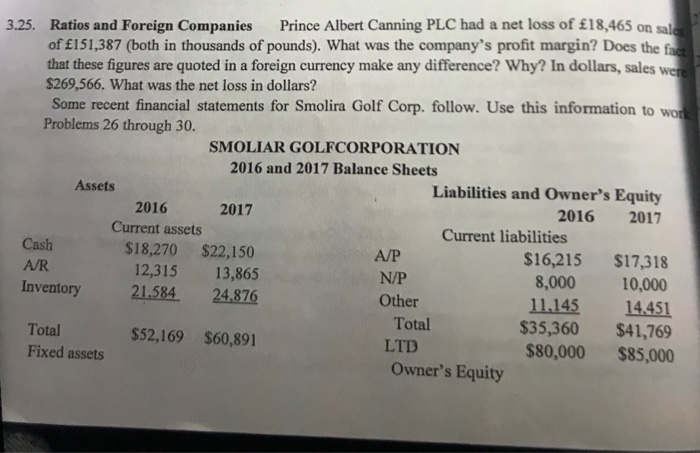

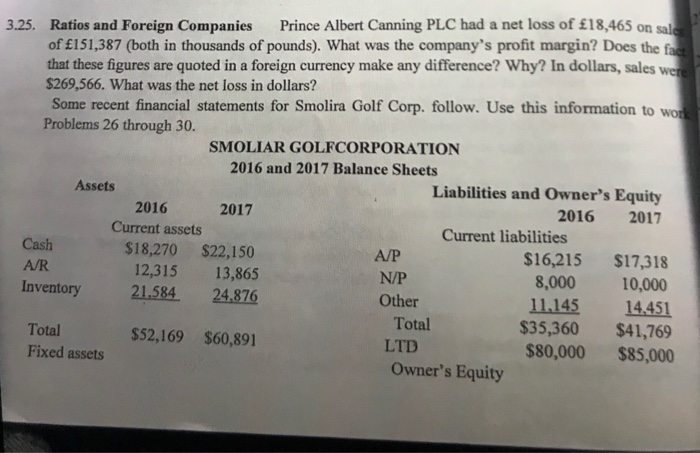

3.25. Ratios and Foreign Companies Prince Albert Canning PLC had a net loss of 18,465 on sale of 151,387 (both in thousands of pounds). What was the company's profit margin? Does the fac that these figures are quoted in a foreign currency make any difference? Why? In dollars, sales were $269,566. What was the net loss in dollars? Some recent financial statements for Smolira Golf Corp. follow. Use this information to wore Problems 26 through 30. SMOLIAR GOLFCORPORATION 2016 and 2017 Balance Sheets Assets Liabilities and Owner's Equity 2016 2017 2016 2017 Current assets Cash Current liabilities $18,270 $22,150 A/P $16,215 AR $17,318 12,315 13,865 N/P Inventory 8,000 21.584 10,000 24.876 Other 11,145 14,451 Total Total $52,169 $60,891 $35,360 $41,769 Fixed assets LTD $80,000 $85,000 Owner's Equity Statement of Cash Flows Prepare the 2017 statement of cash flows for Smolira Golf Corp. 3.25. Ratios and Foreign Companies Prince Albert Canning PLC had a net loss of 18,465 on sale of 151,387 (both in thousands of pounds). What was the company's profit margin? Does the fac that these figures are quoted in a foreign currency make any difference? Why? In dollars, sales were $269,566. What was the net loss in dollars? Some recent financial statements for Smolira Golf Corp. follow. Use this information to wore Problems 26 through 30. SMOLIAR GOLFCORPORATION 2016 and 2017 Balance Sheets Assets Liabilities and Owner's Equity 2016 2017 2016 2017 Current assets Cash Current liabilities $18,270 $22,150 A/P $16,215 AR $17,318 12,315 13,865 N/P Inventory 8,000 21.584 10,000 24.876 Other 11,145 14,451 Total Total $52,169 $60,891 $35,360 $41,769 Fixed assets LTD $80,000 $85,000 Owner's Equity 3.25. Ratios and Foreign Companies Prince Albert Canning PLC had a net loss of 18,465 on sale of 151,387 (both in thousands of pounds). What was the company's profit margin? Does the fac that these figures are quoted in a foreign currency make any difference? Why? In dollars, sales were $269,566. What was the net loss in dollars? Some recent financial statements for Smolira Golf Corp. follow. Use this information to wore Problems 26 through 30. SMOLIAR GOLFCORPORATION 2016 and 2017 Balance Sheets Assets Liabilities and Owner's Equity 2016 2017 2016 2017 Current assets Cash Current liabilities $18,270 $22,150 A/P $16,215 AR $17,318 12,315 13,865 N/P Inventory 8,000 21.584 10,000 24.876 Other 11,145 14,451 Total Total $52,169 $60,891 $35,360 $41,769 Fixed assets LTD $80,000 $85,000 Owner's Equity Statement of Cash Flows Prepare the 2017 statement of cash flows for Smolira Golf Corp. 3.25. Ratios and Foreign Companies Prince Albert Canning PLC had a net loss of 18,465 on sale of 151,387 (both in thousands of pounds). What was the company's profit margin? Does the fac that these figures are quoted in a foreign currency make any difference? Why? In dollars, sales were $269,566. What was the net loss in dollars? Some recent financial statements for Smolira Golf Corp. follow. Use this information to wore Problems 26 through 30. SMOLIAR GOLFCORPORATION 2016 and 2017 Balance Sheets Assets Liabilities and Owner's Equity 2016 2017 2016 2017 Current assets Cash Current liabilities $18,270 $22,150 A/P $16,215 AR $17,318 12,315 13,865 N/P Inventory 8,000 21.584 10,000 24.876 Other 11,145 14,451 Total Total $52,169 $60,891 $35,360 $41,769 Fixed assets LTD $80,000 $85,000 Owner's Equity