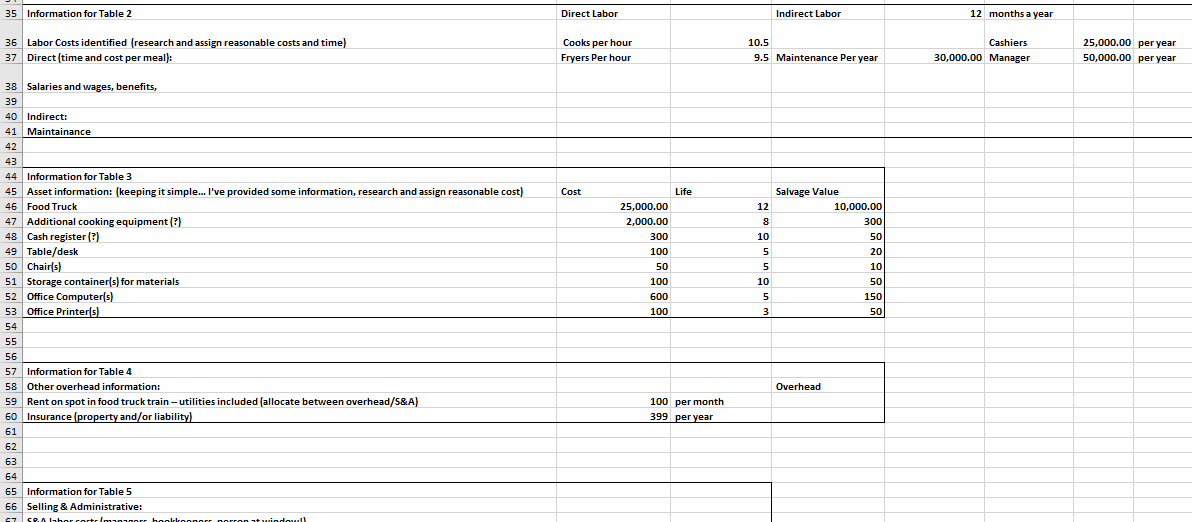

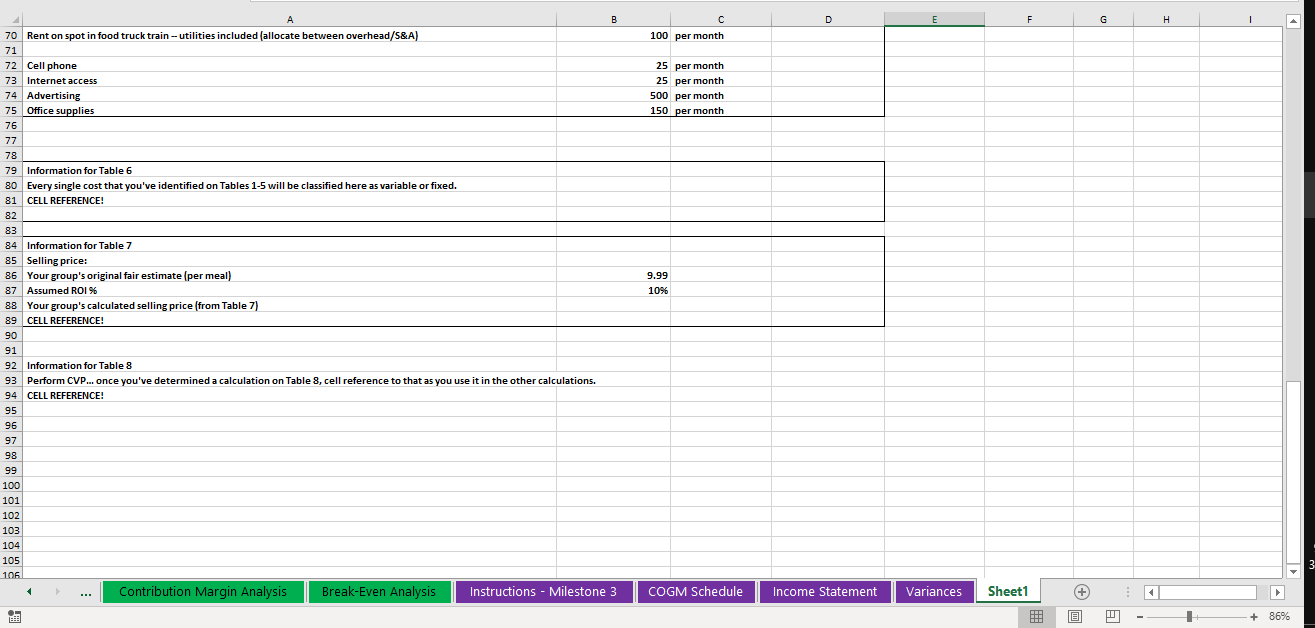

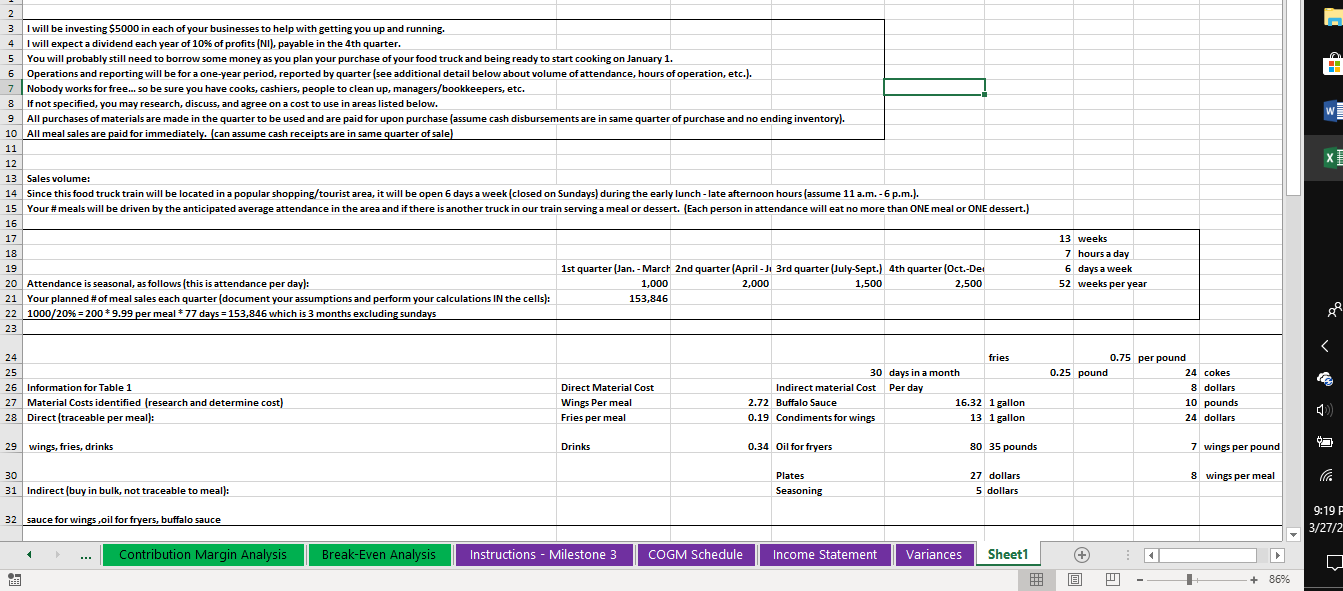

35 Information for Table 2 Direct Labor Indirect Labor 12 months a year 36 Labor Costs identified (research and assign reasonable costs and time] Cooks per hour 10.5 Cashiers 25,000.00 |per year 37 Direct (time and cost per meal) : Fryers Per hour 9.5 |Maintenance Per year 30,000.00 |Manager 50,000.00 |per year Salaries and wages, benefits, 39 40 Indirect: 41 Maintainance 42 Information for Table 3 Asset information: (keeping it simple... I've provided some information, research and assign reasonable cost) Cost Life Salvage Value Food Truck 25,000.00 12 10,000.00 Additional cooking equipment [?) 2,000.00 co 300 Cash register (?) 300 10 50 Table/desk 100 Ln 20 50 Chair(s) 50 5 10 51 Storage container(s) for materials 100 10 50 Office Computer[s) 600 un 150 53 Office Printer(s) LOO 3 50 Information for Table 4 Other overhead information: Overhead Rent on spot in food truck train -- utilities included (allocate between overhead/S&A] 100 per month Insurance (property and/or liability) 399 |per year Information for Table 5 66 Selling & Administrative:D G 70 |Rent on spot in food truck train - utilities included (allocate between overhead/S&A] 100 per month 71 72 Cell phone 25 per month 73 Internet access 25 per month 74 Advertising 500 per month Office supplies 150 per month 76 77 78 79 Information for Table 6 80 Every single cost that you've identified on Tables 1-5 will be classified here as variable or fixed. 81 |CELL REFERENCE! 