Answered step by step

Verified Expert Solution

Question

1 Approved Answer

34. Ferguson Company paid $200 cash for various manufacturing overhead costs. How does this transaction affect the financial statements? A. begin{tabular}{l} begin{tabular}{|l|l|l|c|c|c|c|c|c|c|} hline(200) & +200

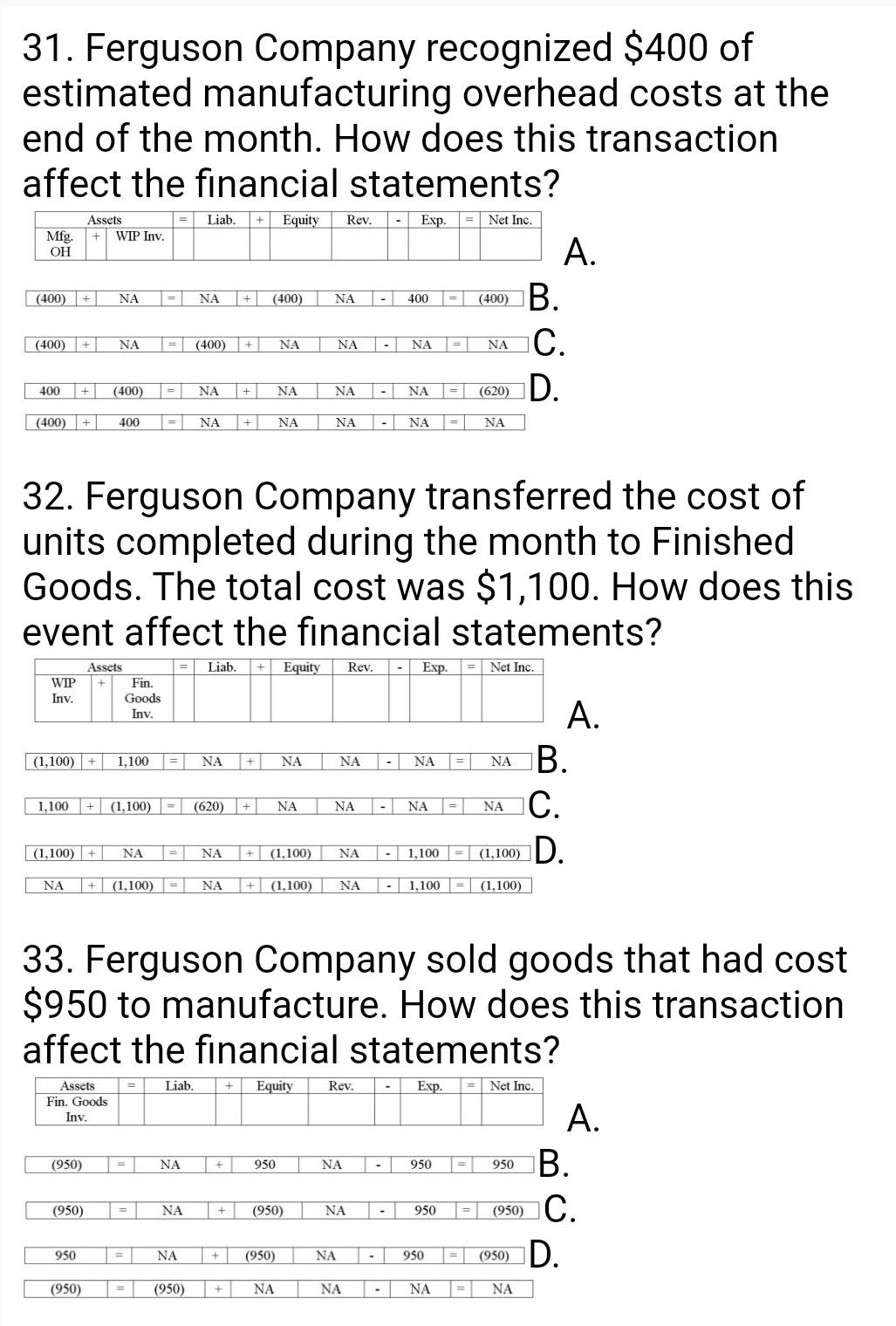

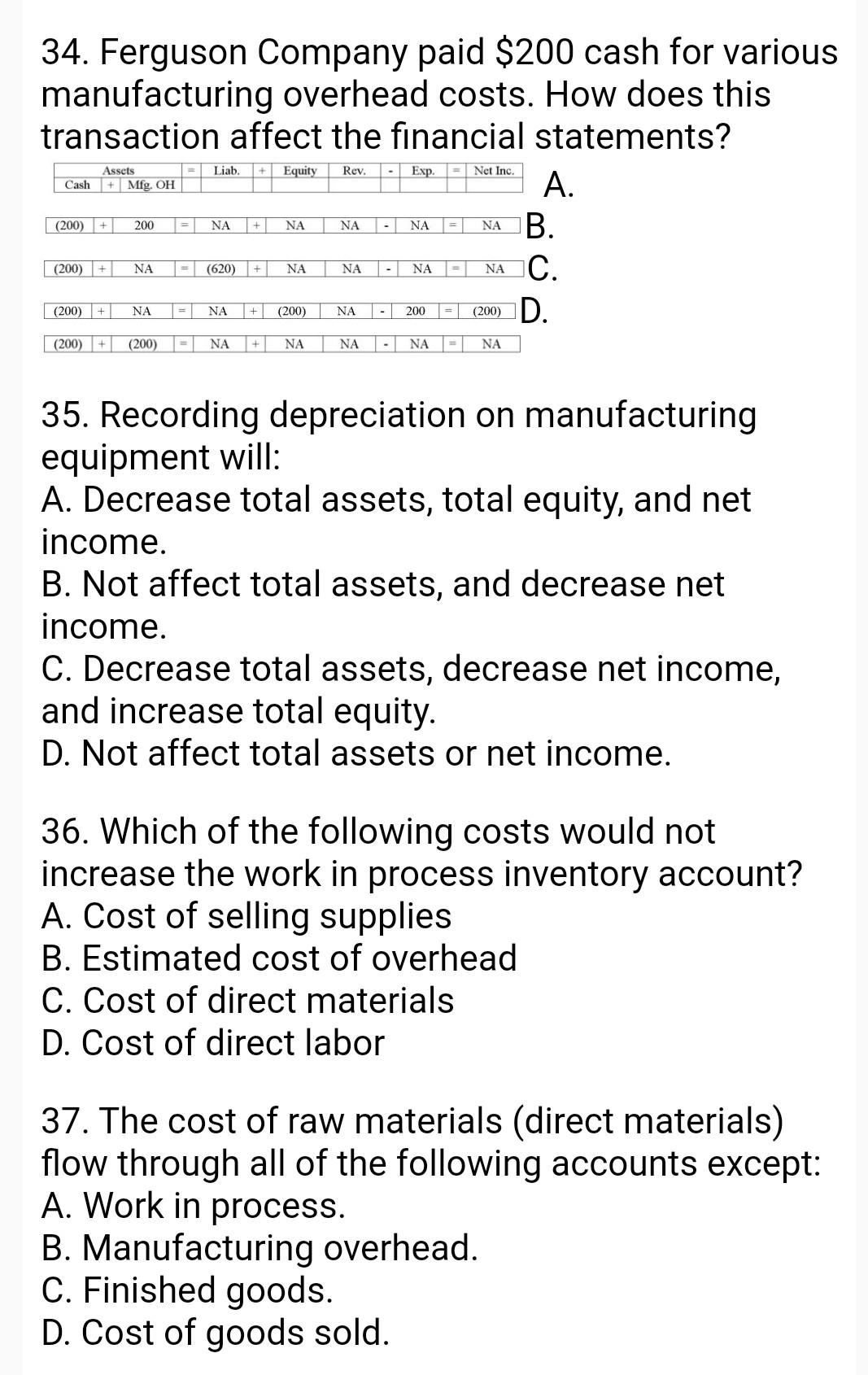

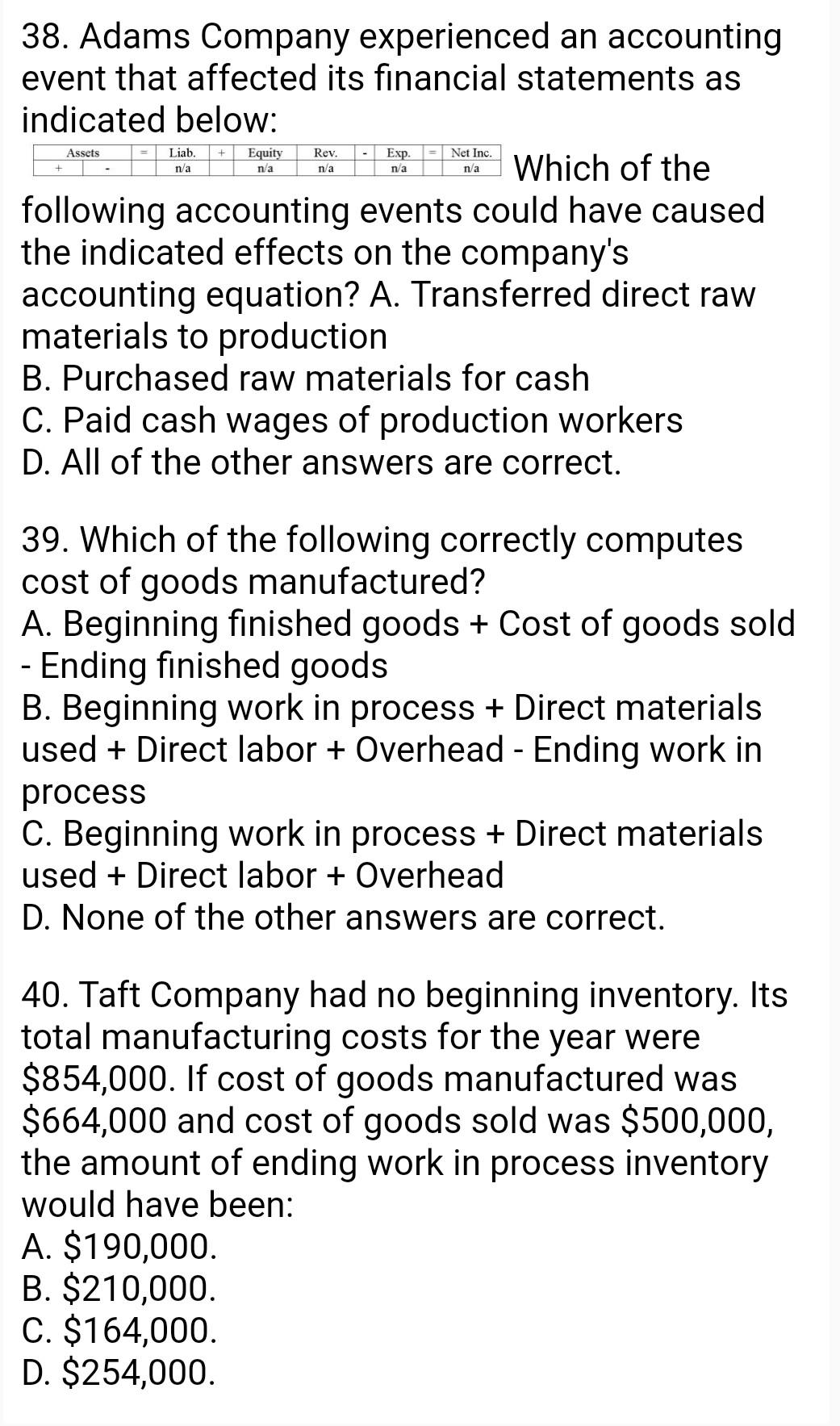

34. Ferguson Company paid $200 cash for various manufacturing overhead costs. How does this transaction affect the financial statements? A. \begin{tabular}{l} \begin{tabular}{|l|l|l|c|c|c|c|c|c|c|} \hline(200) & +200 & NA & NA & NA & - & NA & = & NA \\ \hline \end{tabular} \\ \hline \\ \hline(200) \\ \hline \end{tabular} 35. Recording depreciation on manufacturing equipment will: A. Decrease total assets, total equity, and net income. B. Not affect total assets, and decrease net income. C. Decrease total assets, decrease net income, and increase total equity. D. Not affect total assets or net income. 