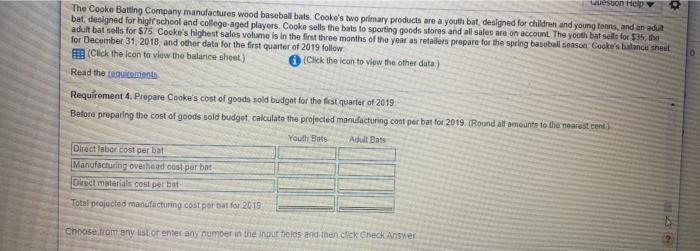

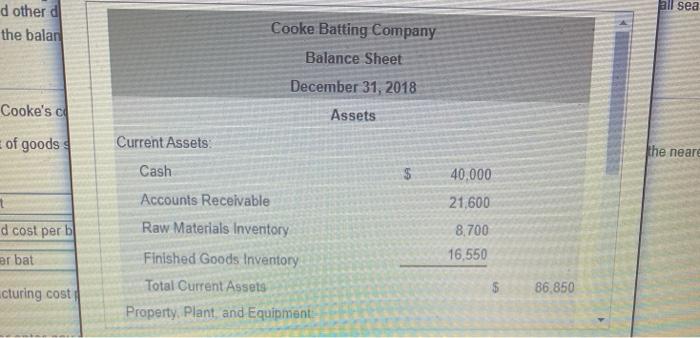

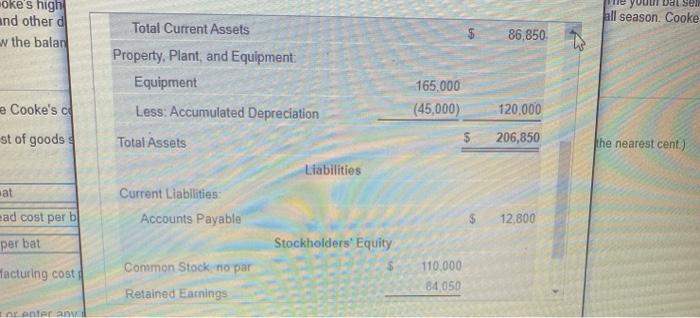

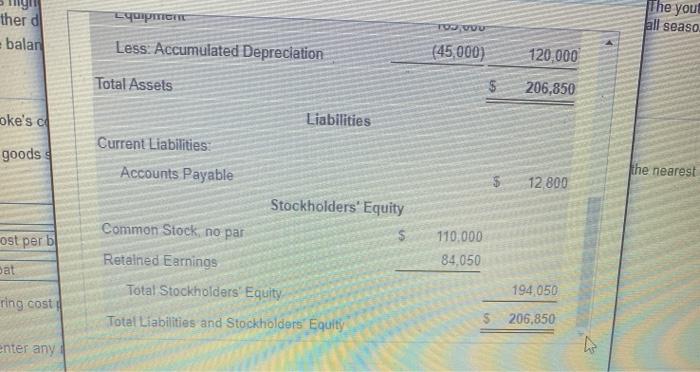

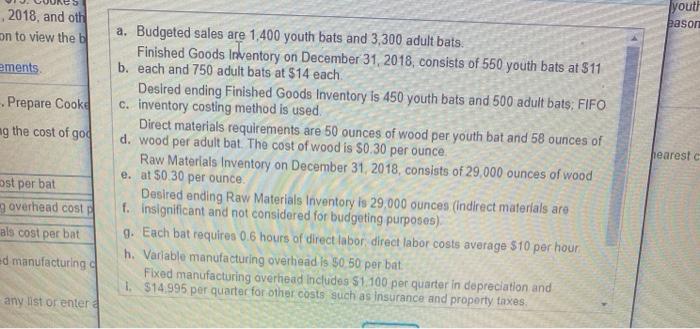

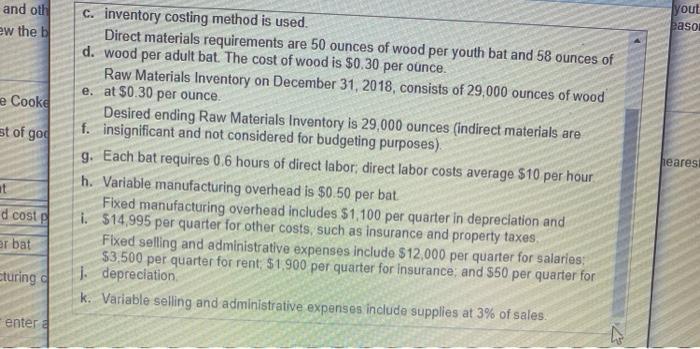

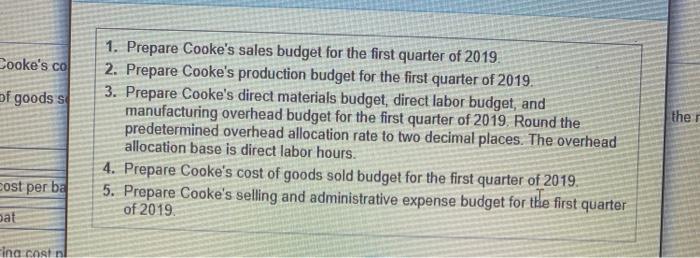

wuestion Help The Cooke Batting Company manufactures wood baseball bats Cooke's two primary products are a youth bat designed for children and young teens, and an adult bat designed for high school and college-aged players. Cooke sells the bats to sporting goods stores and all sales are on account. The youth bat sells for $35, the adult bat sells for $75 Cooke's highest sales volume is in the first three months of the year as retailers prepare for the spring baseball season Cooke's balance sheet for December 31, 2018, and other data for the first quarter of 2019 follow Click the icon to vlow the balance sheet) (Click the icon to view the other data) Read the concent Requirement 4. Prepare Cooke's cost of goods sold budget for the first quarter of 2019 Before preparing the cost of goods sold budget calculate the projected manufacturing cost per bat for 2019. (Round all amounts to the nearest cent Youth Bats Adult Bats Direct labor cost per bat Manufacturing overhead cost per bat Direct materials cost per bot Total projected manufacturing cost per bat for 2019 Choose from any list or enter any number in the input fields and then click Check Answer all sea d other d the balan Cooke Batting Company Balance Sheet December 31, 2018 Cooke's co Assets E of goods Current Assets the neare Cash $ 40.000 7 21,600 d cost per b Accounts Receivable Raw Materials Inventory Finished Goods Inventory Total Current Assets Property. Plant and Equipment 8,700 16,550 er bat $ cturing cost 86,850 okes high and other d w the balan you Dal Sell all season. Cooke 86,850 Total Current Assets Property. Plant, and Equipment Equipment Less: Accumulated Depreciation 165,000 (45,000) 120.000 e Cooke's do st of goods Total Assets $ 206,850 the nearest cent.) Liabilities at Current Liabilities Accounts Payable ead cost perb 12.800 per bat Stockholders' Equity acturing cost Common Stock no par Retained Earnings 110,000 84050 ar antaran The you all seaso. ther d balar Less: Accumulated Depreciation (45,000) 120,000 Total Assets $ 206,850 oke's c Liabilities goods Current Liabilities: Accounts Payable the nearest $ 12 800 Stockholders' Equity Common Stock no par $ ost perb Sat 110.000 84.050 Retained Earnings Total Stockholders' Equity 194 050 ring costa Total Liabilities and Stockholders Equity $206,850 enter any 2018, and oth on to view the yout! ason ements Prepare Cooke mg the cost of god a. Budgeted sales are 