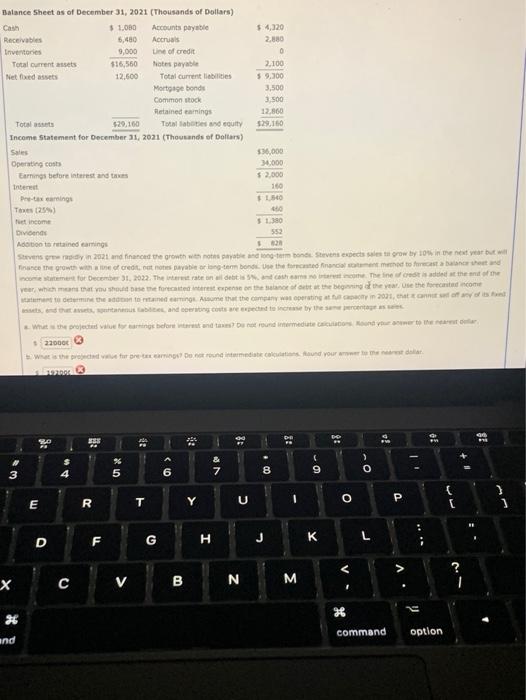

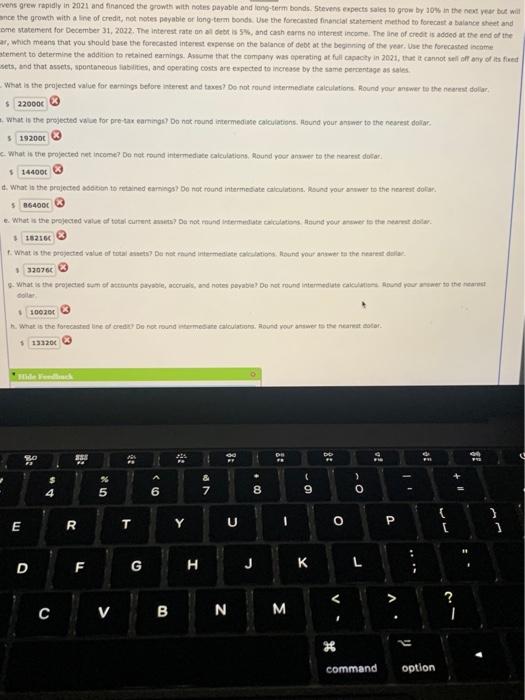

3.500 Balance Sheet as of December 31, 2021 (Thousands of Dollars) Cam $ 1.080 Accounts payable $4,320 Receivables 5,480 Actual 2.880 Inventories 9,000 Line of credit 0 Total current assets 516,560 Notes payable 2.100 Net fedt 12,600 Total current les $9.900 Mortgage bonde 3,500 Common stock Metained earnings 12,860 Total $29,160 To be and culty Income Statement for December 31, 2021 (Thousands of Dollars) Sales 36.000 Operating costs 36000 Earnings before interest and $ 2.000 Interest 160 Pre-tax caring HLsd| T 25 tuet income $ 1.380 Divende 552 Adition to retained carings Stevenson 2021 and financed the growth option to Stevens expects to grow by now in the next year but Trance the growth the credit to be one to be the consent to catched comment for December 31, 2022. The rate on the the line for the one year, which means that you should the forces so that of the beginning the year. We the forced com met and caring me that the company was peringatan 2001, het oost What the wings before and undermedute Conserto the 22000 3 the current medical and your antes de BURDA 8 28 C - % 5 & 7 4 6 8 3 o 9 E T R Y O U P F G D H J L V N B X M V. V U * command option and evens grew rapidly in 2021 and financed the growth with notes payable and long-term bonds. Stevens expects sales to grow by 10% in the next year will ance the growth with a line of credit, not notes payable or long-term bonds. Use the forecasted financial Statement method to forecast a balance sheet and ome statement for December 31, 2022. The interest rate on debt is 5%, and cash cans no interest income. The line of credit is added at the end of the ar, which means that you should be the forecasted interest expense on the balance of debt at the beginning of the year. Use the forecasted Income stement to determine the addition to retained earnings. Assume that the company was operating at full capacity in 2021, that it cannot sell of any of its fleet sets, and that assets, spontaneous abilities, and operating costs are expected to increase by the same percentage as a What is the projected value for earnings before interest and taxes? Do not round remediate calculations. Round your answer to the nearest dollar $ 220003 What is the projected wwe for pre-tax carmings? Do not round intermediate calculations. Hound your answer to the nearest dollar $ 192000 What is the projected rut income? Do not found intermediate calculations. Round your answer to the nearest dostar $ 144000 3 . What is the projected on to retained earnings? Do not round intermediate calculation. Round your answer to the rinores dollar $ 864006 e. What is the projected vuur of total current auta? Dis not round stermediate a cultura. Haunt your answer to the starwat daar 182166 1. What is the projected value of total enneta? Du mot round intermediate atestations. Baunt your answer to the nearest dular. 320763 9. What is the projected sum of setunts Daybete, accruals, and notes payable? Do not round intermediate calculations Sound your own to the street 100200 What is the forecasted tre el cas de rotondeermeste calculator Round your newer to the nearest notar. $ 133206 BO BE :?