Answered step by step

Verified Expert Solution

Question

1 Approved Answer

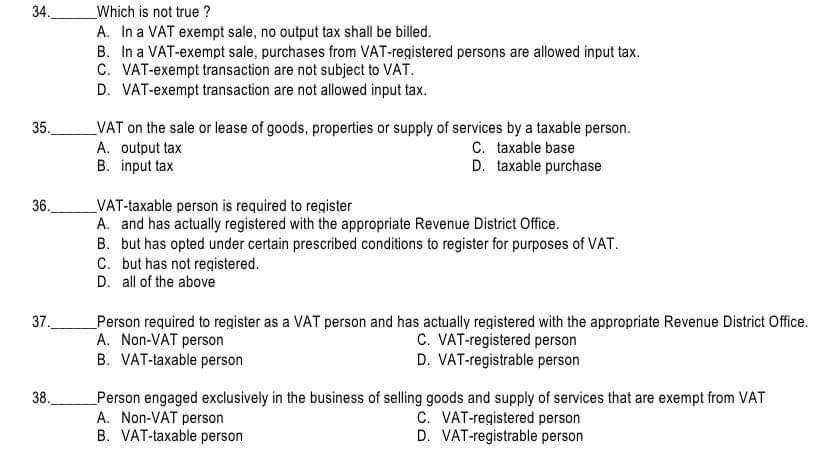

34. Which is not true? A. In a VAT exempt sale, no output tax shall be billed. B. In a VAT-exempt sale, purchases from VAT-reqistered

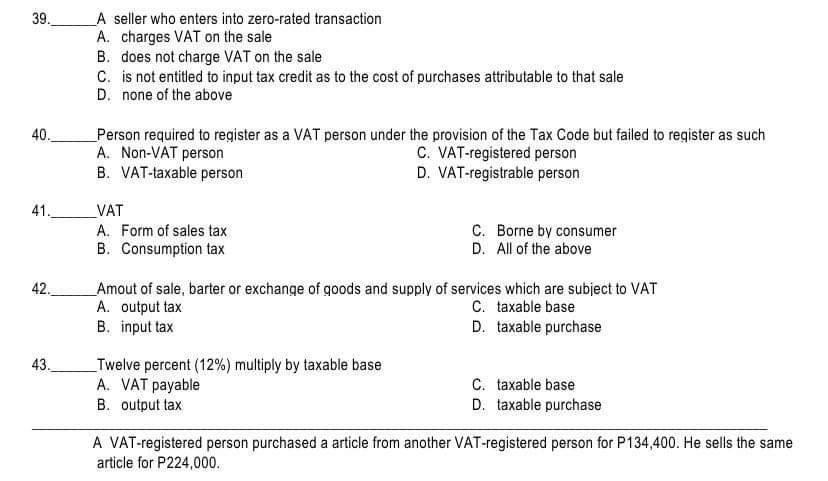

34. Which is not true? A. In a VAT exempt sale, no output tax shall be billed. B. In a VAT-exempt sale, purchases from VAT-reqistered persons are allowed input tax. C. VAT-exempt transaction are not subject to VAT. D. VAT-exempt transaction are not allowed input tax. 35. VAT on the sale or lease of goods, properties or supply of services by a taxable person. A. output tax C. taxable base B. input tax D. taxable purchase 36. VAT-taxable person is required to register A. and has actually registered with the appropriate Revenue District Office. B. but has opted under certain prescribed conditions to register for purposes of VAT. C. but has not registered. D. all of the above 37. Person required to register as a VAT person and has actually registered with the appropriate Revenue District Office. A. Non-VAT person C. VAT-registered person B. VAT-taxable person D. VAT-registrable person 38. Person engaged exclusively in the business of selling goods and supply of services that are exempt from VAT A. Non-VAT person C. VAT-registered person B. VAT-taxable person D. VAT-registrable person 39. A seller who enters into zero-rated transaction A. charges VAT on the sale B. does not charge VAT on the sale C. is not entitled to input tax credit as to the cost of purchases attributable to that sale D. none of the above 40. Person required to register as a VAT person under the provision of the Tax Code but failed to register as such A. Non-VAT person C. VAT-registered person B. VAT-taxable person D. VAT-registrable person 41. VAT A. Form of sales tax C. Borne by consumer B. Consumption tax D. All of the above 42. Amout of sale, barter or exchange of goods and supply of services which are subject to VAT A. output tax C. taxable base B. input tax D. taxable purchase 43. Twelve percent (12\%) multiply by taxable base A. VAT payable C. taxable base B. output tax D. taxable purchase A VAT-registered person purchased a article from another VAT-registered person for P134,400. He sells the same article for P224,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started