82 83 84 Information for Table 7 85 Selling price: 86 |Your group's original fair estimate [per meal) 9.99 87 Assumed ROI % 106 88 |Your group's calculated selling price (from Table 7] 89 CELL REFERENCE! 90 91 92 Information for Table 8 93 Perform CVP... once you've determined a calculation on Table 8, cell reference to that as you use it in the other calculations. 94 CELL REFERENCE! 95 96 97 98 99 100 101 102 103 104 105 106 Contribution Margin Analysis Break-Even Analysis Instructions - Milestone 3 COGM Schedule Income Statement Variances Sheet1 + 86%m I will be investing $5000 in each of your businesses to help with getting you up and running. 4 I will expect a dividend each year of 10%% of profits (NI), payable in the 4th quarter. Ln You will probably still need to borrow some money as you plan your purchase of your food truck and being ready to start cooking on January 1. Operations and reporting will be for a one-year period, reported by quarter (see additional detail below about volume of attendance, hours of operation, etc.). Nobody works for free.. so be sure you have cooks, cashiers, people to clean up, managers/bookkeepers, etc. DO If not specified, you may research, discuss, and agree on a cost to use in areas listed below. All purchases of materials are made in the quarter to be used and are paid for upon purchase (assume cash disbursements are in same quarter of purchase and no ending inventory) W 10 All meal sales are paid for immediately. (can assume cash receipts are in same quarter of sale 11 12 X 13 |Sales volume: 14 Since this food truck train will be located in a popular shopping/tourist area, it will be open 6 days a week (closed on Sundays) during the early lunch - late afternoon hours (assume 11 a.m. - 6 p.m.). 