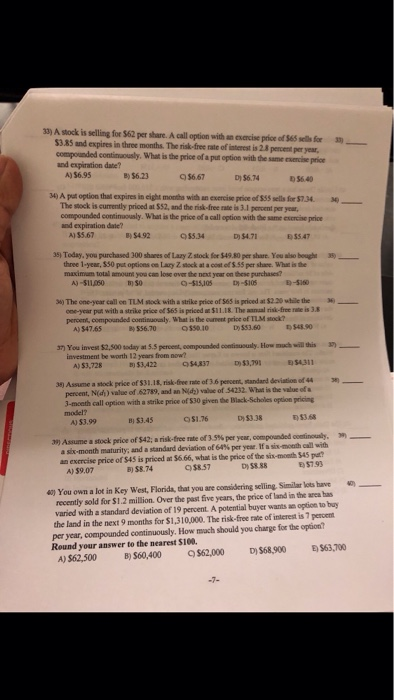

33) A stock is selling for $62 per share. A call option with an esxancise price of $565 sells for $3.85 and expires in three months. The risk-free rate of interest is 2.8 pencent per year 3_ compounded contiously What i the prise of a put option with the same eserce price and expiration date? A) 56.95 B) $6.23 $6.67 D) 56.74 36.40 34) A pat option thas expires in elight moths with an exencise price of $35 sells for $7.34_ The stock is currently priced at $52, and the risk-free rate is 3.1 percent per year comgounded continuously. What is the price of a call option with the same esencise price and expiration datie? A) 35.67 )$4.92 D) $4.71 $5.34 E 55.47 35) Today, you purchased 300 shares of Lazy Z stock for $49.80 per share. You also beught three 1-yem, $30 put options on Lary Z stock at a cost of $.55 per share. What is the maximum total amount you can lose over the next year on these purchases? 38 -$15,105 D-5105 ) The one-year call on TLM stlock with a strike price of 565 is priced at $2.20 while the one-year put with a strike price of $65 is priced an 511.18 The aanal risk-free rate is 3.8 peroent, compounded continsoualy. What is the ounent price of IL.M stock? O $50.10 A) $47.65 ) 556.70 D) 553.60 D $48.90 37m) You invest $2,500 soday at 5.5 percest, compounded continuously. How much will this investment be worth 12 years from now? A) $3,728 3 B) $3,422 54837D$3,7914311 5) Assume a stock price of $31.18, risk-free ratc of 3.6 percent, standand deviation of 44 percent, N(d) value of 62789, and an Nid) value of 54232 What is the value of a 3-moath call option with a strike price of $30 given the Black-Scholes option pricing model? B) $3.45 A) $3.99 D) $3.38 E53.68 39) Assume a stock price of$42; . risk-free rate of35% per year, compounded asix-month maturity; and a standard deviation of64% per year. If a six-metal with an exercise price of S45 is priced at $6.66, what is the price of the sin-month $45 pat A) $9.07 ondnouly, D 58.88 E $7.93 $857 B)$8.74 40) You own a lot in Key West, Florida, that you are comsidering selling Similar lots have recently sold for $1.2 million. Over the past five years, the price of land in the area has varied with a standard deviation of 19 percent. A potential buyer wants an option to buy the land in the next 9 months for $1,310,000. The risk-free rate of interest is 7 percent per year, compounded continuously. How mach should you charge fior the option Round your answer to the nearest S100. A)$62,500 B)$60,400 0$62,000 D)$68.900 ES63,700 33) A stock is selling for $62 per share. A call option with an esxancise price of $565 sells for $3.85 and expires in three months. The risk-free rate of interest is 2.8 pencent per year 3_ compounded contiously What i the prise of a put option with the same eserce price and expiration date? A) 56.95 B) $6.23 $6.67 D) 56.74 36.40 34) A pat option thas expires in elight moths with an exencise price of $35 sells for $7.34_ The stock is currently priced at $52, and the risk-free rate is 3.1 percent per year comgounded continuously. What is the price of a call option with the same esencise price and expiration datie? A) 35.67 )$4.92 D) $4.71 $5.34 E 55.47 35) Today, you purchased 300 shares of Lazy Z stock for $49.80 per share. You also beught three 1-yem, $30 put options on Lary Z stock at a cost of $.55 per share. What is the maximum total amount you can lose over the next year on these purchases? 38 -$15,105 D-5105 ) The one-year call on TLM stlock with a strike price of 565 is priced at $2.20 while the one-year put with a strike price of $65 is priced an 511.18 The aanal risk-free rate is 3.8 peroent, compounded continsoualy. What is the ounent price of IL.M stock? O $50.10 A) $47.65 ) 556.70 D) 553.60 D $48.90 37m) You invest $2,500 soday at 5.5 percest, compounded continuously. How much will this investment be worth 12 years from now? A) $3,728 3 B) $3,422 54837D$3,7914311 5) Assume a stock price of $31.18, risk-free ratc of 3.6 percent, standand deviation of 44 percent, N(d) value of 62789, and an Nid) value of 54232 What is the value of a 3-moath call option with a strike price of $30 given the Black-Scholes option pricing model? B) $3.45 A) $3.99 D) $3.38 E53.68 39) Assume a stock price of$42; . risk-free rate of35% per year, compounded asix-month maturity; and a standard deviation of64% per year. If a six-metal with an exercise price of S45 is priced at $6.66, what is the price of the sin-month $45 pat A) $9.07 ondnouly, D 58.88 E $7.93 $857 B)$8.74 40) You own a lot in Key West, Florida, that you are comsidering selling Similar lots have recently sold for $1.2 million. Over the past five years, the price of land in the area has varied with a standard deviation of 19 percent. A potential buyer wants an option to buy the land in the next 9 months for $1,310,000. The risk-free rate of interest is 7 percent per year, compounded continuously. How mach should you charge fior the option Round your answer to the nearest S100. A)$62,500 B)$60,400 0$62,000 D)$68.900 ES63,700