1,400 youth bats and 3,300 adult bats. Finished Goods Inventory on December 31, 2018, consists of 550 youth bats at $11 b. each and 750 adult bats at $14 each Desired ending Finished Goods Inventory is 450 youth bats and 500 adult bats: FIFO c. inventory costing method is used. Direct materials requirements are 50 ounces of wood per youth bat and 58 ounces of d. wood per adult bat. The cost of wood is $0.30 per ounce Raw Materials Inventory on December 31, 2018, consists of 29,000 ounces of wood e. at $0.30 per ounce Desired ending Raw Materials Inventory is 29,000 ounces (Indirect materials are 1. insignificant and not considered for budgeting purposes) g. Each bat requires 0.6 hours of direct labor direct labor costs average $10 per hour h. Variable manufacturing overhead is 50 50 per bat Fixed manufacturing overhead includes $1.100 per quarter in depreciation and $14.995 per quarter for other costs such as insurance and property taxes. hearest st per bat goverhead cost als cost per bat ed manufacturing any list or enter and oth ew the bi yout Pasol e Cooke st of god c. inventory costing method is used. Direct materials requirements are 50 ounces of wood per youth bat and 58 ounces of d. wood per adult bat. The cost of wood is $0,30 per ounce. Raw Materials Inventory on December 31, 2018, consists of 29,000 ounces of wood e. at $0.30 per ounce. Desired ending Raw Materials Inventory is 29,000 ounces (indirect materials are f. insignificant and not considered for budgeting purposes). g. Each bat requires 0.6 hours of direct labor, direct labor costs average $10 per hour h. Variable manufacturing overhead is $0.50 per bat Fixed manufacturing overhead includes $1,100 per quarter in depreciation and i. $14.995 per quarter for other costs, such as insurance and property taxes Fixed selling and administrative expenses include $12,000 per quarter for salaries: $3,500 per quarter for rent $1900 per quarter for insurance, and $50 per quarter for 1. depreciation k. Variable selling and administrative expenses include supplies at 3% of sales. heares at d cost er bat sturing enter G Cooke's co of goods s ther 1. Prepare Cooke's sales budget for the first quarter of 2019 2. Prepare Cooke's production budget for the first quarter of 2019. 3. Prepare Cooke's direct materials budget direct labor budget, and manufacturing overhead budget for the first quarter of 2019. Round the predetermined overhead allocation rate to two decimal places. The overhead allocation base is direct labor hours. 4. Prepare Cooke's cost of goods sold budget for the first quarter of 2019. 5. Prepare Cooke's selling and administrative expense budget for tile first quarter of 2019. post per bal bat ina costa