Answered step by step

Verified Expert Solution

Question

1 Approved Answer

343 Investments in Joint Arrangements, Associates and Joint Ventures 18-36: On January 1, 2017, entities R and S each acquired 40% of the ordinary

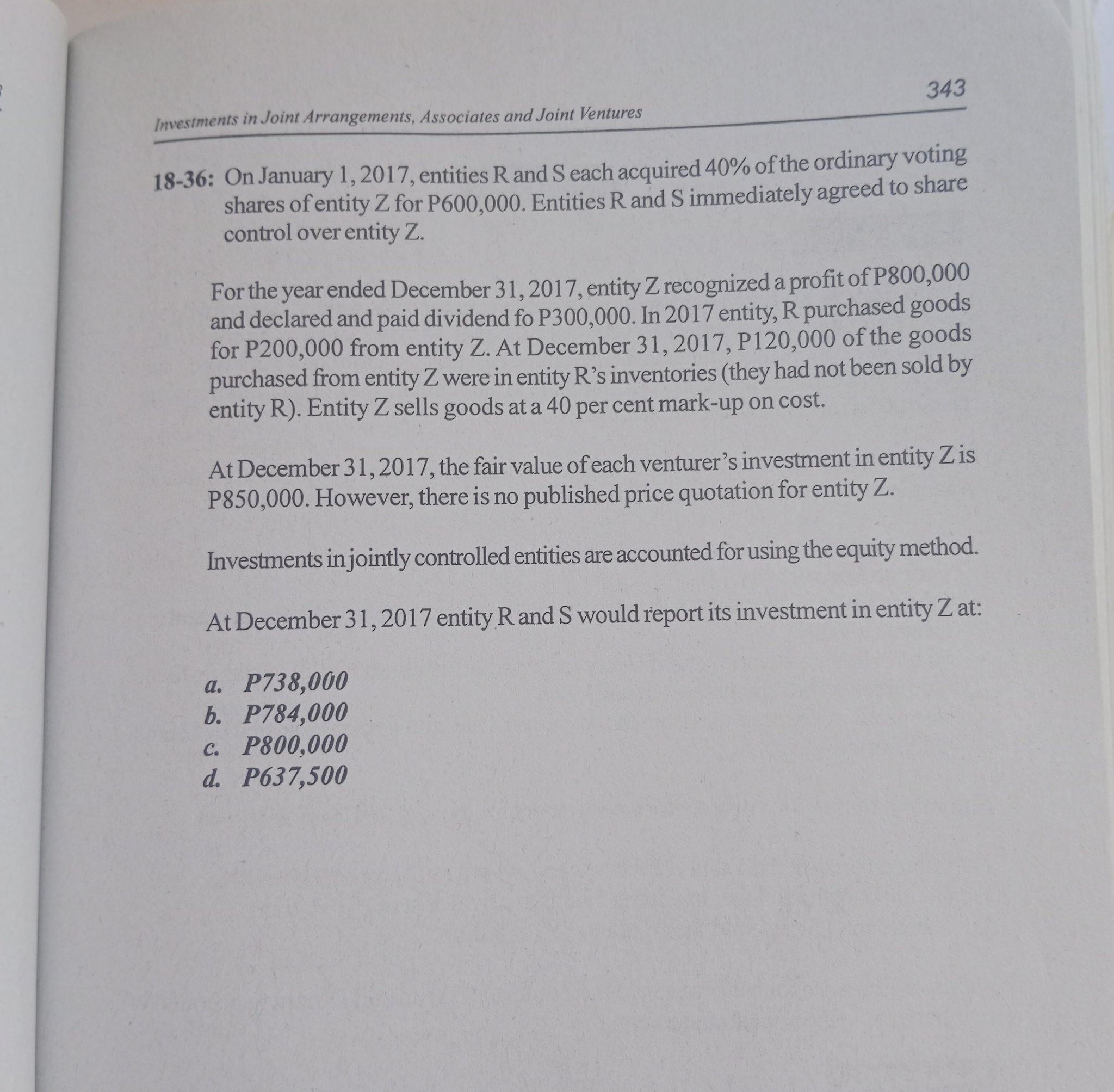

343 Investments in Joint Arrangements, Associates and Joint Ventures 18-36: On January 1, 2017, entities R and S each acquired 40% of the ordinary voting shares of entity Z for P600,000. Entities R and S immediately agreed to share control over entity Z. For the year ended December 31, 2017, entity Z recognized a profit of P800,000 and declared and paid dividend fo P300,000. In 2017 entity, R purchased goods for P200,000 from entity Z. At December 31, 2017, P120,000 of the goods purchased from entity Z were in entity R's inventories (they had not been sold by entity R). Entity Z sells goods at a 40 per cent mark-up on cost. At December 31, 2017, the fair value of each venturer's investment in entity Z is P850,000. However, there is no published price quotation for entity Z. Investments in jointly controlled entities are accounted for using the equity method. At December 31, 2017 entity R and S would report its investment in entity Z at: a. P738,000 b. P784,000 c. P800,000 d. P637,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started