Answered step by step

Verified Expert Solution

Question

1 Approved Answer

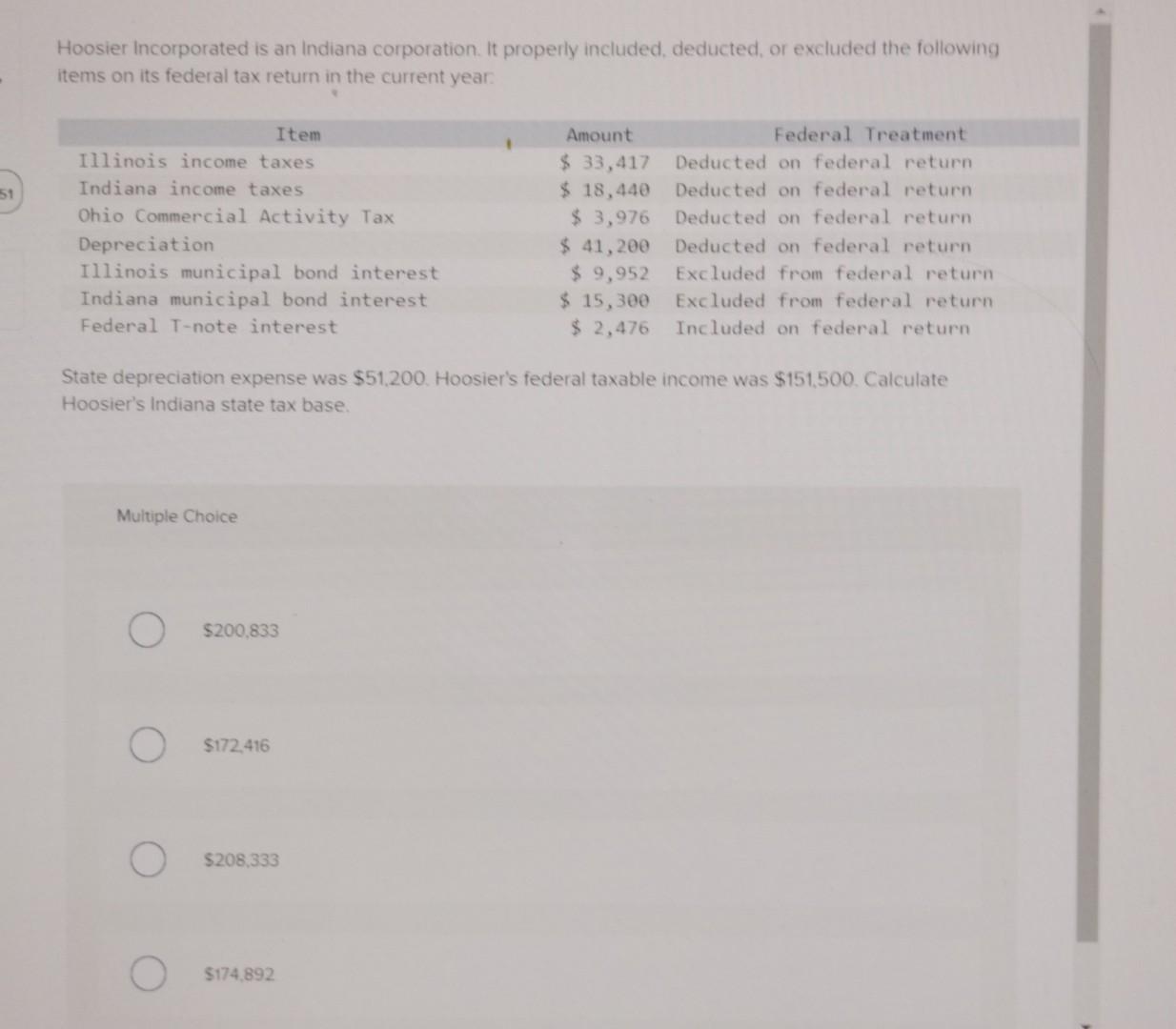

34 Hoosier Incorporated is an Indiana corporation. It properly included, deducted, or excluded the following items on its federal tax return in the current year:

