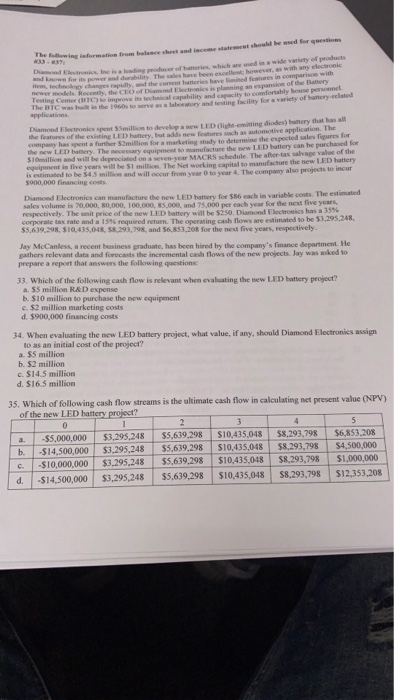

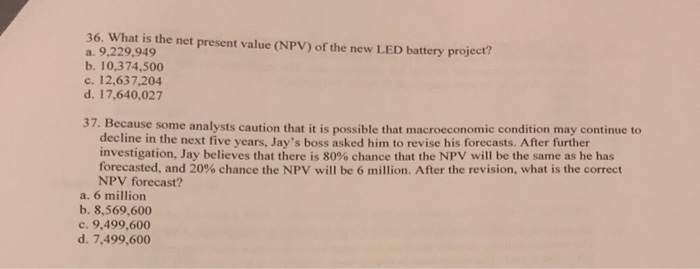

should med for questions and The information from wide variety of products ased in R of the Battery ewently, CEO is planning to Testing Center (BTC its technical capability and for a variety of de lal and testing spent ssmillion to develop a ew LED oigh emirting dioses) bumery that has all features such as automotive application. for determine espected figures the features of the LED banery. but has a further s2minion for a marketing LED bamery. The inecessary cquipment manufacture the new LED hallery can be purchased MACRS schedule. The after-tax walvage value of the SIomillion and will depreciated manufacture the new LED battery in five years will si million. The Net working capital year The company to be S4.5 million and will occur So00,000 financing costs. is 70,000, 80,000, 100,000, 8s.000, and 75.000 per each year for the next five years. pectively. price the LED bes 50. Diamond a 35 corporate tax rate and a IS% required retum. The operating cash estimated vo be ss 639.298, SIO 435,048 S8.293,798, and S6.853-208 for the next five years. Fespective Jay McCanless, a recent business graduate, has been hired by the company's finance department. He was asked to projects. Jay gathers relevant data and forecasts the incremental cash flows of the new prepare a report that answers the following questions: 33, which of the following cash flow is relevant when evaluating the new LED battery project? a. ss million R&D expense b. $10 million to purchase the new equipment $900,000 financing costs 34. When evaluating the new LED battery project, what value, ifany, should Diamond Electronics assign to as an initial cost of the project? c, $14.5 million d. $16.5 mil 35, which of following cash flow streams is the ultimate cash flow in calculating net present value (NPvy of the new LED battery a .35.000.000 $3.295.248 55,639.298 S10,435,048 $8.293,798 S6 85320S b I.SI4 500.000 S3.295.248 s5.639.298 $10,435,048 S8,293,798 SA500,000 c -$10,000,000 $3.295,248 55639.295 SI000000 d -S14.500,000 S3,295.248 ss.639,298 10,435,048 S8.293,798 S12,353.208 should med for questions and The information from wide variety of products ased in R of the Battery ewently, CEO is planning to Testing Center (BTC its technical capability and for a variety of de lal and testing spent ssmillion to develop a ew LED oigh emirting dioses) bumery that has all features such as automotive application. for determine espected figures the features of the LED banery. but has a further s2minion for a marketing LED bamery. The inecessary cquipment manufacture the new LED hallery can be purchased MACRS schedule. The after-tax walvage value of the SIomillion and will depreciated manufacture the new LED battery in five years will si million. The Net working capital year The company to be S4.5 million and will occur So00,000 financing costs. is 70,000, 80,000, 100,000, 8s.000, and 75.000 per each year for the next five years. pectively. price the LED bes 50. Diamond a 35 corporate tax rate and a IS% required retum. The operating cash estimated vo be ss 639.298, SIO 435,048 S8.293,798, and S6.853-208 for the next five years. Fespective Jay McCanless, a recent business graduate, has been hired by the company's finance department. He was asked to projects. Jay gathers relevant data and forecasts the incremental cash flows of the new prepare a report that answers the following questions: 33, which of the following cash flow is relevant when evaluating the new LED battery project? a. ss million R&D expense b. $10 million to purchase the new equipment $900,000 financing costs 34. When evaluating the new LED battery project, what value, ifany, should Diamond Electronics assign to as an initial cost of the project? c, $14.5 million d. $16.5 mil 35, which of following cash flow streams is the ultimate cash flow in calculating net present value (NPvy of the new LED battery a .35.000.000 $3.295.248 55,639.298 S10,435,048 $8.293,798 S6 85320S b I.SI4 500.000 S3.295.248 s5.639.298 $10,435,048 S8,293,798 SA500,000 c -$10,000,000 $3.295,248 55639.295 SI000000 d -S14.500,000 S3,295.248 ss.639,298 10,435,048 S8.293,798 S12,353.208