Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3.5 2. Fill in the blanks: recorded/unrecorded paid in cash/ not yet paid in cash overstated/understated overstated/understated overstated/understated overstated/understated Accrued Expense Adjusting Entries Manning Manufacturing

3.5

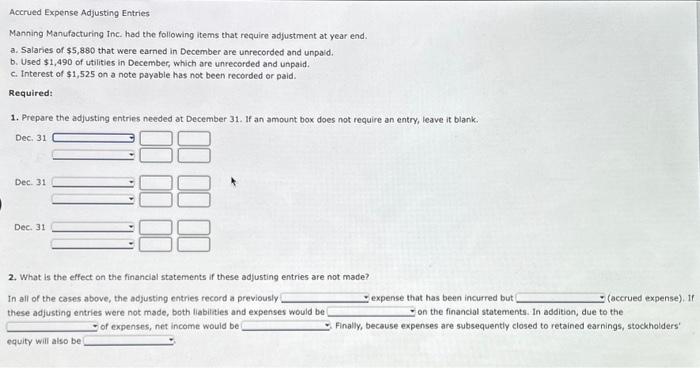

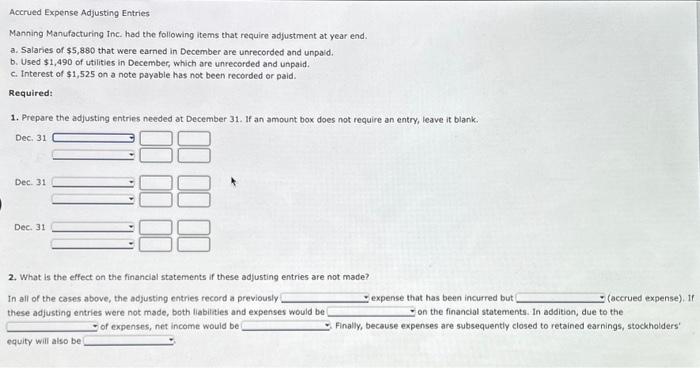

Accrued Expense Adjusting Entries Manning Manufacturing Inc. had the following items that require adjustment at year end. a. Salaries of $5,880 that were earned in December are unrecorded and unpaid. b. Used $1,490 of utilities in December, which are unrecorded and unpaid. c. Interest of $1,525 on a note payable has not been recorded or paid. Required: 1. Prepare the adjusting entries needed at December 31 . If an amount box does not require an entry, leave it blank. Dec. 31 Dec- 31 Dec. 31 2. What is the effect on the financial statements if these adjusting entries are not made? In all of the cases above, the adjusting entries record a previously expense that has been incurred but (accrued expense), if these adjusting entries were not made, both liabilties and expenses would be on the financial statements. In addition, due to the of expenses, net income would be Finally, because expenses are subsequently closed to retained earnings, stockholders' equity will also be

2. Fill in the blanks:

recorded/unrecorded

paid in cash/ not yet paid in cash

overstated/understated

overstated/understated

overstated/understated

overstated/understated

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started