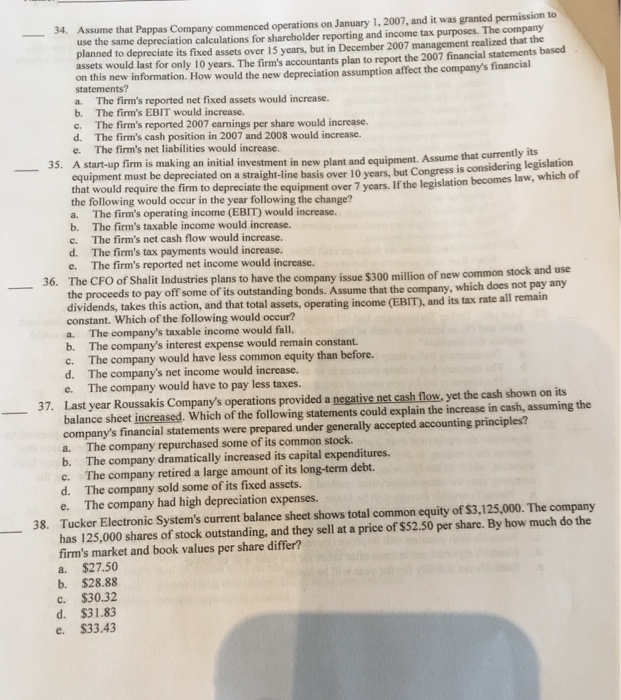

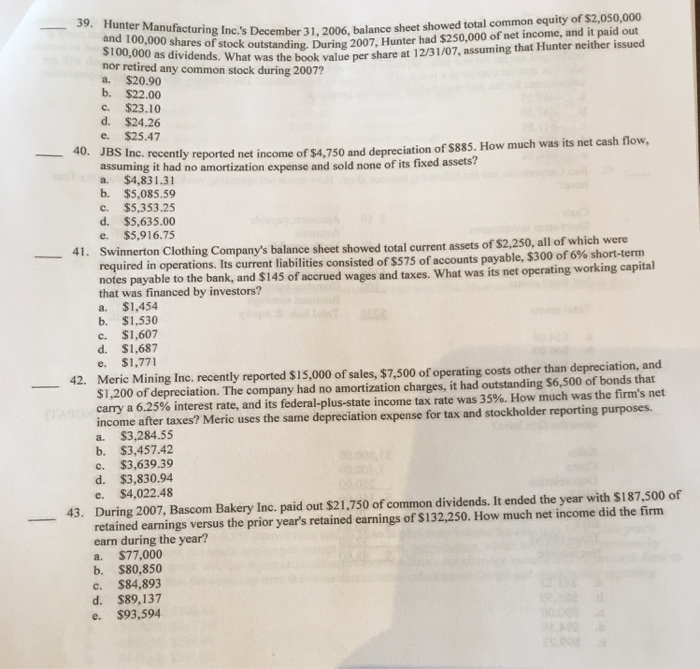

34. Assume that Pappas Company commenced operations on January 1, 2007, and it was granted permission to use the same depreciation calculations for shareholder reporting and income tax purposes. The company planned to depreciate its fixed assets over 15 years, but in December 2007 management realized that the assets would last for only 10 years. The firm's accountants plan to report the 2007 financial statements based on this new information. How would the new depreciation assumption statements? a. b. affect the company's financial The firm's reported net fixed assets would increase. The firm's EBIT would increase. The firm's reported 2007 earnings per share would increase. The firm's cash position in 2007 and 2008 would increase. The firm's net liabilities would increase. c. d. e. 35. A start-u p firm is making an initial investment in new plant and equipment. Assume that currently its equipment must be depreciated on a straight-line basis over 10 years, but Congress is cons that would require the firm to depreciate the equipment over 7 years. If the legislation becomes the following would occur in the year following the change? which of a. The firm's operating income (EBIT) would increase. b. The firm's taxable income would increase. The firm's net cash flow would increase. c. d The firm's tax payments would increase. The firm's reported net income would increase. The CFO of Shalit Industries plans to have the company issue $300 million of the proceeds to pay off some of its outstanding bonds. Assume that the company, which dividends, takes this action, and that total assets, operating income (EBIT), and constant. Which of the following would occur? e. 36. new common stock and use does not pay any its tax rate all remain a. b. c. d. e. The company's taxable income would fall. The company's interest expense would remain constant. The company would have less common equity than before. The company's net income would increase. The company would have to pay less taxes. t year Roussakis Company's operations provided a negative net cash flow, yet the cash shown on its balance company's financial statements were prepared under generally accepted accounting principles? a. The company repurchased some of its common stock. b. The company dramatically increased its capital expenditures. c- The company retired a large amount of its long-term debt. d. The company sold some of its fixed assets. e. The company had high depreciation expenses. Tucker Electronic System's current balance sheet shows total common equity of $3,125,000. The company has 125,000 shares of stock outstanding, and they sell at a price of $52.50 per share. By how much do the firm's market and book values per share differ? sheet increased. Which of the following statements could explain the increase in cash, assuming the 38. $27.50 a. b. $28.88 c. $30.32 d. $31.83 e. $33.43 39. Hunter Manufacturing ek outstanding. During 2007, Hunter had $250,000 of net income, and it paid out idends. What was the book value per share at 12/31/07, assuming that Hunter neither issued ng Inc.'s December 31, 2006, balance sheet showed total common equity of $2,050,000 Decem and 100,000 shares of stock nor retired any common stock during 2007? a. $20.90 b. $22.00 c. $23.10 d. $24.26 e. $25.47 40. JBS I 40. JBS nc. recently reported net income of $4,750 and depreciation of s885. How much was its net cash flow, assuming a. $4,831.31 b. $5,085.59 c. $5,353.25 d. $5,635.00 e. $5,916.75 Swinnerton Clothing Company's balance sheet required in operations. Its current liabilities notes payable to the bank, and $145 o that was financed by investors? a. $1,454 b. $1.530 c. $1.607 d. $1,687 e. $1,771 Meric Mining Inc. recently reported $15,000 of sales, $7,500 of operating costs other than depreciation, and $1,200 carry a 6.25% interest rate, and its federal plus state income tax rate was 35% How much was the firm's net income after taxes? Meric uses a. $3,284.55 b. $3,457.42 c. $3,639.39 d. $3,830.94 e. $4,022.48 it had no amortization expense and sold none of its fixed assets? showed total current assets of $2,250, all of which were consisted of $575 of accounts payable, $300 of 6% short-term 41 . _ faccrued wages and taxes. What was its net operating working capital of depreciation. The company had no amortization charges, it had outstanding $6,500 of bonds that the same depreciation expense for tax and stockholder reporting purposes. 42. 43. During 2007, Bascom Bakery Inc. paid out $21,750 of common dividends. It ended the year with $187,500 of retained earnings versus the prior year's retained earnings of $132,250. How much net income did the firm earn during the year? a. $77,000 b. $80,850 c. $84,893 d. $89,137 e. $93,594