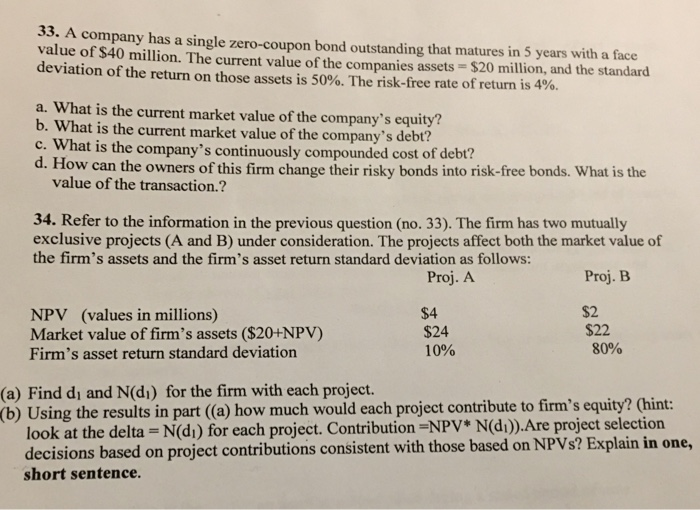

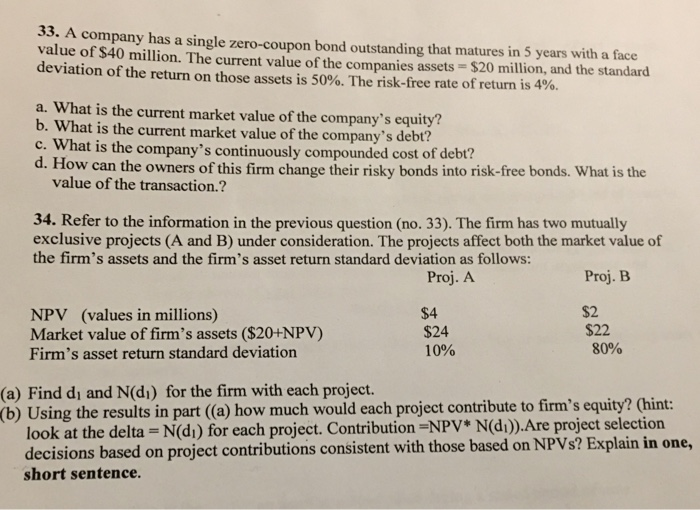

33. A company has a single zero-coupon bond outstanding that matures in 5 years with a face value of $40 million. The current value of the companies assets -$20 million, and the standard deviation of the return on those assets is 50%. Thensk-free rate of return is 4%. a. What is the current market value of the company's equity? b. What is the current market value of the company's debt? c. What is the company's continuously compounded cost of debt? d. How can the owners of this firm change their risky bonds into risk-free bonds. What is the value of the transaction.? 34. Refer to the information in the previous question (no. 33). The firm has two mutually exclusive projects (A and B) under consideration. The projects affect both the market value of the firm's assets and the firm's asset return standard deviation as follows Proj. B Proj. A $2 $22 80% $4 $24 10% NPV (values in millions) Market value of firm's assets ($20+NPV) Firm's asset return standard deviation (a) Find di and N(di) for the firm with each project. (b) Using the results in part (a) how much would each project contribute to firm's equity? (hint: look at the delta N(di) for each project. Contribution-NPV* N(di)).Are project selection decisions based on project contributions consistent with those based on NPVs short sentence. ? Explain in one, 33. A company has a single zero-coupon bond outstanding that matures in 5 years with a face value of $40 million. The current value of the companies assets -$20 million, and the standard deviation of the return on those assets is 50%. Thensk-free rate of return is 4%. a. What is the current market value of the company's equity? b. What is the current market value of the company's debt? c. What is the company's continuously compounded cost of debt? d. How can the owners of this firm change their risky bonds into risk-free bonds. What is the value of the transaction.? 34. Refer to the information in the previous question (no. 33). The firm has two mutually exclusive projects (A and B) under consideration. The projects affect both the market value of the firm's assets and the firm's asset return standard deviation as follows Proj. B Proj. A $2 $22 80% $4 $24 10% NPV (values in millions) Market value of firm's assets ($20+NPV) Firm's asset return standard deviation (a) Find di and N(di) for the firm with each project. (b) Using the results in part (a) how much would each project contribute to firm's equity? (hint: look at the delta N(di) for each project. Contribution-NPV* N(di)).Are project selection decisions based on project contributions consistent with those based on NPVs short sentence. ? Explain in one