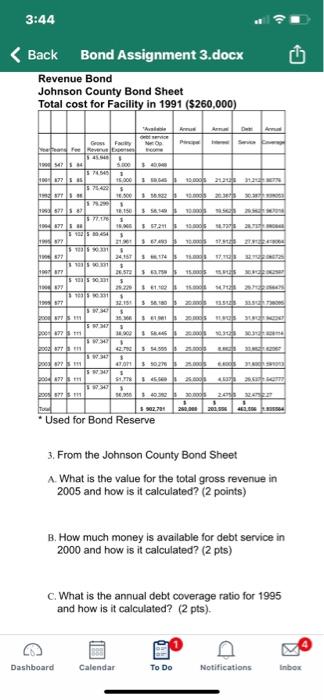

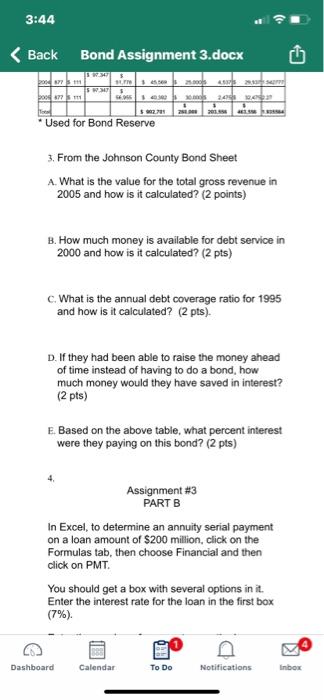

3:44 Back Bond Assignment 3.docx Revenue Bond Johnson County Bond Sheet Total cost for Facility in 1991 ($260,000) $ 10 310000 100 15.000 10000 230N 10.00312 1. 23 150 SA STRE 1 100177 18.05.2015 os 10402 SMYGA 1 BANS S. ZES . 2416 S 1 3 1901 2653 15.00 15 mm som ho! 22 161.00 16.00 1333 - 1 $ UPTS SEO 1 boed 16 . BOGOTT 2. so 11.50 pood szoros SWS bood Sim. 2.600 ST 103000024 Tour 390271 200.00 2008 46.00 *Used for Bond Reserve 3. From the Johnson County Bond Sheet A. What is the value for the total gross revenue in 2005 and how is it calculated? (2 points) B. How much money is available for debt service in 2000 and how is it calculated? (2 pts) C. What is the annual debt coverage ratio for 1995 and how is it calculated? (2 pts). Dashboard Calendar To Do Notifications Inbox 3:44 Back Bond Assignment 3.docx po 1775 messe 2.000.00 1535 boom 30 24 2:01 22358 * Used for Bond Reserve 3. From the Johnson County Bond Sheet A. What is the value for the total gross revenue in 2005 and how is it calculated? (2 points) B. How much money is available for debt service in 2000 and how is it calculated? (2 pts) c. What is the annual debt coverage ratio for 1995 and how is it calculated? (2 pts). D. If they had been able to raise the money ahead of time instead of having to do a bond, how much money would they have saved in interest? (2 pts) E. Based on the above table, what percent interest were they paying on this bond? (2 pts) Assignment #3 PART B In Excel, to determine an annuity serial payment on a loan amount of $200 million, click on the Formulas tab, then choose Financial and then click on PMT. You should get a box with several options in it. Enter the interest rate for the loan in the first box (7%). Dashboard Calendar To Do Notifications Inbox 3:44 Back Bond Assignment 3.docx Revenue Bond Johnson County Bond Sheet Total cost for Facility in 1991 ($260,000) $ 10 310000 100 15.000 10000 230N 10.00312 1. 23 150 SA STRE 1 100177 18.05.2015 os 10402 SMYGA 1 BANS S. ZES . 2416 S 1 3 1901 2653 15.00 15 mm som ho! 22 161.00 16.00 1333 - 1 $ UPTS SEO 1 boed 16 . BOGOTT 2. so 11.50 pood szoros SWS bood Sim. 2.600 ST 103000024 Tour 390271 200.00 2008 46.00 *Used for Bond Reserve 3. From the Johnson County Bond Sheet A. What is the value for the total gross revenue in 2005 and how is it calculated? (2 points) B. How much money is available for debt service in 2000 and how is it calculated? (2 pts) C. What is the annual debt coverage ratio for 1995 and how is it calculated? (2 pts). Dashboard Calendar To Do Notifications Inbox 3:44 Back Bond Assignment 3.docx po 1775 messe 2.000.00 1535 boom 30 24 2:01 22358 * Used for Bond Reserve 3. From the Johnson County Bond Sheet A. What is the value for the total gross revenue in 2005 and how is it calculated? (2 points) B. How much money is available for debt service in 2000 and how is it calculated? (2 pts) c. What is the annual debt coverage ratio for 1995 and how is it calculated? (2 pts). D. If they had been able to raise the money ahead of time instead of having to do a bond, how much money would they have saved in interest? (2 pts) E. Based on the above table, what percent interest were they paying on this bond? (2 pts) Assignment #3 PART B In Excel, to determine an annuity serial payment on a loan amount of $200 million, click on the Formulas tab, then choose Financial and then click on PMT. You should get a box with several options in it. Enter the interest rate for the loan in the first box (7%). Dashboard Calendar To Do Notifications Inbox