Answered step by step

Verified Expert Solution

Question

1 Approved Answer

33. Projects that are 3s, affect the choice to one another, so that investing in one project does not prochude or about investing in the

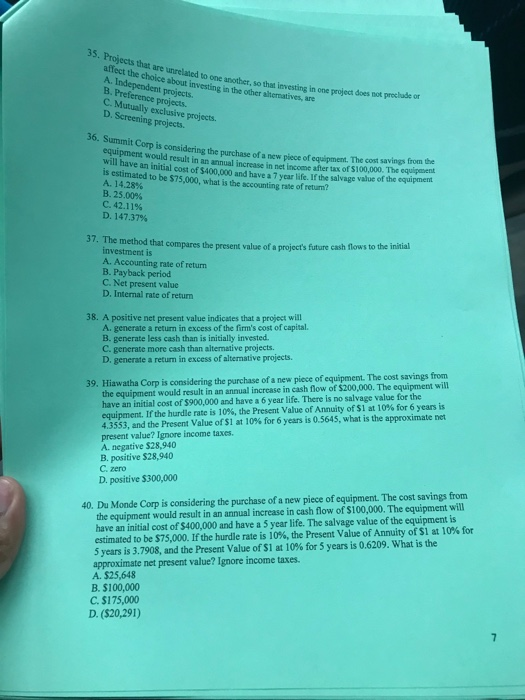

33. Projects that are 3s, affect the choice to one another, so that investing in one project does not prochude or about investing in the other aitematives, are projects. B. Preference projects. C. Mutually exclusive projects. D. Screening projects. 36. Summit Corp is considering the purchase of a new piece of equipment. The cost savings from the ould result in an annual increase in net incone after tax of S100,000. The equipasent ve an initial cost of $400,000 and have a 7 year life. If the salvage value of the equipmen is estimated to be $75,000, what is the accounting rate of retum? A. 14.28% B. 25.00% C. 42.11% D. 147.37% 37. The method that compares the present value of a project's future cash flows to the initial investment is A. Accounting rate of return B. Payback period C. Net present value D. Internal rate of return 38. A positive net present value indicates that a project will A. generate a return in excess of the firm's cost of capital B. generate less cash than is initially invested C. generate more cash than alternative projects. D. generate a return in excess of alternative projects. the equipment would result in an annual increase in cash flow of $200,000. The equipment will have an initial cost of $900,000 and have a 6 year life. There is no salvage value for the equipment. If the hurdle rate is 10%, the Present Value of Annuity of Si at 10% for 6 years is 4.3553, and the Present Value of$1 at 10% for 6 years is 0.5645, what is the approximate net present value? Ignore income taxes A. negative $28,940 B. positive $28,940 C. zero D. positive $300,000 39. Hiawatha Corp is considering the purchase of a new piece of equipment. The cost savings from the equipment would result in an annual increase in cash flow of $100,000. The equipment will have an initial cost of $400,000 and have a 5 year life. The salvage value of the equipment is estimated to be $75,000. If the hurdle rate is i0%, the Present Value of Annuity of Sl at 10% for 5 years is 3.7908, and the Present Value of$1 at 10% for 5 years is 0.6209, what is the approximate net present value? Ignore income taxes. A. $25,648 B. $100,000 C. $175,000 40. Du Monde Corp is considering the purchase of a new piece of equipment. The cost savings from D. ($20,291)

33. Projects that are 3s, affect the choice to one another, so that investing in one project does not prochude or about investing in the other aitematives, are projects. B. Preference projects. C. Mutually exclusive projects. D. Screening projects. 36. Summit Corp is considering the purchase of a new piece of equipment. The cost savings from the ould result in an annual increase in net incone after tax of S100,000. The equipasent ve an initial cost of $400,000 and have a 7 year life. If the salvage value of the equipmen is estimated to be $75,000, what is the accounting rate of retum? A. 14.28% B. 25.00% C. 42.11% D. 147.37% 37. The method that compares the present value of a project's future cash flows to the initial investment is A. Accounting rate of return B. Payback period C. Net present value D. Internal rate of return 38. A positive net present value indicates that a project will A. generate a return in excess of the firm's cost of capital B. generate less cash than is initially invested C. generate more cash than alternative projects. D. generate a return in excess of alternative projects. the equipment would result in an annual increase in cash flow of $200,000. The equipment will have an initial cost of $900,000 and have a 6 year life. There is no salvage value for the equipment. If the hurdle rate is 10%, the Present Value of Annuity of Si at 10% for 6 years is 4.3553, and the Present Value of$1 at 10% for 6 years is 0.5645, what is the approximate net present value? Ignore income taxes A. negative $28,940 B. positive $28,940 C. zero D. positive $300,000 39. Hiawatha Corp is considering the purchase of a new piece of equipment. The cost savings from the equipment would result in an annual increase in cash flow of $100,000. The equipment will have an initial cost of $400,000 and have a 5 year life. The salvage value of the equipment is estimated to be $75,000. If the hurdle rate is i0%, the Present Value of Annuity of Sl at 10% for 5 years is 3.7908, and the Present Value of$1 at 10% for 5 years is 0.6209, what is the approximate net present value? Ignore income taxes. A. $25,648 B. $100,000 C. $175,000 40. Du Monde Corp is considering the purchase of a new piece of equipment. The cost savings from D. ($20,291)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started