100,000; and a decrease in inventory and increase in cost of sales of $500,000. The company uses a perpetual inventory system). The customer has advised that the order was only 40% complete (so, 60% of items were not delivered). The company has checked and has confirmed that while only 40% of the order had been shipped, the company incorrectly recorded the transaction as though the full order had been completed. As the last stock take of inventory was completed in July 2021, this discrepancy in inventory levels was not detected.

The company has no stock of that particular item on hand at present but has agreed to send the customer the rest of the order when stocks are available. The company recognises revenue (and associated receivable/cost of sales etc) when orders are shipped to customers.

(l) On 16 July 2021, the directors decided that one type of product would no longer be supplied to customers. This product has been the cause of the legal action taken against the company since February 2019. This product currently accounts for 8% of the total sales revenue of the company.

(m) The company tax rate is 30%. Ignore tax-effect accounting. Tax expense should be based on 30% of the accounting profit before tax. No tax expense has yet been recorded.

(n) You should assume that the company that is a reporting entity and that you began preparing this report at 15th August 2021 and that the date the annual report (including the financial report) is authorised for issue is the 30th August 2021.

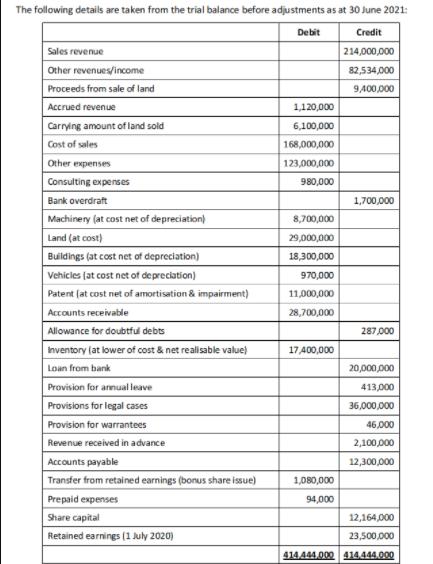

The following details are taken from the trial balance before adjustments as at 30 June 2021: Debit Credit Sales revenue 214,000,000 Other revenues/income 82,534,000 Proceeds from sale of land 9,400,000 Accrued revenue 1,120,000 Carrying amount of land sold 6,100,000 Cost of sales 168,000,000 Other expenses 123,000,000 Consulting expenses 980,000 Bank overdraft 1,700,000 Machinery (at cost net of depreciation) 8,700,000 Land (at cost) 29,000,000 Buildings (at cost net of depreciation) 18,300,000 Vehicles (at cost net of depreciation) 970,000 Patent (at cost net of amortisation & impairment) 11,000,000 Accounts receivable 28,700,000 Allowance for doubtful debts 287,000 Inventory (at lower of cost & net realisable value) 17,400,000 Loan from bank 20,000,000 Provision for annual leave 413,000 Provisions for legal cases 36,000,000 Provision for warrantees 46,000 Revenue received in advance 2,100,000 Accounts payable 12,300,000 Transfer from retained earnings (bonus share issue) 1,080,000 Prepaid expenses 94,000 Share capital 12,164,000 Retained earnings (1 July 2020) 23,500,000 414.444.000 414444.000

Step by Step Solution

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started