Answered step by step

Verified Expert Solution

Question

1 Approved Answer

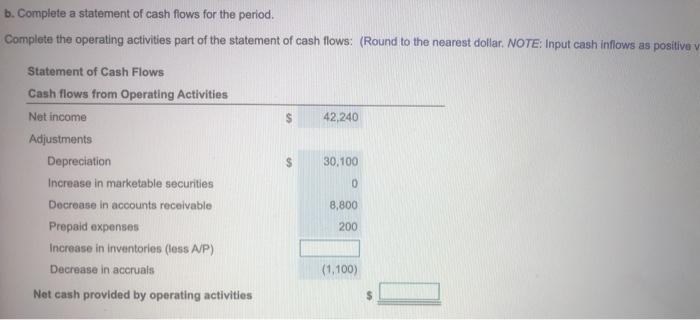

3:5 two misisng boxes help (Working with financial statements) Based on the balance sheet and income statement, . for T. P. Jarmon Company for the

3:5

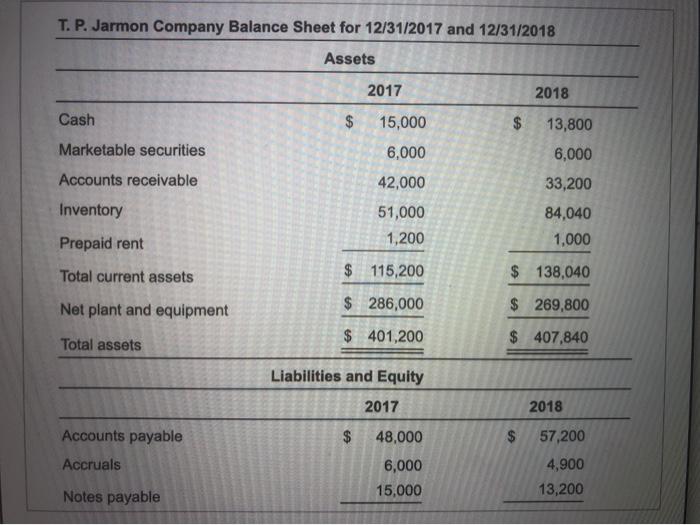

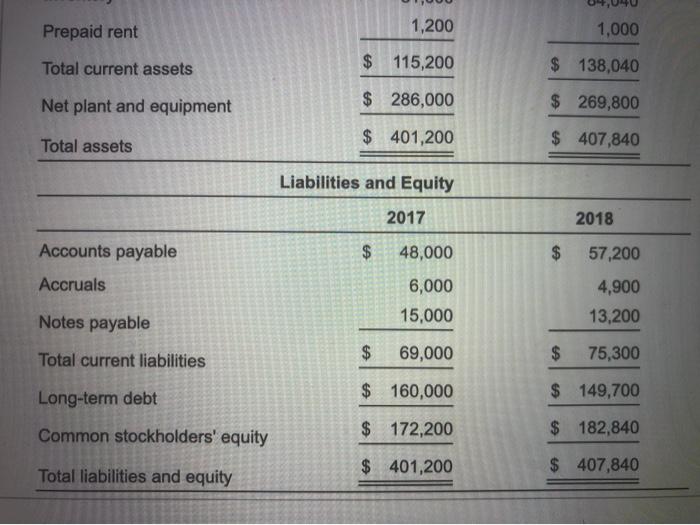

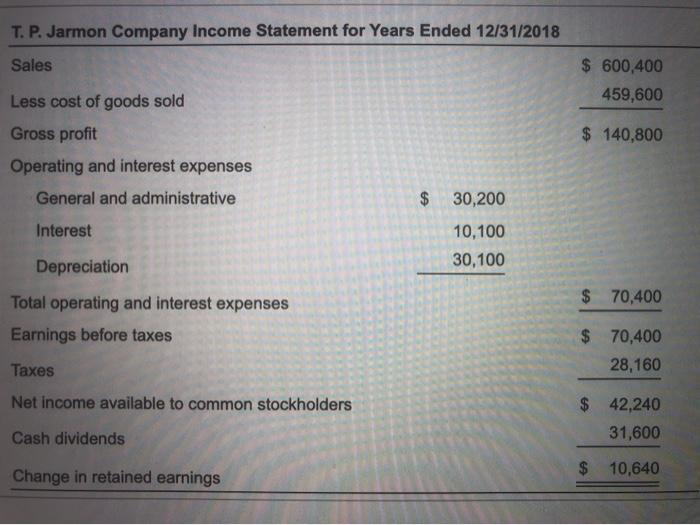

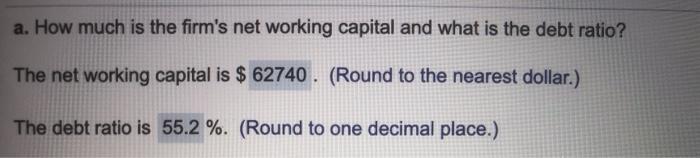

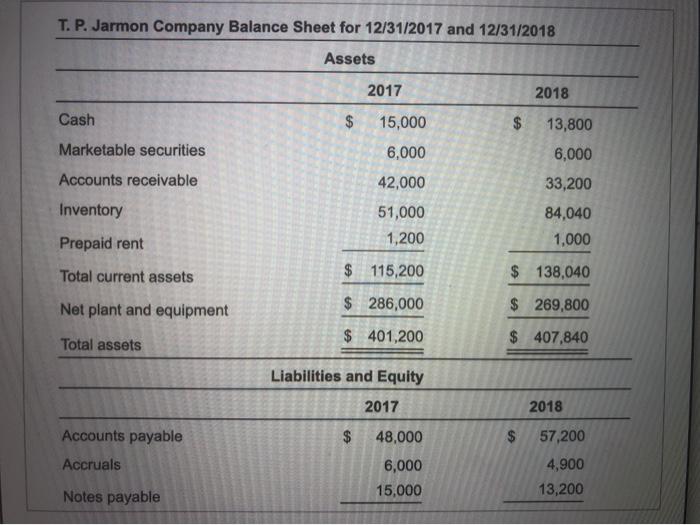

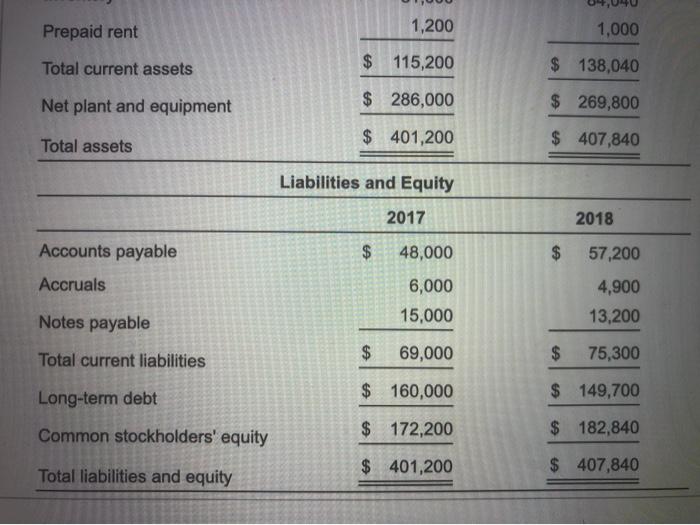

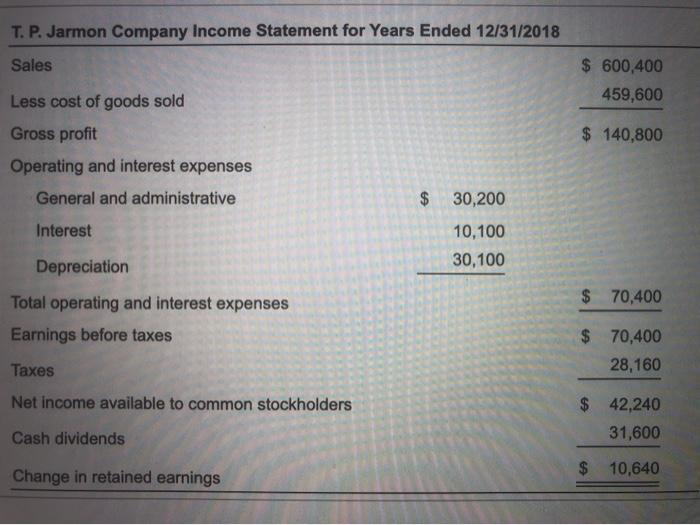

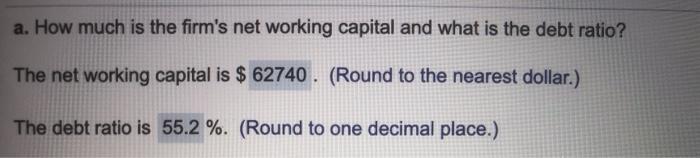

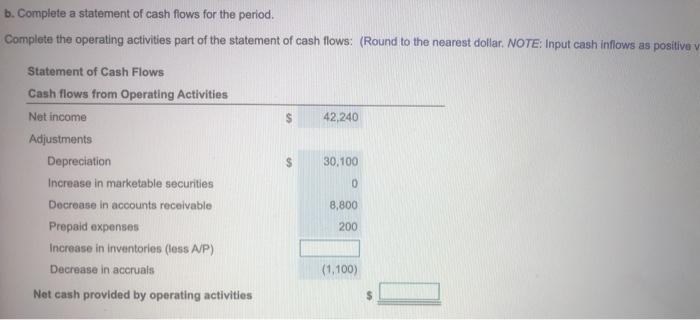

(Working with financial statements) Based on the balance sheet and income statement, . for T. P. Jarmon Company for the year ended December 31, 2018: a. How much is the firm's net working capital and what is the debt ratio? b. Complete a statement of cash flows for the period. c. Compute the changes in the balance sheets from 2017 to 2018 T. P. Jarmon Company Balance Sheet for 12/31/2017 