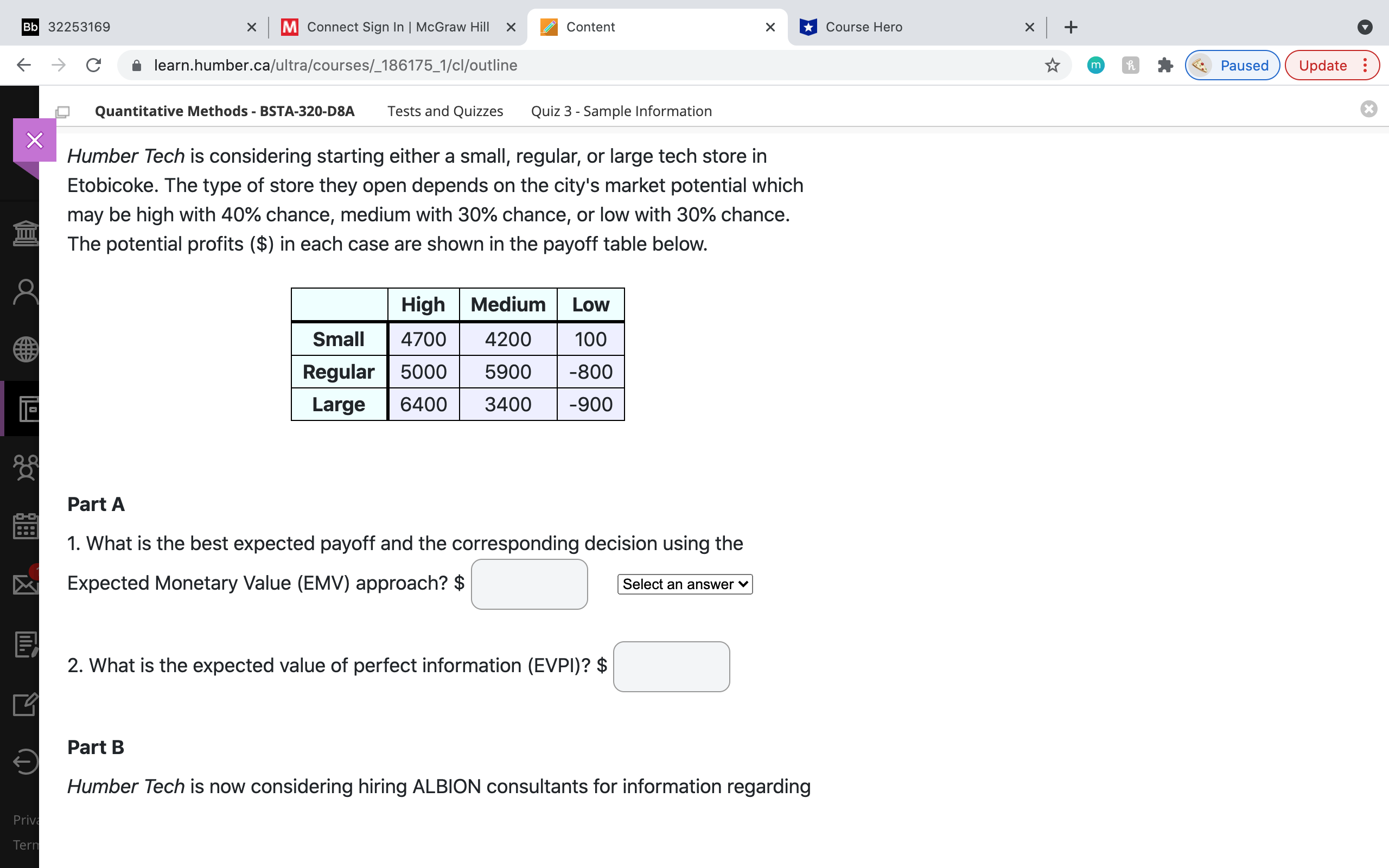

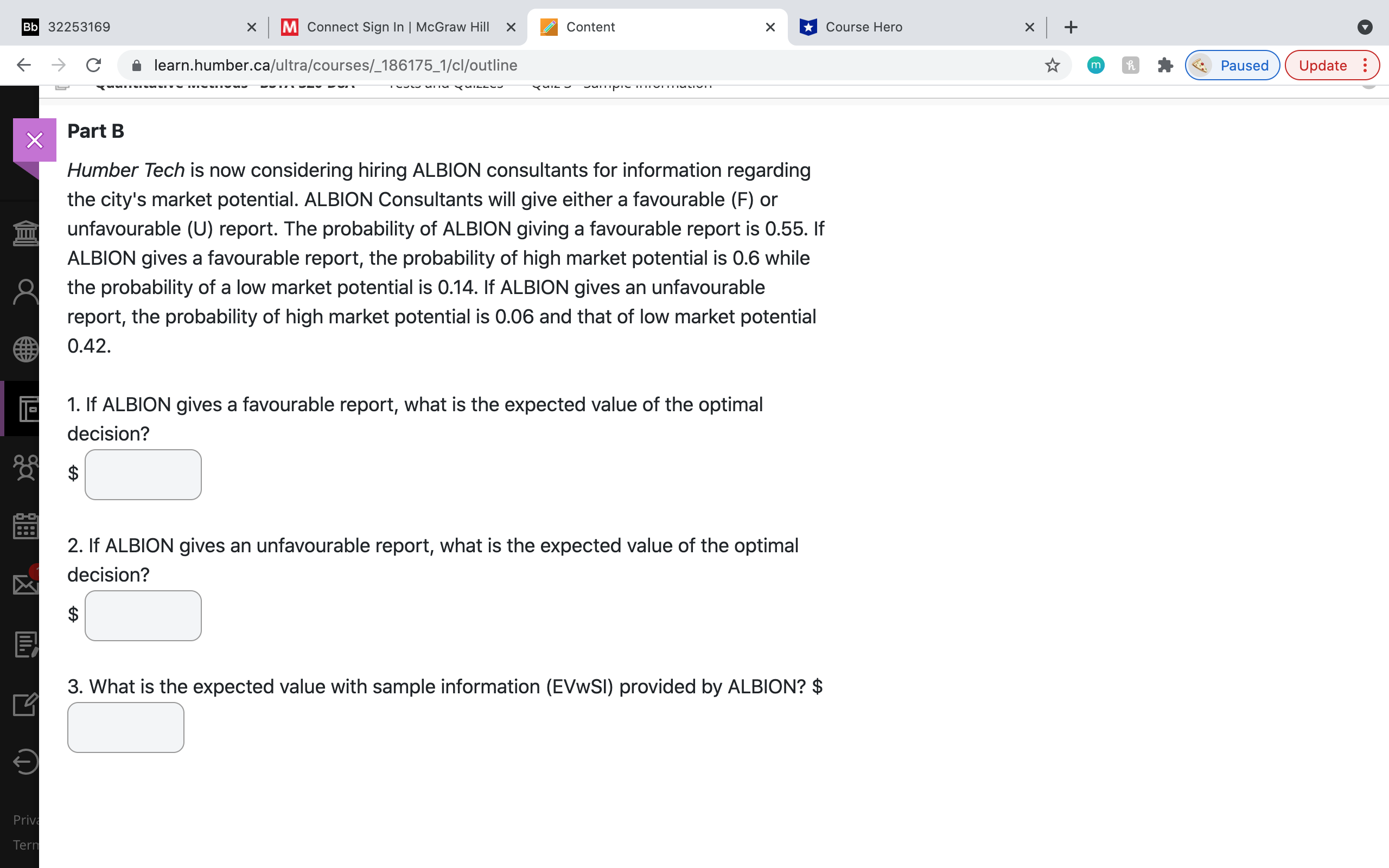

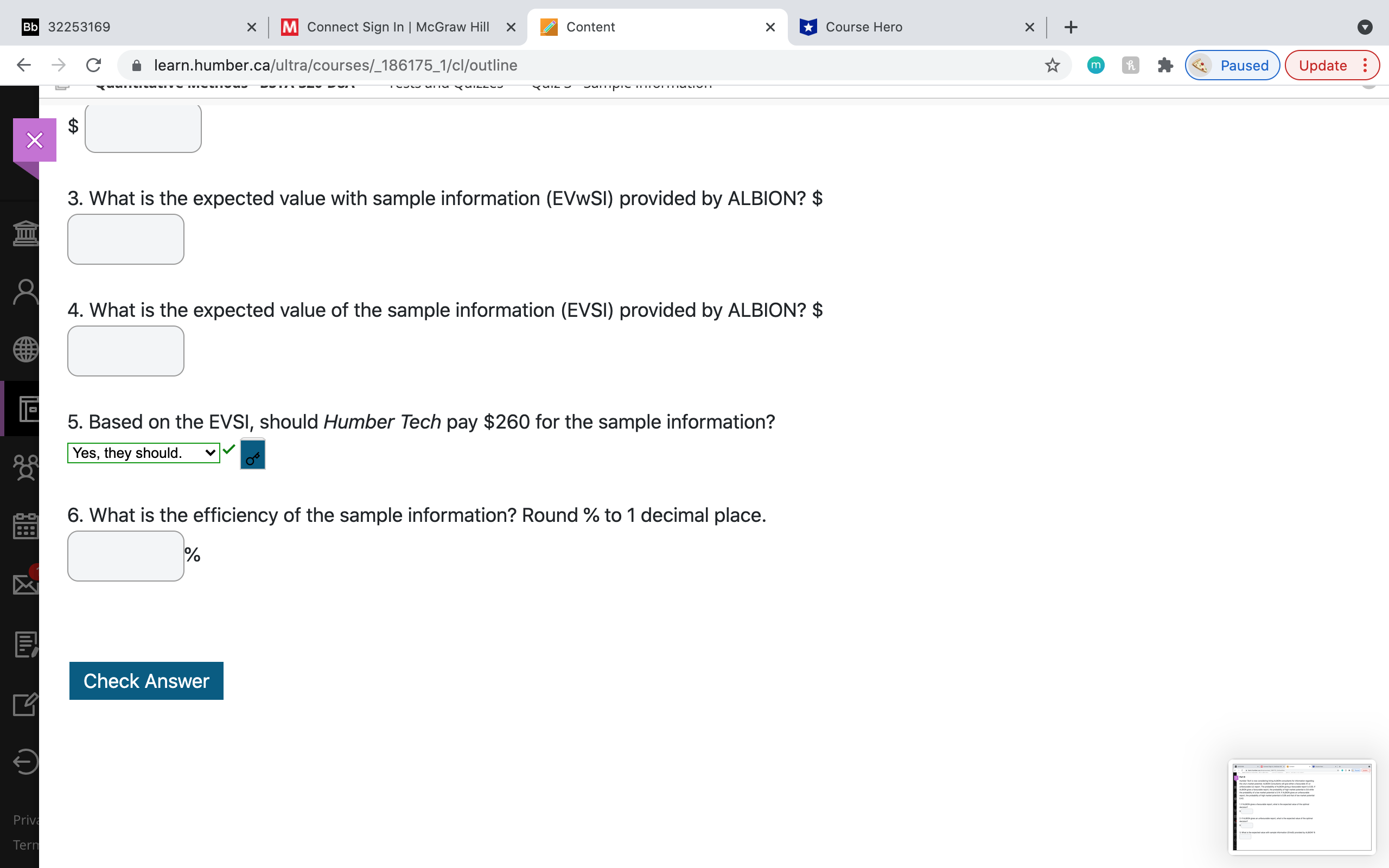

32253169 X I m ConnectSignlnlMcGraw Hill X E Content X H Course Hero x I + O ( 9 C' a learn.humber.ca/ultra/courses/_186175_1/cl/outline i} a *- Quantitative Methods - BSTA-320-D8A Tests and Quizzes Quiz 3 - Sample Information 2: Humber Tech is considering starting either a small, regular, or large tech store in Etobicoke. The type of store they open depends on the city's market potential which may be high with 40% chance, medium with 30% chance, or low with 30% chance. The potential profits ($) in each case are shown in the payoff table below. Regular Large 64oo| 3400 -900 Part A 1. What is the best expected payoff and the corresponding decision using the Expected Monetary Value (EMV) approach? $ [3 Select an answerv 2. What is the expected value of perfect information (EVPI)? $ C] Part B Humber Tech is now considering hiring ALBION consultants for information regarding Bb 32253169 X M Connect Sign In | McGraw Hill X Content X Course Hero X -) C learn.humber.ca/ultra/courses/_186175_1/cl/outline m Paused Update : X Part B Humber Tech is now considering hiring ALBION consultants for information regarding the city's market potential. ALBION Consultants will give either a favourable (F) or unfavourable (U) report. The probability of ALBION giving a favourable report is 0.55. If ALBION gives a favourable report, the probability of high market potential is 0.6 while the probability of a low market potential is 0.14. If ALBION gives an unfavourable report, the probability of high market potential is 0.06 and that of low market potential 0.42. 1. If ALBION gives a favourable report, what is the expected value of the optimal decision? 28 $ 2. If ALBION gives an unfavourable report, what is the expected value of the optimal decision? $ 3. What is the expected value with sample information (EVwSI) provided by ALBION? $ Priv TerBb 32253169 X M Connect Sign In | McGraw Hill X Content X Course Hero X C learn.humber.ca/ultra/courses/_186175_1/cl/outline m Paused Update : $ X 3. What is the expected value with sample information (EVwSI) provided by ALBION? $ 4. What is the expected value of the sample information (EVSI) provided by ALBION? $ 5. Based on the EVSI, should Humber Tech pay $260 for the sample information? 28 Yes, they should. 6. What is the efficiency of the sample information? Round % to 1 decimal place. Check Answer Priv Ter