Answered step by step

Verified Expert Solution

Question

1 Approved Answer

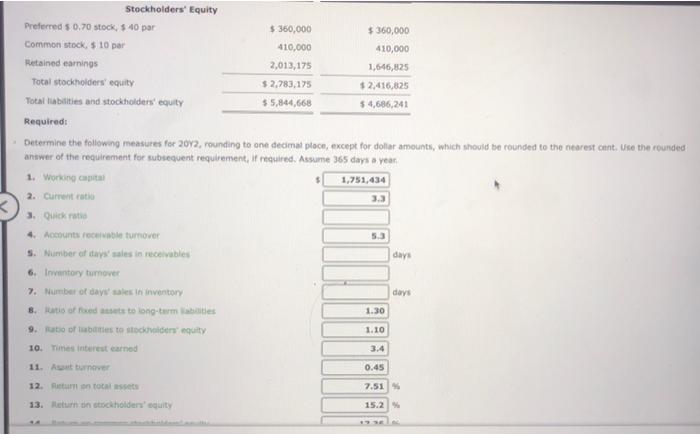

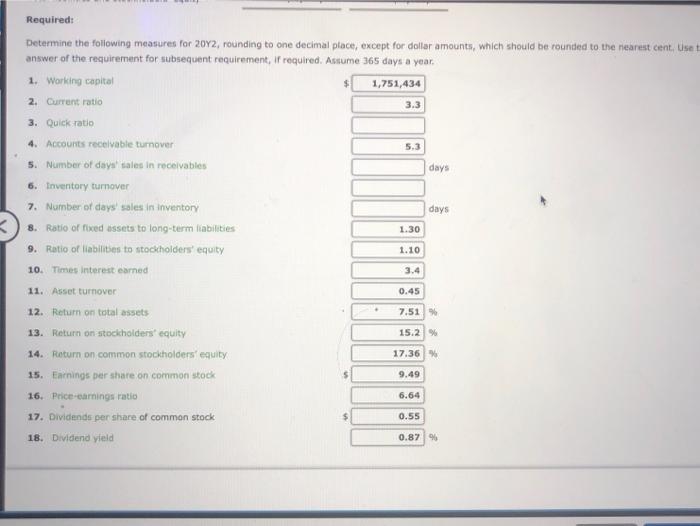

3,5,6,7 if someone wouldnt mind reviewing the other ones as well, ive had some mixed answers Measures of liquidity, Solvency and Profitability The comparative financial

