Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3:36 DK QV Post vel ill. Final%20term%20ac...20fall2020%20arab - Saved n Question One Mostafa, a former disc golf star, operates Mostafa's Discorama. At the beginning of

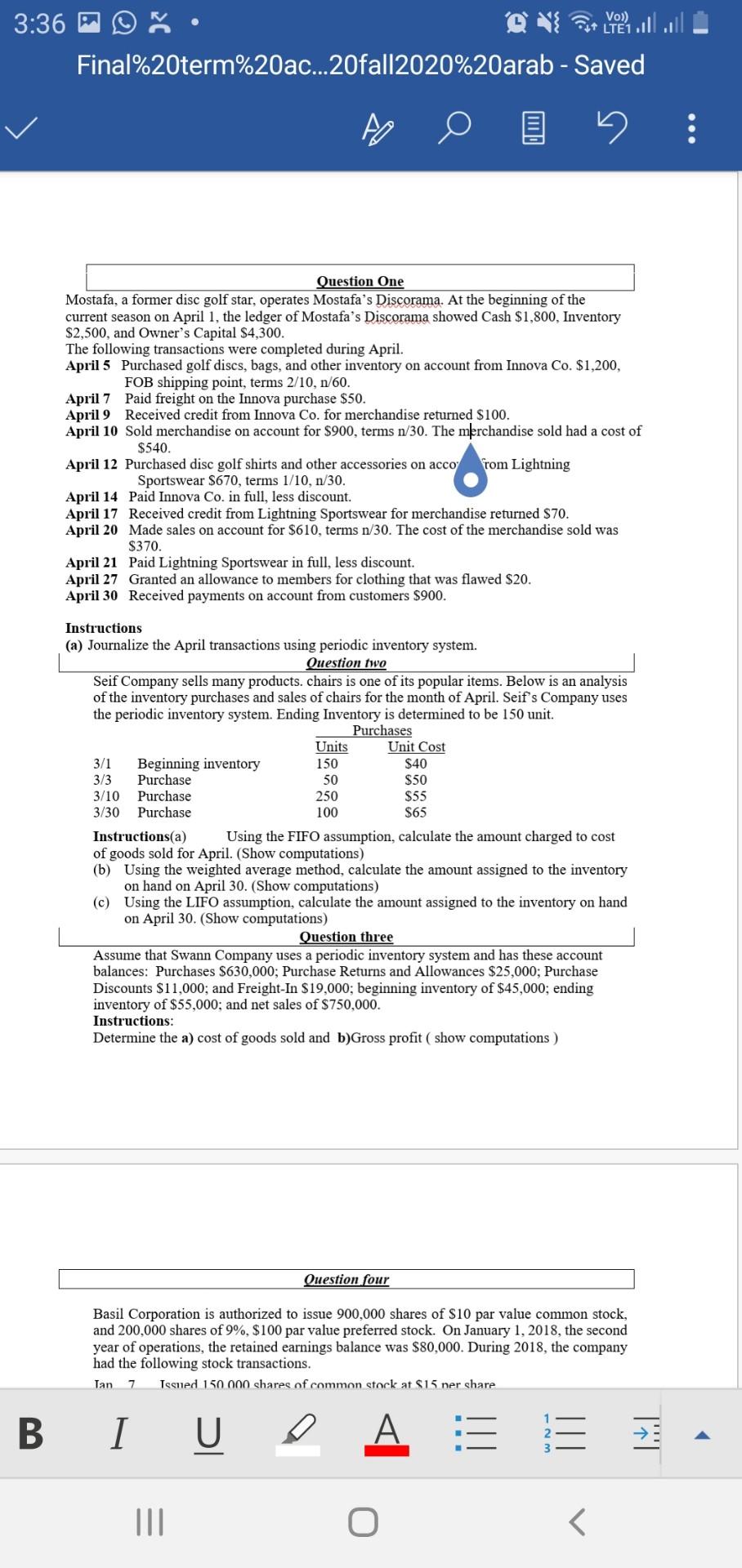

3:36 DK QV Post vel ill. Final%20term%20ac...20fall2020%20arab - Saved n Question One Mostafa, a former disc golf star, operates Mostafa's Discorama. At the beginning of the current season on April 1, the ledger of Mostafa's Discorama showed Cash $1,800, Inventory $2,500, and Owner's Capital $4,300. The following transactions were completed during April. April 5 Purchased golf discs, bags, and other inventory on account from Innova Co. $1,200, FOB shipping point, terms 2/10, n/60. April 7 Paid freight on the Innova purchase $50. April 9 Received credit from Innova Co. for merchandise returned $100. April 10 Sold merchandise on account for $900, terms n/30. The merchandise sold had a cost of $540. April 12 Purchased disc golf shirts and other accessories on acco from Lightning Sportswear $670, terms 1/10, n/30. April 14 Paid Innova Co. in full, less discount. April 17 Received credit from Lightning Sportswear for merchandise returned $70. April 20 Made sales on account for $610, terms n/30. The cost of the merchandise sold was $370. April 21 Paid Lightning Sportswear in full, less discount. April 27 Granted an allowance to members for clothing that was flawed $20. April 30 Received payments on account from customers $900. Instructions (a) Journalize the April transactions using periodic inventory system. Question two Seif Company sells many products. chairs is one of its popular items. Below is an analysis of the inventory purchases and sales of chairs for the month of April. Seif's Company uses the periodic inventory system. Ending Inventory is determined be 150 unit Purchases Units Unit Cost 3/1 Beginning inventory 150 S40 3/3 Purchase 50 $50 3/10 Purchase 250 $55 3/30 Purchase 100 $65 Instructions(a) Using the FIFO assumption, calculate the amount charged to cost of goods sold for April. (Show computations) (b) Using the weighted average method, calculate the amount assigned to the inventory on hand on April 30. (Show computations) (c) Using the LIFO assumption, calculate the amount assigned to the inventory on hand on April 30. (Show computations) Question three Assume that Swann Company uses a periodic inventory system and has these account balances: Purchases $630,000; Purchase Returns and Allowances $25,000; Purchase Discounts $11,000; and Freight-In $19,000; beginning inventory of $45,000; ending inventory of $55,000; and net sales of $750,000. Instructions: Determine the a) cost of goods sold and b)Gross profit (show computations ) Question four Basil Corporation is authorized to issue 900,000 shares of $10 par value common stock, and 200,000 shares of 9%, $100 par value preferred stock. On January 1, 2018, the second year of operations, the retained earnings balance was $80,000. During 2018, the company had the following stock transactions. Tan 7 Issued 150 000 shares of common stock at $15 ner share A 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started