Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3,4,5,6. can you explain me how to do it! 3. (10 pts) Six years from today you need $600,000. You plan to deposit $5000 monthly,

3,4,5,6. can you explain me how to do it!

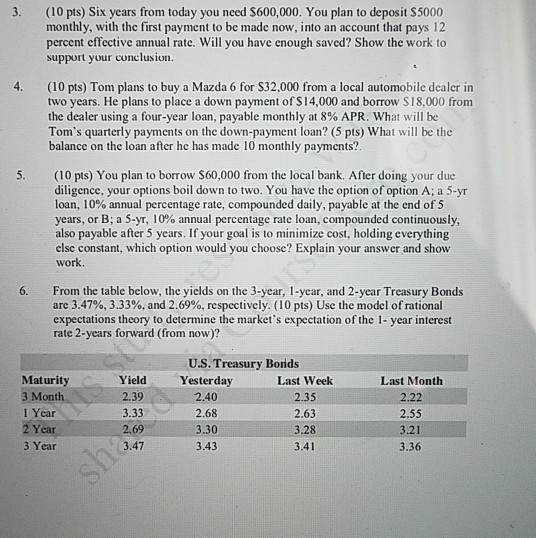

3. (10 pts) Six years from today you need $600,000. You plan to deposit $5000 monthly, with the first payment to be made now. into an account that pays 12 percent effective annual rate. Will you have enough saved? Show the work to support your conclusion, (10 pts) Tom plans to buy a Mazda 6 for $32,000 from a local automobile dealer in two years. He plans to place a down payment of $14,000 and borrow $18,000 from the dealer using a four-year loan, payable monthly at 8% APR. What will be Tom's quarterly payments on the down-payment loan? (5 pts) What will be the balance on the loan after he has made 10 monthly payments?. (10 pts) You plan to borrow $60,000 from the local bank. After doing your due diligence, your options boil down to two. You have the option of option A, a 5-yr loan, 10% annual percentage rate, compounded daily, payable at the end of 5 years, or B; a 5-yr, 10% annual percentage rate loan, compounded continuously, also payable after 5 years. If your goal is to minimize cost, holding everything else constant, which option would you choose? Explain your answer and show work. From the table below, the yields on the 3-year, 1-year, and 2-year Treasury Bonds are 3.47%, 3.33%, and 2.69%, respectively. (10 pts) Use the model of rational expectations theory to determine the market's expectation of the 1-year interest rate 2-years forward (from now)? Maturity 3 Month 1 Year 2 Year 3 Year Yield 2.39 3.33 2.69 3.47 U.S. Treasury Bonds Yesterday Last Week 2.40 2.35 2.68 2.63 3.30 3.28 3.43 3.41 Last Month 2.22 2.55 3.21 3.36Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started