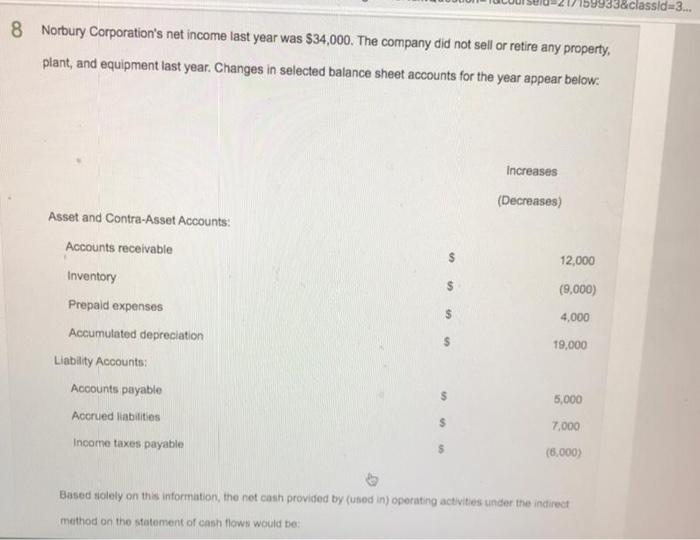

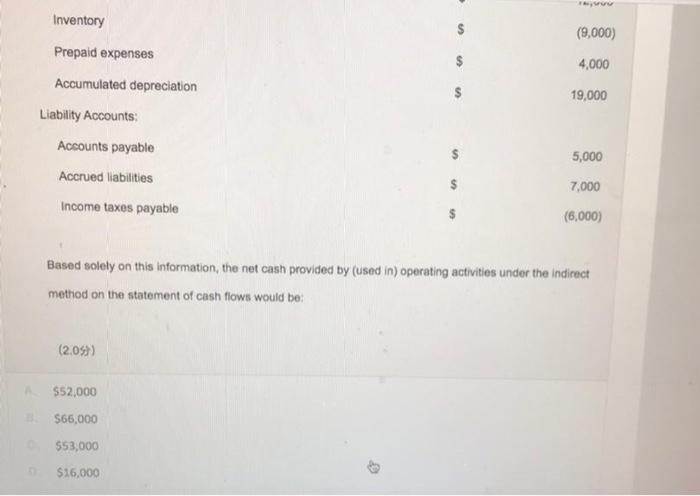

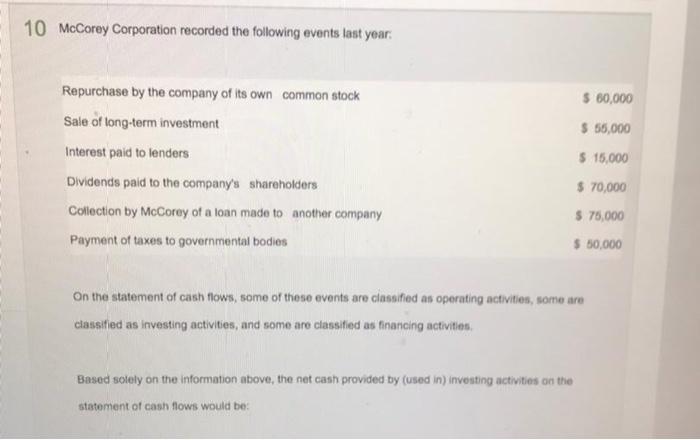

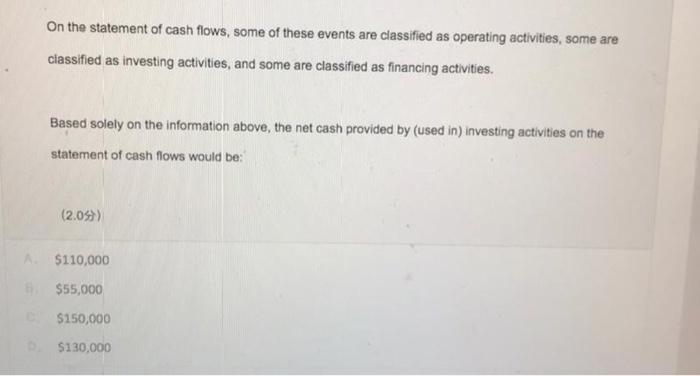

33&classida 3... 8 Norbury Corporation's net income last year was $34,000. The company did not sell or retire any property, plant, and equipment last year. Changes in selected balance sheet accounts for the year appear below: Increases (Decreases) 12,000 (9,000) Asset and Contra-Asset Accounts: Accounts receivable Inventory Prepaid expenses Accumulated depreciation Liability Accounts: Accounts payable Accrued liabilities 4,000 19.000 5,000 7,000 Income taxes payable (6.000) Based solely on this information, the net cash provided by used in) operating activities under the indirect method on the statement of cash flow would be Inventory (9,000) 4,000 19,000 Prepaid expenses Accumulated depreciation Liability Accounts: Accounts payable Accrued liabilities Income taxes payable 5,000 7.000 (6,000) Based solely on this information, the net cash provided by (used in) operating activities under the Indirect method on the statement of cash flows would be (2.05)) $52,000 $66,000 $53,000 $16,000 10 McCorey Corporation recorded the following events last year $ 60,000 $ 55,000 $ 15,000 Repurchase by the company of its own common stock Sale of long-term investment Interest paid to lenders Dividends paid to the company's shareholders Collection by McCorey of a loan made to another company Payment of taxes to governmental bodies $ 70,000 $ 75,000 $ 50.000 On the statement of cash flows, some of these events are classified as operating activities, some are classified as investing activities, and some are classified as financing activities Based solely on the information above, the net cash provided by (used in) investing activities on the statement of cash flows would be On the statement of cash flows, some of these events are classified as operating activities, some are classified as investing activities, and some are classified as financing activities. Based solely on the information above, the net cash provided by (used in) investing activities on the statement of cash flows would be: (2.0%) $110,000 $55,000 $150,000 $130,000