Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3-26 Integrative: Optimal capital structure The board of directors of Morales Publishing Inc., has commissioned a capital structure study. The company has total assets of

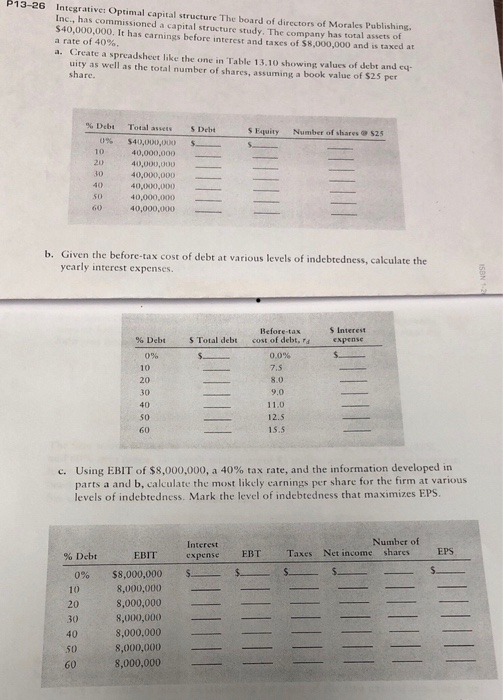

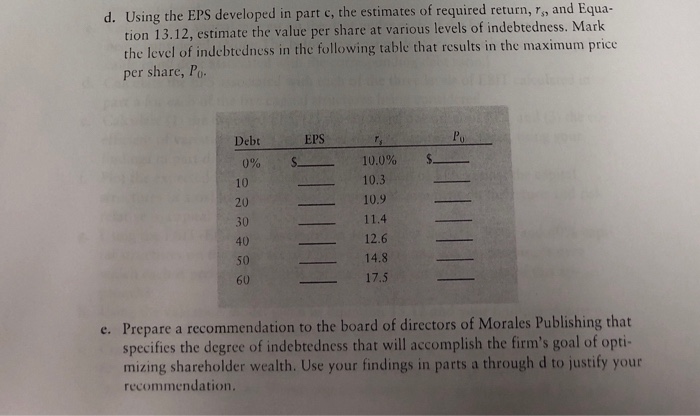

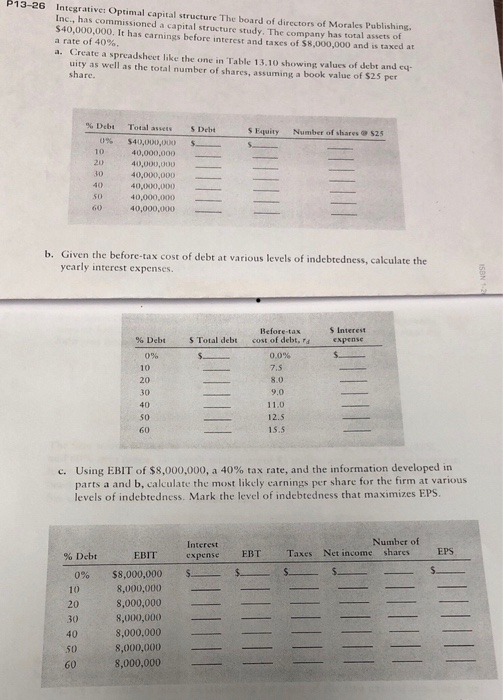

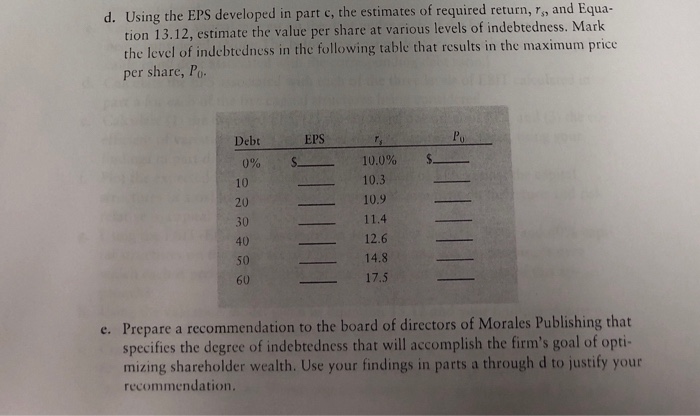

3-26 Integrative: Optimal capital structure The board of directors of Morales Publishing Inc., has commissioned a capital structure study. The company has total assets of $40,000,000. It has carnings before interest and taxes of $8,000,000 and is taxed at a rate of 40%. a. Create a spreadsheet like the one in Table 13.10 showing values of debt and eq- uity as well as the total number of shares, assuming a book value of $25 per % Debt Total assets s Equity Numiber of shares @S25 S Debt 096 $40,000,000 $ 40,000,000 40,000,000_ 20 30 40 s0 60 40,000,000_ 40,000,00o 40,000,000 b. Given the before-tax cost of debt at various levels of indebtedness, calculate the yearly interest expenses. Before tax s Interest expense % Debt s Total debt 0% 10 20 30 40 50 60 cost of debt, rs 0.0% 7.s 8.0 9.0 11.0 12.5 15.5 Using EBIT. of $8,000,000, a 40% tax rate, and the information developed in parts a and b, calculate the most likely carnings per share for the firm at various levels of indebtedness. Mark the level of indebtedness that maximizes EPS c. Number of Interest expense s_-_ % Debt EBIT EBT Taxes Net income shares EPS $8,000,000 s_ _ _ s___ 056 10 20 30 40 50 60 8,000,000 8,000,000_ 8,000,000 8,000,000 8,000,000_ 8,000,000

3-26 Integrative: Optimal capital structure The board of directors of Morales Publishing Inc., has commissioned a capital structure study. The company has total assets of $40,000,000. It has carnings before interest and taxes of $8,000,000 and is taxed at a rate of 40%. a. Create a spreadsheet like the one in Table 13.10 showing values of debt and eq- uity as well as the total number of shares, assuming a book value of $25 per % Debt Total assets s Equity Numiber of shares @S25 S Debt 096 $40,000,000 $ 40,000,000 40,000,000_ 20 30 40 s0 60 40,000,000_ 40,000,00o 40,000,000 b. Given the before-tax cost of debt at various levels of indebtedness, calculate the yearly interest expenses. Before tax s Interest expense % Debt s Total debt 0% 10 20 30 40 50 60 cost of debt, rs 0.0% 7.s 8.0 9.0 11.0 12.5 15.5 Using EBIT. of $8,000,000, a 40% tax rate, and the information developed in parts a and b, calculate the most likely carnings per share for the firm at various levels of indebtedness. Mark the level of indebtedness that maximizes EPS c. Number of Interest expense s_-_ % Debt EBIT EBT Taxes Net income shares EPS $8,000,000 s_ _ _ s___ 056 10 20 30 40 50 60 8,000,000 8,000,000_ 8,000,000 8,000,000 8,000,000_ 8,000,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started