Answered step by step

Verified Expert Solution

Question

1 Approved Answer

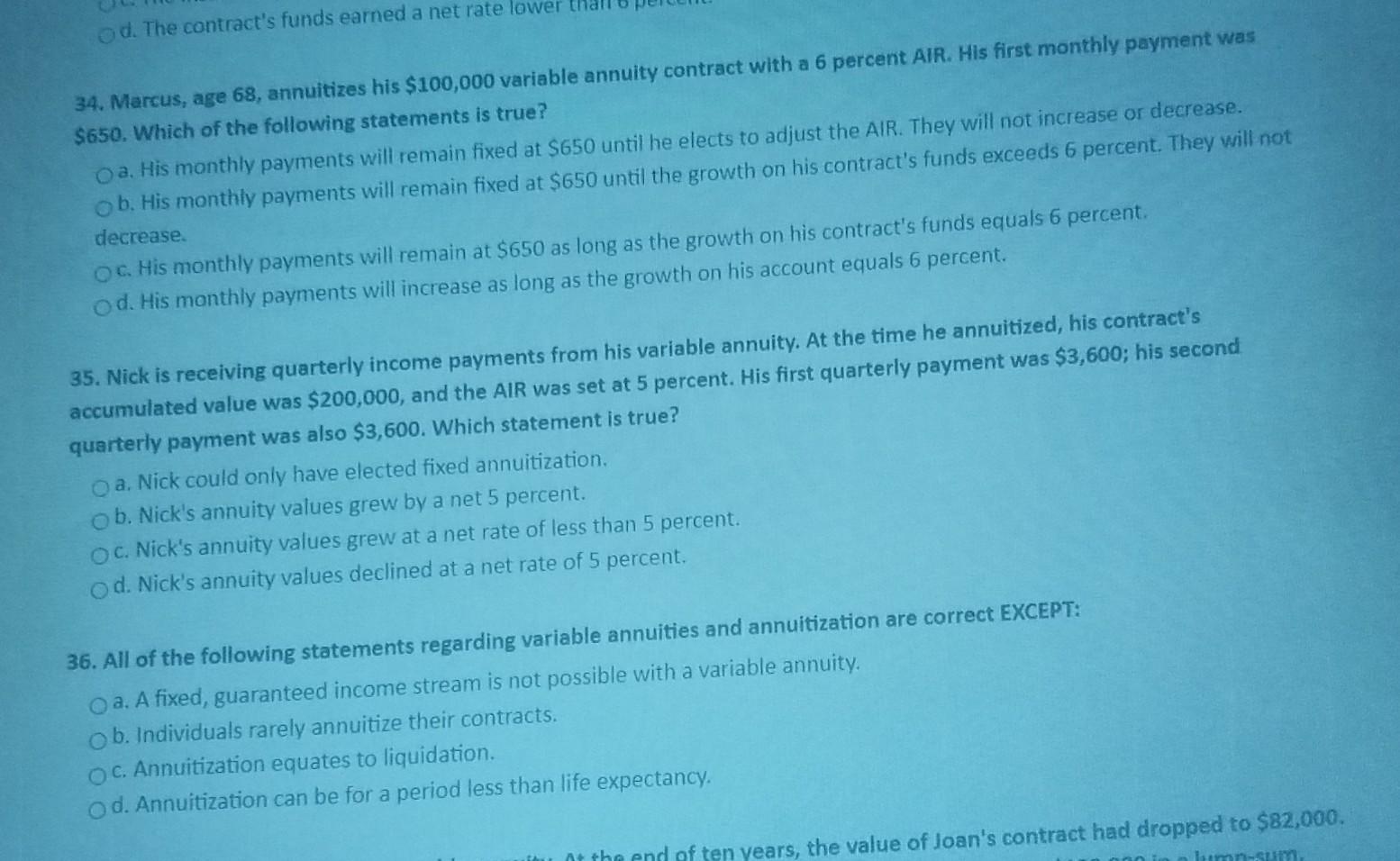

34. Marcus, age 68 , annuitizes his $100,000 variable annuity contract with a 6 percent AlR. His first monthly payment was $650. Which of the

34. Marcus, age 68 , annuitizes his $100,000 variable annuity contract with a 6 percent AlR. His first monthly payment was $650. Which of the following statements is true? a. His monthly payments will remain fixed at $650 until he elects to adjust the AlR. They will not increase or decrease. b. His monthly payments will remain fixed at $650 until the growth on his contract's funds exceeds 6 percent. They will not decrease. His monthly payments will remain at $650 as long as the growth on his contract's funds equals 6 percent. d. His monthly payments will increase as long as the growth on his account equals 6 percent. 35. Nick is receiving quarterly income payments from his variable annuity. At the time he annuitized, his contract's accumulated value was $200,000, and the AIR was set at 5 percent. His first quarterly payment was $3,600; his second quarterly payment was also $3,600. Which statement is true? a. Nick could only have elected fixed annuitization. b. Nick's annuity values grew by a net 5 percent. c. Nick's annuity values grew at a net rate of less than 5 percent. d. Nick's annuity values declined at a net rate of 5 percent. 36. All of the following statements regarding variable annuities and annuitization are correct EXCEPT: a. A fixed, guaranteed income stream is not possible with a variable annuity. b. Individuals rarely annuitize their contracts. c. Annuitization equates to liquidation. d. Annuitization can be for a period less than life expectancy

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started