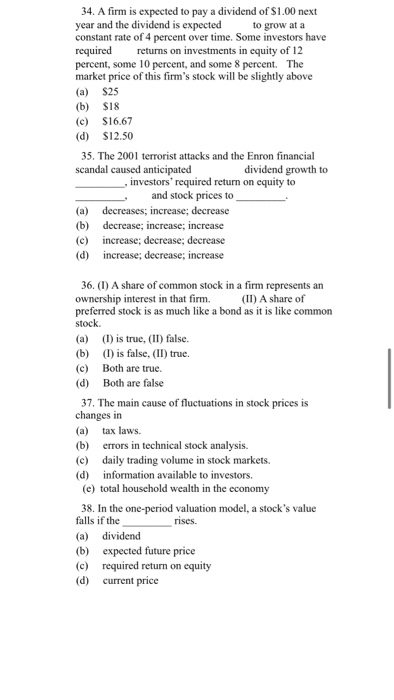

34. A firm is expected to pay a dividend of $1.00 next year and the dividend is expected to grow at a constant rate of 4 percent over time. Some investors have required returns on investments in equity of 12 percent, some 10 percent, and some 8 percent. The market price of this firm's stock will be slightly above (a) $25 (b) $18 (c) S16.67 (d) $12.50 35. The 2001 terrorist attacks and the Enron financial scandal caused anticipated dividend growth to investors' required return on equity to , and stock prices to (a) decreases, increase; decrease (b) decrease; increase; increase (c) increase; decrease; decrease (d) increase; decrease; increase 36. (I) A share of common stock in a firm represents an ownership interest in that firm. (II) A share of preferred stock is as much like a bond as it is like common stock (a) (1) is true, (II) false. (b) (I) is false, (II) true. (c) Both are true. (d) Both are false 37. The main cause of fluctuations in stock prices is changes in (a) tax laws. (b) errors in technical stock analysis. (c) daily trading volume in stock markets. (d) information available to investors. (e) total household wealth in the economy 38. In the one-period valuation model, a stock's value falls if the rises. (a) dividend (b) expected future price (c) required return on equity (d) current price 34. A firm is expected to pay a dividend of $1.00 next year and the dividend is expected to grow at a constant rate of 4 percent over time. Some investors have required returns on investments in equity of 12 percent, some 10 percent, and some 8 percent. The market price of this firm's stock will be slightly above (a) $25 (b) $18 (c) S16.67 (d) $12.50 35. The 2001 terrorist attacks and the Enron financial scandal caused anticipated dividend growth to investors' required return on equity to , and stock prices to (a) decreases, increase; decrease (b) decrease; increase; increase (c) increase; decrease; decrease (d) increase; decrease; increase 36. (I) A share of common stock in a firm represents an ownership interest in that firm. (II) A share of preferred stock is as much like a bond as it is like common stock (a) (1) is true, (II) false. (b) (I) is false, (II) true. (c) Both are true. (d) Both are false 37. The main cause of fluctuations in stock prices is changes in (a) tax laws. (b) errors in technical stock analysis. (c) daily trading volume in stock markets. (d) information available to investors. (e) total household wealth in the economy 38. In the one-period valuation model, a stock's value falls if the rises. (a) dividend (b) expected future price (c) required return on equity (d) current price