Answered step by step

Verified Expert Solution

Question

1 Approved Answer

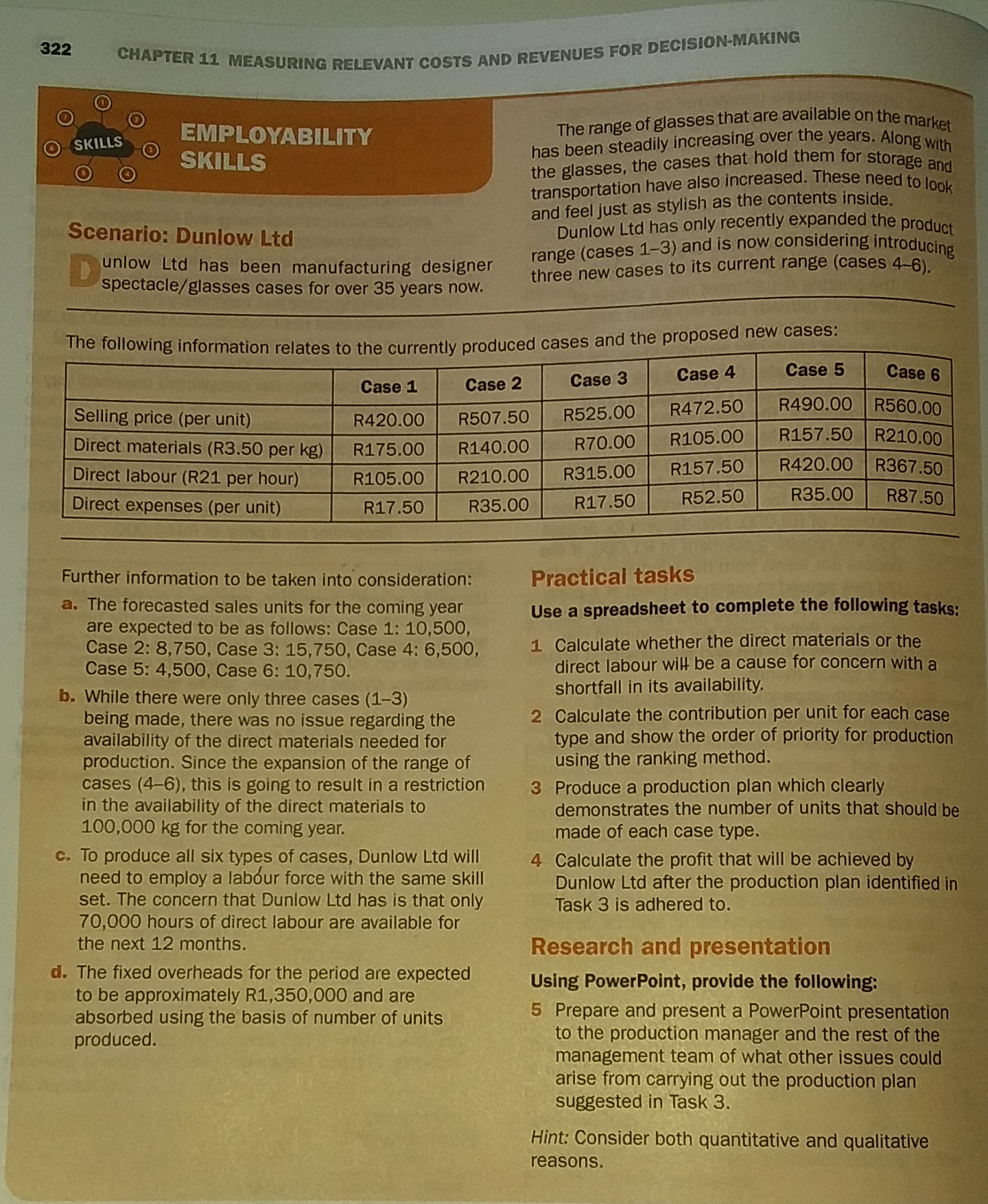

322 CHAPTER 11 MEASURING RELEVANT COSTS AND REVENUES FOR DECISION-MAKING SKILLS EMPLOYABILITY SKILLS Scenario: Dunlow Ltd unlow Ltd has been manufacturing designer spectacle/glasses cases

322 CHAPTER 11 MEASURING RELEVANT COSTS AND REVENUES FOR DECISION-MAKING SKILLS EMPLOYABILITY SKILLS Scenario: Dunlow Ltd unlow Ltd has been manufacturing designer spectacle/glasses cases for over 35 years now. The following information relates to the currently produced cases and the proposed new cases: Case 2 Case 3 Case 4 Case 5 R507.50 R525.00 R140.00 R70.00 R210.00 R315.00 R35.00 R17.50 Selling price (per unit) Direct materials (R3.50 per kg) Direct labour (R21 per hour) Direct expenses (per unit) Case 1 R420.00 R175.00 R105.00 R17.50 Further information to be taken into consideration: a. The forecasted sales units for the coming year are expected to be as follows: Case 1: 10,500, Case 2: 8,750, Case 3: 15,750, Case 4: 6,500, Case 5: 4,500, Case 6: 10,750. b. While there were only three cases (1-3) being made, there was no issue regarding the availability of the direct materials needed for production. Since the expansion of the range of cases (4-6), this is going to result in a restriction in the availability of the direct materials to 100,000 kg for the coming year. c. To produce all six types of cases, Dunlow Ltd will need to employ a labour force with the same skill set. The concern that Dunlow Ltd has is that only 70,000 hours of direct labour are available for the next 12 months. The range of glasses that are available on the market has been steadily increasing over the years. Along with the glasses, the cases that hold them for storage and transportation have also increased. These need to look and feel just as stylish as the contents inside. Dunlow Ltd has only recently expanded the product range (cases 1-3) and is now considering introducing three new cases to its current range (cases 4-6). d. The fixed overheads for the period are expected to be approximately R1,350,000 and are absorbed using the basis of number of units produced. R472.50 R105.00 R157.50 R52.50 R490.00 R157.50 R420.00 R35.00 Case 6 R560.00 R210.00 R367.50 R87.50 Practical tasks Use a spreadsheet to complete the following tasks: 1 Calculate whether the direct materials or the direct labour will be a cause for concern with a shortfall in its availability. 2 Calculate the contribution per unit for each case type and show the order of priority for production using the ranking method. 3 Produce a production plan which clearly demonstrates the number of units that should be made of each case type. 4 Calculate the profit that will be achieved by Dunlow Ltd after the production plan identified in Task 3 is adhered to. Research and presentation Using PowerPoint, provide the following: 5 Prepare and present a PowerPoint presentation to the production manager and the rest of the management team of what other issues could arise from carrying out the production plan suggested in Task 3. Hint: Consider both quantitative and qualitative reasons.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Calculation of Concern for Shortfall in Direct Materials and Direct Labour a Direct Materials Total direct materials required for cases 13 Case 1 10500 units x 350 kg 36750 kg Case 2 8750 units x 350 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started