3.3

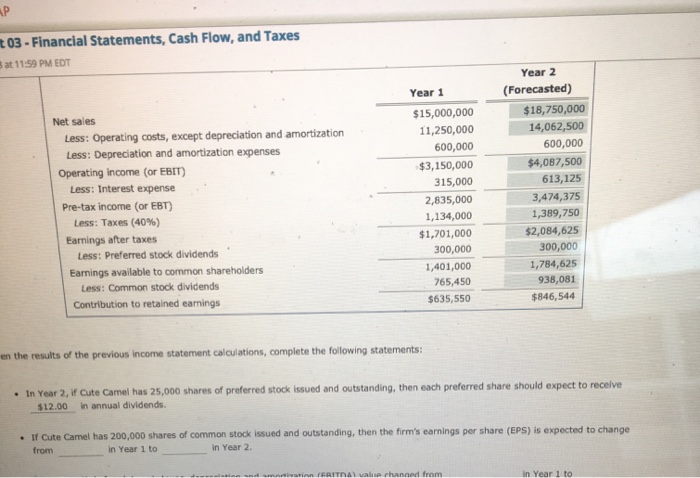

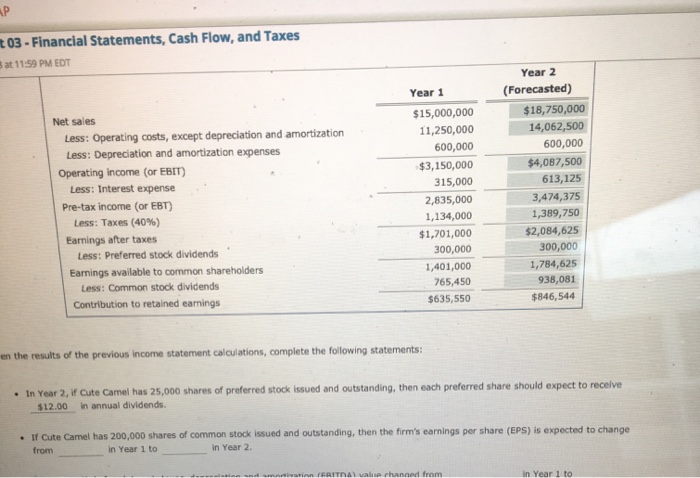

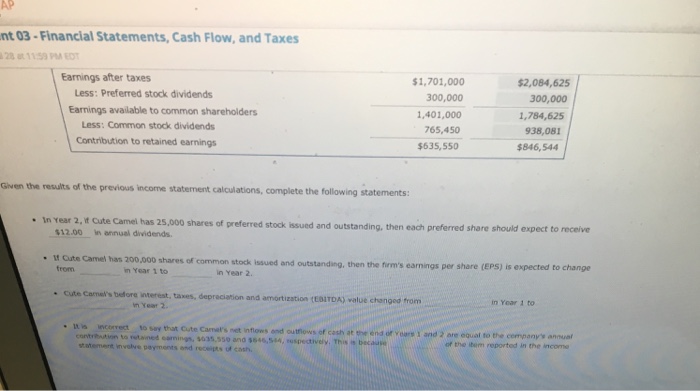

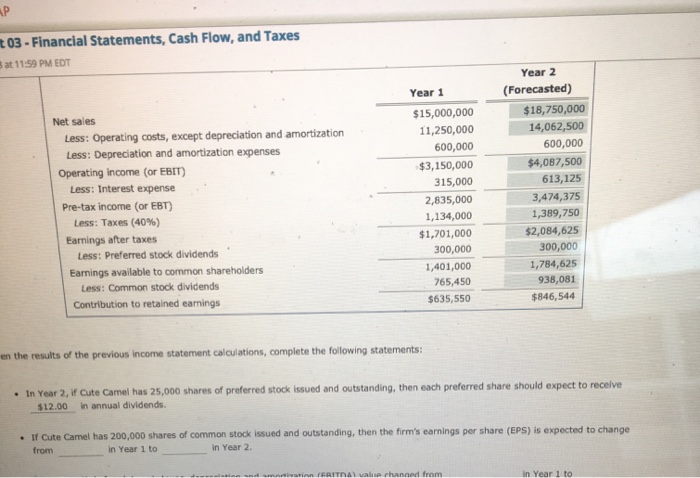

t03-Financial Statements, Cash Flow, and Taxes at 1159 PM EDT Year 2 (Forecasted) Year 1 $15,000,000 $18,750,000 Net sales 11,250,000 14,062,500 Less: operating costs, except depreciation and amortization 600,000 600,000 Less: Depreciation and amortization expenses $4,087,500 $3,150,000 operating income (or EBIT) 613,125 315,000 Less: Interest expense 3,474,375 2,835,000 Pre-tax income (or EBT) 1,389,750 1,134,000 Less: Taxes (40%) $2,084,625 $1,701,000 Earnings after taxes 300,000 300,000 Less: Preferred stock dividends 1,784,625 1,401,000 Earnings available to common shareholders 938,081 765,450 Less: Common stock dividends $846,544 $635,550 Contribution to retained earnings en the results of the previous income statement calculations, complete the following statements: In Year 2, if cute camel has 25,000 shares of preferred stock issued and outstanding, then each preferred share should expect to recelve $12.00 in annual dividends. If cute camel has shares of common stock issued and outstanding, then the firm's earnings per share (EPs) is expected to change 200,000 Year 2 in Year 1 to in Year 1 to t03-Financial Statements, Cash Flow, and Taxes at 1159 PM EDT Year 2 (Forecasted) Year 1 $15,000,000 $18,750,000 Net sales 11,250,000 14,062,500 Less: operating costs, except depreciation and amortization 600,000 600,000 Less: Depreciation and amortization expenses $4,087,500 $3,150,000 operating income (or EBIT) 613,125 315,000 Less: Interest expense 3,474,375 2,835,000 Pre-tax income (or EBT) 1,389,750 1,134,000 Less: Taxes (40%) $2,084,625 $1,701,000 Earnings after taxes 300,000 300,000 Less: Preferred stock dividends 1,784,625 1,401,000 Earnings available to common shareholders 938,081 765,450 Less: Common stock dividends $846,544 $635,550 Contribution to retained earnings en the results of the previous income statement calculations, complete the following statements: In Year 2, if cute camel has 25,000 shares of preferred stock issued and outstanding, then each preferred share should expect to recelve $12.00 in annual dividends. If cute camel has shares of common stock issued and outstanding, then the firm's earnings per share (EPs) is expected to change 200,000 Year 2 in Year 1 to in Year 1 to