36. Which of the following costs would not increase the work in process inventory account? A. Cost of selling supplies B. Estimated cost of overhead C. Cost of direct materials D. Cost of direct labor 37. The cost of raw materials (direct materials) flow through all of the following accounts except: A. Work in process. B. Manufacturing overhead. C. Finished goods. D. Cost of goods sold. 31. Ferguson Company recognized $400 of estimated manufacturing overhead costs at the end of the month. How does this transaction affect the financial statements? A. ;. ). 32. Ferguson Company transferred the cost of units completed during the month to Finished Goods. The total cost was $1,100. How does this event affect the financial statements? A. 33. Ferguson Company sold goods that had cost $950 to manufacture. How does this transaction affect the financial statements? 38. Adams Company experienced an accounting event that affected its financial statements as indicated below: Which of the following accounting events could have caused the indicated effects on the company's accounting equation? A. Transferred direct raw materials to production B. Purchased raw materials for cash C. Paid cash wages of production workers D. All of the other answers are correct. 39. Which of the following correctly computes cost of goods manufactured? A. Beginning finished goods + Cost of goods sold - Ending finished goods B. Beginning work in process + Direct materials used + Direct labor + Overhead - Ending work in process C. Beginning work in process + Direct materials used + Direct labor + Overhead D. None of the other answers are correct. 40. Taft Company had no beginning inventory. Its total manufacturing costs for the year were $854,000. If cost of goods manufactured was $664,000 and cost of goods sold was $500,000, the amount of ending work in process inventory would have been: A. $190,000. B. $210,000. C. $164,000. D. $254,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started