15 Your # meals will be driven by the anticipated average attendance in the area and if there is another truck in our train serving a meal or dessert. (Each person in attendance will eat no more than ONE meal or ONE dessert.) 16 17 13 weeks 18 hours a day 19 1st quarter (Jan. - March 2nd quarter (April - Ji 3rd quarter (July-Sept. ) | 4th quarter (Oct.-De 6 daysa week 20 Attendance is seasonal, as follows (this is attendance per day): 1,000 2,000 1,500 2,500 52 weeks per year 21 Your planned # of meal sales each quarter (document your assumptions and perform your calculations IN the cells): 153,846 22 1000/20%= 200 * 9.99 per meal * 77 days = 153,846 which is 3 months excluding sundays 23 24 fries 0.75 |per pound 25 30 days in a month 0.25 pound 24 cokes 26 Information for Table 1 Direct Material Cost Indirect material Cost Per day 8 dollars 27 Material Costs identified (research and determine cost) Wings Per meal 2.72 Buffalo Sauce 16.32 |1 gallon 10 pounds 28 Direct (traceable per meal): Fries per meal 0.19 Condiments for wings 13 1 gallon 24 dollars 29 wings, fries, drinks Drinks 0.34 Oil for fryers 80 35 pounds wings per pound 30 Plates 27 |dollars 8 wings per meal 31 Indirect (buy in bulk, not traceable to meal) : Seasoning 5 dollars 32 sauce for wings ,oil for fryers, buffalo sauce 9:19 3/27/2 . . . Contribution Margin Analysis Break-Even Analysis Instructions - Milestone 3 COGM Schedule Income Statement Variances Sheet1 + 86%