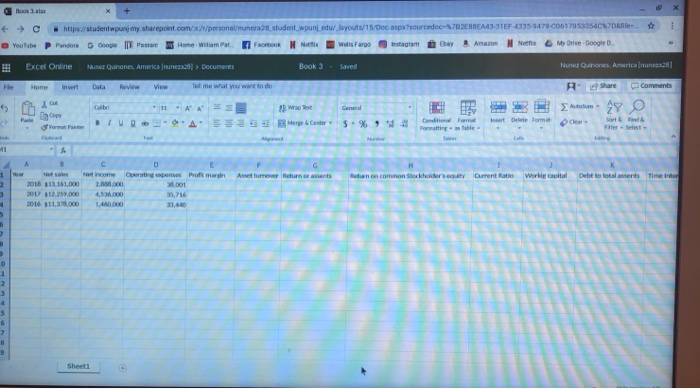

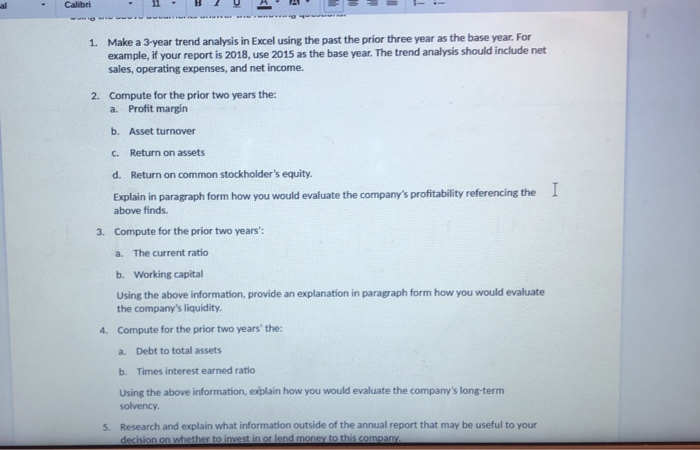

3-31EF 4335-9470 C0617053354Ck7Dnle. eC https/stutentwpunj my.sharepoint.com/x/t/personalunera2.studentepunj edur Juyouts/15/Docaspx Nunez Quinones, America [nuncea28] Excel Online Nusez Qunones, America Inunezazdl>Documenes Book 3 Saved A- L share : -Comments apbt Selest - 22018 $33 161000 00 12.259,000 4,536000 016 $11,3,0001460000 8,001 5,716 31,440 Sheetl Calibri al . Make a 3-year trend analysis in Excel using the past the prior three year as the base year. For example, if your report is 2018, use 2015 as the base year. The trend analysis should include net sales, operating expenses, and net income. Compute for the prior two years the: 2. a. Profit margin b. Asset turnover c. Return on assets Return on common stockholder's equity. d. Explain in paragraph form how you would evaluate the company's profitability referencing the above finds. Compute for the prior two years': a. The current ratio b. Working capital Using the above information, provide an explanation in paragraph form how you would evaluate 3. the company's liquidity Compute for the prior two years' the: a. Debt to total assets b. Times interest earned ratio Using the above information, explain how you would evaluate the company's long-term 4. Research and explain what information outside of the annual report that may be useful to your 5. 3-31EF 4335-9470 C0617053354Ck7Dnle. eC https/stutentwpunj my.sharepoint.com/x/t/personalunera2.studentepunj edur Juyouts/15/Docaspx Nunez Quinones, America [nuncea28] Excel Online Nusez Qunones, America Inunezazdl>Documenes Book 3 Saved A- L share : -Comments apbt Selest - 22018 $33 161000 00 12.259,000 4,536000 016 $11,3,0001460000 8,001 5,716 31,440 Sheetl Calibri al . Make a 3-year trend analysis in Excel using the past the prior three year as the base year. For example, if your report is 2018, use 2015 as the base year. The trend analysis should include net sales, operating expenses, and net income. Compute for the prior two years the: 2. a. Profit margin b. Asset turnover c. Return on assets Return on common stockholder's equity. d. Explain in paragraph form how you would evaluate the company's profitability referencing the above finds. Compute for the prior two years': a. The current ratio b. Working capital Using the above information, provide an explanation in paragraph form how you would evaluate 3. the company's liquidity Compute for the prior two years' the: a. Debt to total assets b. Times interest earned ratio Using the above information, explain how you would evaluate the company's long-term 4. Research and explain what information outside of the annual report that may be useful to your 5