and 12/31/2018 Assets 2017 2018 Cash $ 15,000 $ 13,800 Marketable securities 6,000 6,000 42,000 Accounts receivable Inventory 51,000 1,200 33,200 84,040 1,000 Prepaid rent Total current assets $ 115,200 $ 138,040 Net plant and equipment $ 286,000 $ 269,800 Total assets $ 401,200 $ 407,840 Liabilities and Equity 2017 2018 Accounts payable $ $ Accruals 48,000 6,000 15,000 57,200 4,900 13,200 Notes payable Prepaid rent 1,200 1,000 Total current assets $ 115,200 $ 138,040 Net plant and equipment $ 286,000 $ 269,800 Total assets $ 401,200 $ 407,840 Liabilities and Equity 2017 2018 Accounts payable $ $ 57,200 Accruals 48,000 6,000 15,000 4,900 13,200 Notes payable $ Total current liabilities 69,000 $ 75,300 Long-term debt $ 160,000 $ 149,700 Common stockholders' equity $ 172,200 $ 182,840 $ 401,200 $ 407,840 Total liabilities and equity T. P. Jarmon Company Income Statement for Years Ended 12/31/2018 Sales $ 600,400 459,600 $ 140,800 Less cost of goods sold Gross profit Operating and interest expenses General and administrative $ 30,200 Interest 10,100 30,100 Depreciation $ 70,400 Total operating and interest expenses Earnings before taxes $ 70,400 28,160 Taxes Net Income available to common stockholders $ 42,240 31,600 Cash dividends Change in retained earnings $ 10,640 a. How much is the firm's net working capital and what is the debt ratio? The net working capital is $ 62740. (Round to the nearest dollar.) The debt ratio is 55.2 %. (Round to one decimal place.) b. Complete a statement of cash flows for the period. Complete the operating activities part of the statement of cash flows: (Round to the nearest dollar. NOTE: Input cash inflows as positive v Statement of Cash Flows Cash flows from Operating Activities Net Income 42,240 Adjustments Depreciation S 30,100 Increase in marketable securities 0 Decrease in accounts receivable 8,800 Prepaid expenses 200 Increase in inventories (less N/P) Decrease in accruals (1.100) Net cash provided by operating activities two misisng boxes help

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started