34

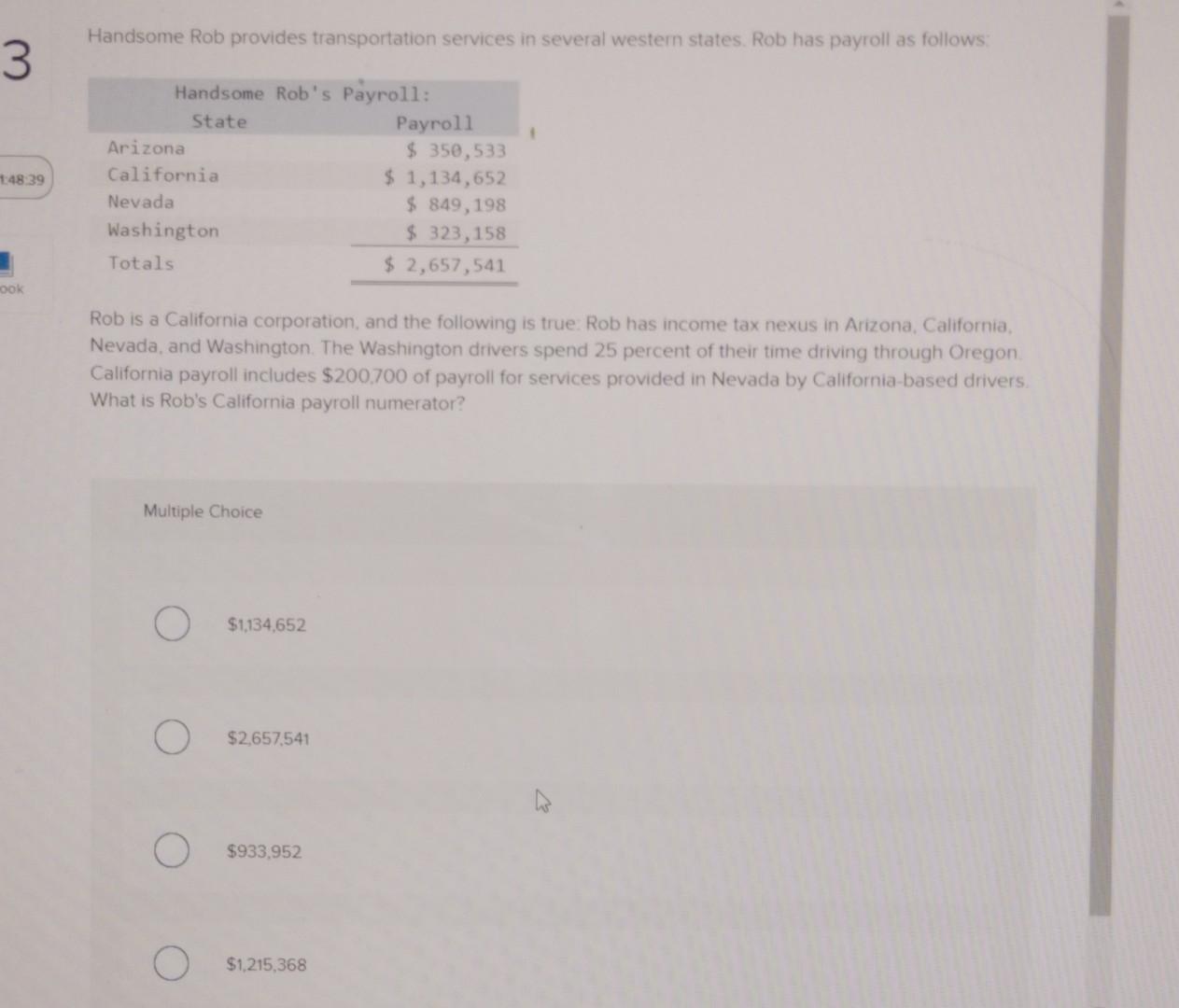

Hoosier Incorporated is an Indiana corporation. It properly included, deducted, or excluded the following items on its federal tax return in the current year: State depreciation expense was $51,200. Hoosier's federal taxable income was $151,500. Calculate Hoosier's Indiana state tax base. Multiple Choice $200,833 $172.416 $208,333 $174,892 Handsome Rob provides transportation services in several westem states. Rob has payroll as follows Rob is a California corporation, and the following is true: Rob has income tax nexus in Arizona, California, Nevada, and Washington. The Washington drivers spend 25 percent of their time driving through Oregon California payroll includes $200,700 of payroll for services provided in Nevada by California-based drivers. What is Rob's California payroll numerator? Multiple Choice $1,134,652 $2,657,541 $933,952 $1,215,368Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started