Answered step by step

Verified Expert Solution

Question

1 Approved Answer

33. The periodicity assumption that underlies U.S. GAAP presumes: A. Economic events can be identified specifically with an economic entity. B. A business entity will

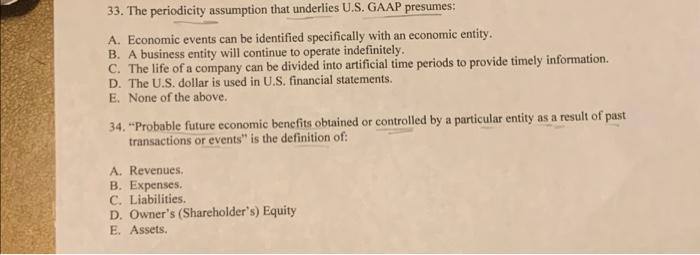

33. The periodicity assumption that underlies U.S. GAAP presumes: A. Economic events can be identified specifically with an economic entity. B. A business entity will continue to operate indefinitely. C. The life of a company can be divided into artificial time periods to provide timely information. D. The U.S. dollar is used in U.S. financial statements. E. None of the above. 34. "Probable future economic benefits obtained or controlled by a particular entity as a result of past transactions or events" is the definition of: A. Revenues. B. Expenses. C. Liabilities. D. Owner's (Shareholder's) Equity E. Assets.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started