Answered step by step

Verified Expert Solution

Question

1 Approved Answer

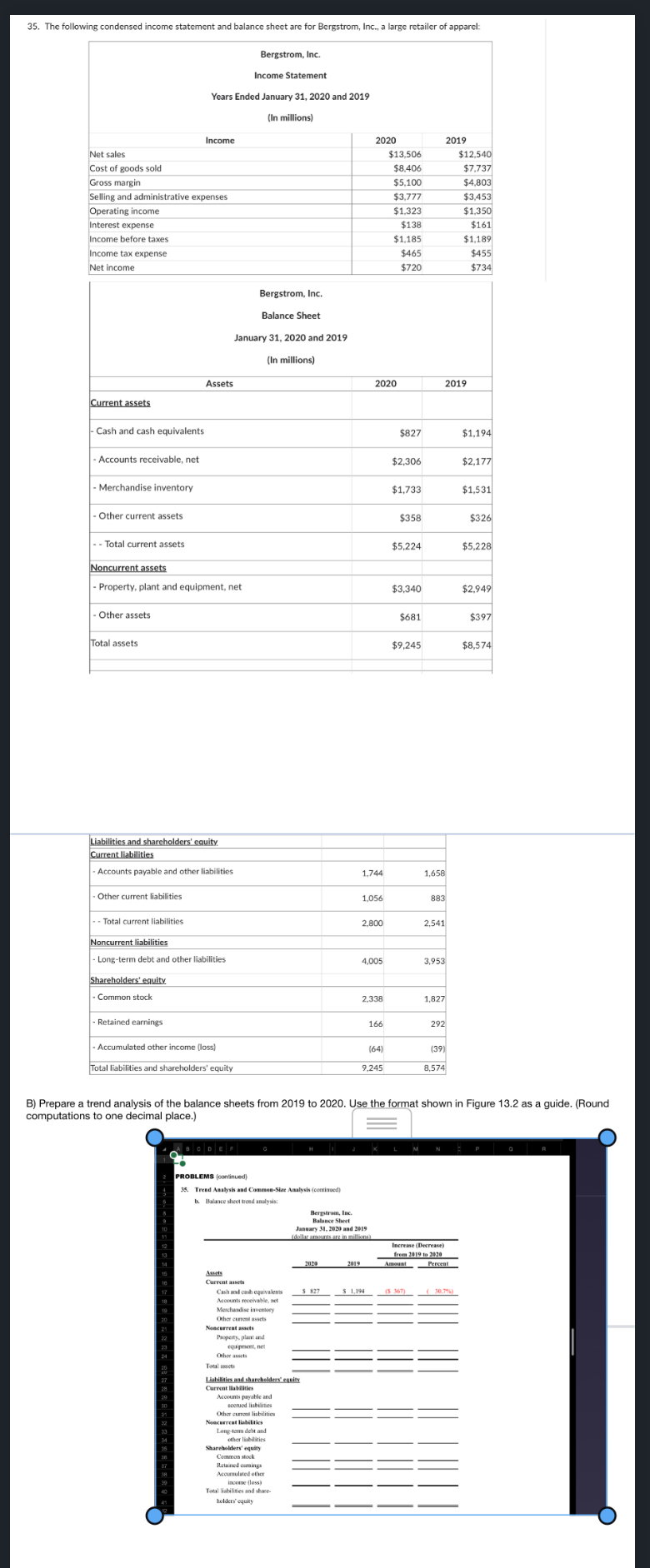

35. The following condensed income statement and balance sheet are for Bergstrom, Inc., a large retailer of apparel: Bergstrom, Inc. Income Statement Years Ended

35. The following condensed income statement and balance sheet are for Bergstrom, Inc., a large retailer of apparel: Bergstrom, Inc. Income Statement Years Ended January 31, 2020 and 2019 Net sales (In millions) Income Cost of goods sold Gross margin Selling and administrative expenses Operating income Interest expense Income before taxes Income tax expense Net income Current assets Cash and cash equivalents Accounts receivable, net Merchandise inventory Other current assets 2020 2019 $13,506 $12,540 $8,406 $7,737 $5,100 $4,803 $3,777 $3,453 $1,323 $1,350 $138 $161 $1,185 $1,189 $465 $455 $720 $734 Bergstrom, Inc. Balance Sheet January 31, 2020 and 2019 (In millions) Assets 2020 2019 $827 $1,194 $2,306 $2,177 $1,733 $1,531 $358 $326 $5,224 $5,228 -- Total current assets Noncurrent assets Property, plant and equipment, net $3,340 $2,949 Other assets $681 $397 Total assets $9,245 $8,574 Liabilities and shareholders' equity Current liabilities Accounts payable and other liabilities 1,744 1,658 Other current liabilities 1,056 883 -- Total current liabilities 2,800 2,541 Noncurrent liabilities Long-term debt and other liabilities 4,005 3,953 Shareholders' equity. Common stock 2,338 1,827 Retained earnings 166 292 Accumulated other income (loss) Total liabilities and shareholders' equity (64) (39) 9,245 8,574 B) Prepare a trend analysis of the balance sheets from 2019 to 2020. Use the format shown in Figure 13.2 as a guide. (Round computations to one decimal place.) BCDER H PROBLEMS (continued) 35. Trend Analysis and Common-Size Analysis (continued) b. Balance sheet trend analysis Bergstrom, Inc. Balance Sheet January 31, 2020 and 2019 (dollar amounts are in millions) Assets Current assets 2020 2019 Increase (Decrease) from 2019 to 2020 Amount Percent Cash and cash equivalents Accounts receivable, net 5827 $ 1,194 ($ 367) Merchandise inventory Other current assets Noncurrent assets Property, plant and equipment, net Other assets Total assets Liabilities and shareholders' equity Current liabilities Accounts payable and accrued liabilities Other cu Noncurrent liabilities Long-term debt and other liabilities Shareholders' equity Common stock Retained curings Accumulated other income (loss) Total liabilities and share holders' equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started