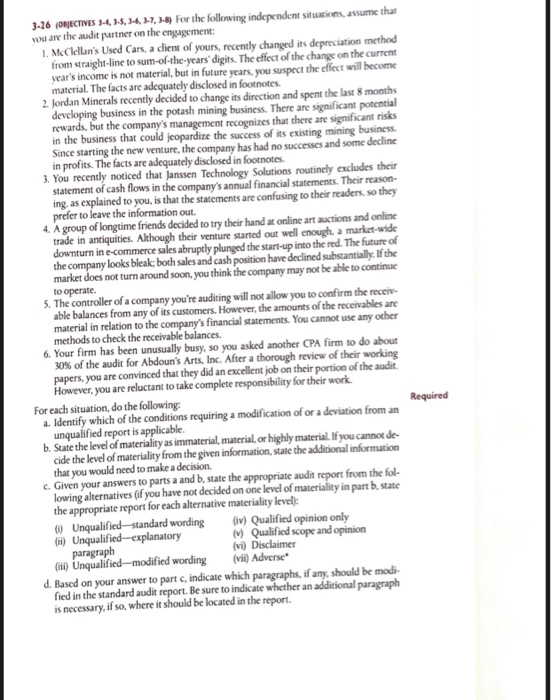

3-26 (OBJECTIVES 3-4, 3-5, 3-4, 1-7.1-8) For the following independent situations, assume that you are the audit partner on the engagement: 1. McClellan's Used Cars, a client of yours, recently changed its depreciation method from straight-line to sum-of-the-years' digits. The effect of the change on the current year's income is not material, but in future years, you suspect the effect will become material. The facts are adequately disclosed in footnotes. 2. Jordan Minerals recently decided to change its direction and spent the last 8 months developing business in the potash mining business. There are significant potential rewards, but the company's management recognizes that there are significant risks in the business that could jeopardize the success of its existing mining business. Since starting the new venture, the company has had no successes and some decline in profits. The facts are adequately disclosed in footnotes. 3. You recently noticed that Janssen Technology Solutions routinely excludes their statement of cash flows in the company's annual financial statements. Their reason ing, as explained to you, is that the statements are confusing to their readers, so they prefer to leave the information out. 4. A group of longtime friends decided to try their hand at online art actions and online trade in antiquities. Although their venture started out well enough, a market-wide downturn in e-commerce sales abruptly plunged the start-up into the red. The future of the company looks bleak: both sales and cash position have declined substantially. If the market does not turn around soon, you think the company may not be able to continue to operate. 5. The controller of a company you're auditing will not allow you to confirm the receiv- able balances from any of its customers. However, the amounts of the receivables are material in relation to the company's financial statements. You cannot use any other methods to check the receivable balances. 6. Your firm has been unusually busy, so you asked another CPA firm to do about 30% of the audit for Abdoun's Arts, Inc. After a thorough review of their working papers, you are convinced that they did an excellent job on their portion of the audit. However, you are reluctant to take complete responsibility for their work. For each situation, do the following: Required 1. Identify which of the conditions requiring a modification of or a deviation from an unqualified report is applicable. b. State the level of materiality as immaterial, material, or highly material. If you cannot de cide the level of materiality from the given information, state the additional information that you would need to make a decision. c. Given your answers to parts a and b, state the appropriate audit report from the fol- lowing alternatives (if you have not decided on one level of materiality in part b, state the appropriate report for each alternative materiality level): Unqualified standard wording (iv) Qualified opinion only (1) Unqualified-explanatory M Qualified scope and opinion paragraph (vi) Disclaimer (ii) Unqualified-modified wording (vii) Adverse d. Based on your answer to part c, indicate which paragraphs, if any, should be modi fied in the standard audit report. Be sure to indicate whether an additional paragraph is necessary, if so, where it should be located in the report. 3-26 (OBJECTIVES 3-4, 3-5, 3-4, 1-7.1-8) For the following independent situations, assume that you are the audit partner on the engagement: 1. McClellan's Used Cars, a client of yours, recently changed its depreciation method from straight-line to sum-of-the-years' digits. The effect of the change on the current year's income is not material, but in future years, you suspect the effect will become material. The facts are adequately disclosed in footnotes. 2. Jordan Minerals recently decided to change its direction and spent the last 8 months developing business in the potash mining business. There are significant potential rewards, but the company's management recognizes that there are significant risks in the business that could jeopardize the success of its existing mining business. Since starting the new venture, the company has had no successes and some decline in profits. The facts are adequately disclosed in footnotes. 3. You recently noticed that Janssen Technology Solutions routinely excludes their statement of cash flows in the company's annual financial statements. Their reason ing, as explained to you, is that the statements are confusing to their readers, so they prefer to leave the information out. 4. A group of longtime friends decided to try their hand at online art actions and online trade in antiquities. Although their venture started out well enough, a market-wide downturn in e-commerce sales abruptly plunged the start-up into the red. The future of the company looks bleak: both sales and cash position have declined substantially. If the market does not turn around soon, you think the company may not be able to continue to operate. 5. The controller of a company you're auditing will not allow you to confirm the receiv- able balances from any of its customers. However, the amounts of the receivables are material in relation to the company's financial statements. You cannot use any other methods to check the receivable balances. 6. Your firm has been unusually busy, so you asked another CPA firm to do about 30% of the audit for Abdoun's Arts, Inc. After a thorough review of their working papers, you are convinced that they did an excellent job on their portion of the audit. However, you are reluctant to take complete responsibility for their work. For each situation, do the following: Required 1. Identify which of the conditions requiring a modification of or a deviation from an unqualified report is applicable. b. State the level of materiality as immaterial, material, or highly material. If you cannot de cide the level of materiality from the given information, state the additional information that you would need to make a decision. c. Given your answers to parts a and b, state the appropriate audit report from the fol- lowing alternatives (if you have not decided on one level of materiality in part b, state the appropriate report for each alternative materiality level): Unqualified standard wording (iv) Qualified opinion only (1) Unqualified-explanatory M Qualified scope and opinion paragraph (vi) Disclaimer (ii) Unqualified-modified wording (vii) Adverse d. Based on your answer to part c, indicate which paragraphs, if any, should be modi fied in the standard audit report. Be sure to indicate whether an additional paragraph is necessary, if so, where it should be located in the report