Answered step by step

Verified Expert Solution

Question

1 Approved Answer

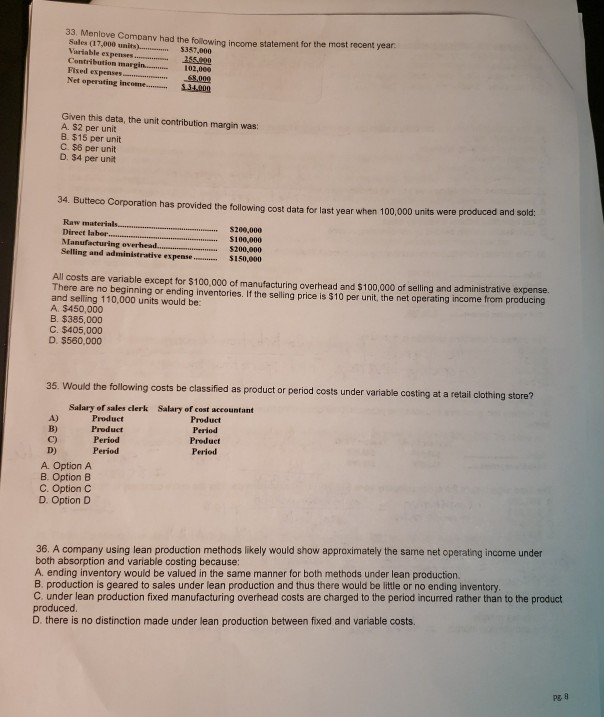

33 Menlove Companv had the folilowing income statement for the most recent year Sales (17,000 unt$37,000 Variable expenses Contrbution margin..102,000 Fised expenses Net operating incoeme..

33 Menlove Companv had the folilowing income statement for the most recent year Sales (17,000 unt$37,000 Variable expenses Contrbution margin..102,000 Fised expenses Net operating incoeme.. $.34.000 Given this data, the unit contribution margin was: A. $2 per unit B. $15 per unit C. $6 per unit D. $4 per unit 34. Butteco Corporation has provided the following cost data for last year when 100,000 units were produced and sold Raw materinl Direet laber Manufacturing overhead.$200,000 Selling and administrative expense S200,000 $100,000 $150,000 All costs are variable except for $100,000 of manufacturing overhead and $100,000 of selling and administrative expense. There are no beginning or ending inventories. If the seling price is $10 per unit, the net operating income from producing and selling 110,000 units would be: A. $450,000 B. $385,000 C. $405,000 D. $560,000 35. Would the following costs be classified as product or period costs under variable costing at a retail clothing store? A) B) C) D) Salary of sales clerk Product Product Period Period Salary of cost accountant Product Period Product Period A. Option A B. Option EB C. Option C D. Option D 36. A company using lean production methods likely would show approximately the same net operating income under both absorption and variable costing because: A. ending inventory would be valued in the same manner for both methods under lean production. B. production is geared to sales under lean production and thus there would be little or no ending inventory C under lean production fixed manufacturing overhead costs are charged to the period incurred rather than to the product produced D. there is no distinction made under lean production between fixed and variable costs. pz 8

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started