3,5,6,7

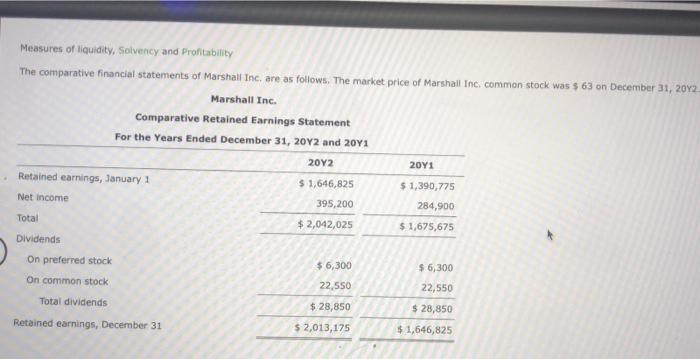

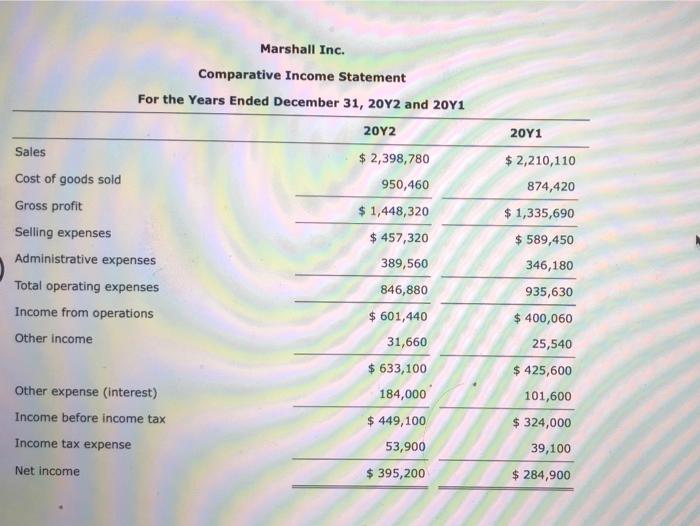

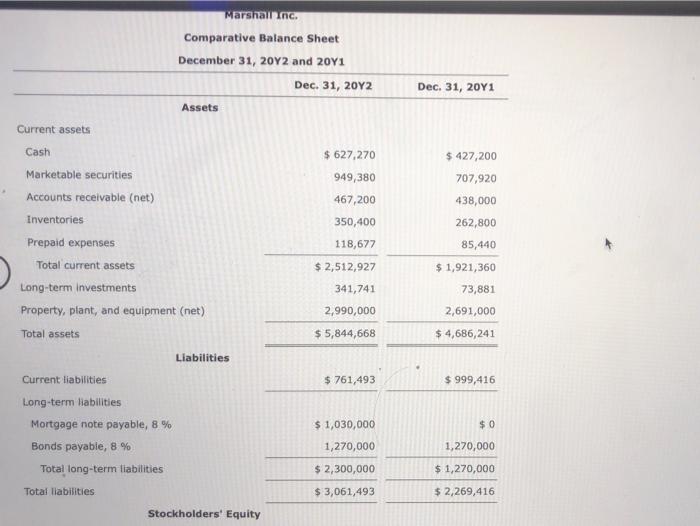

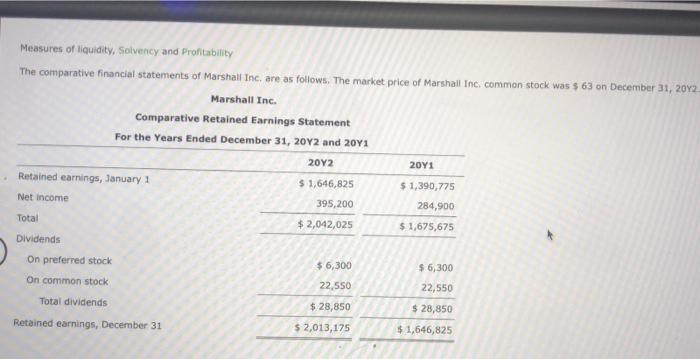

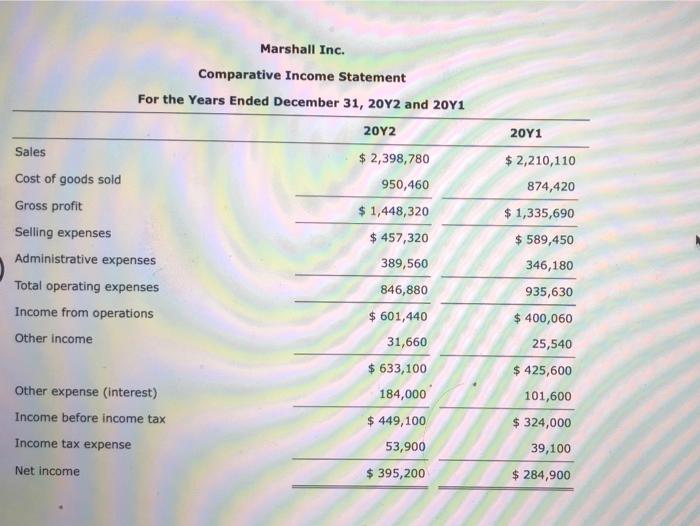

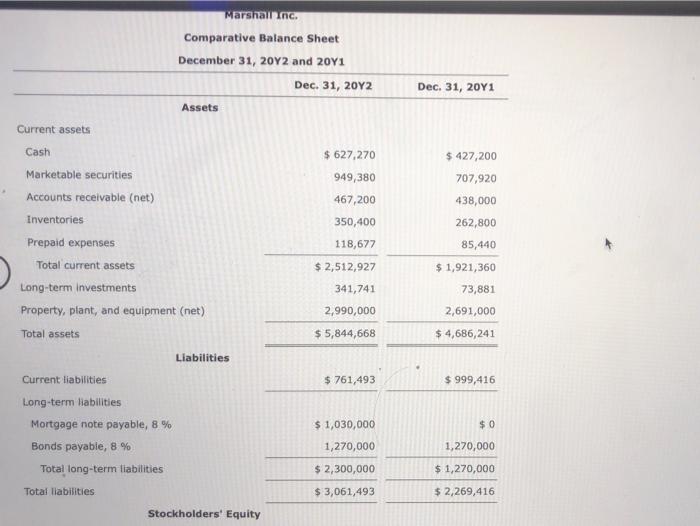

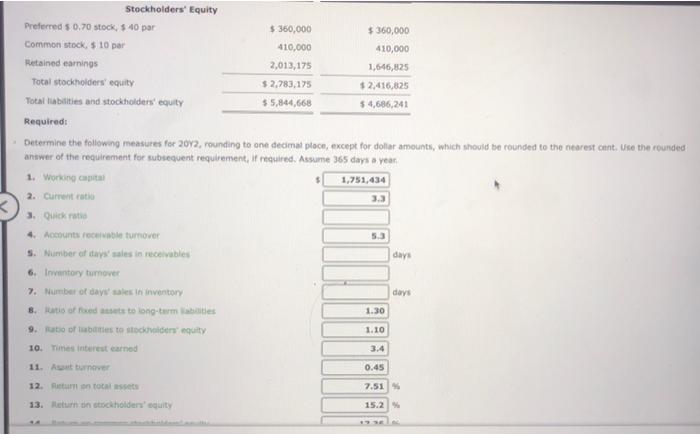

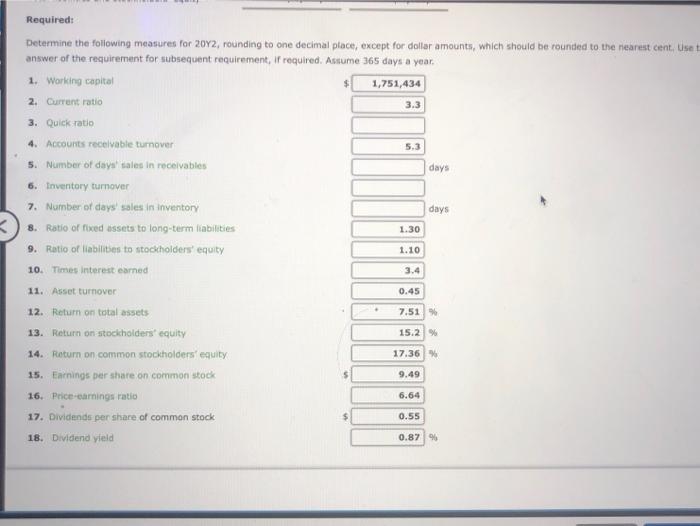

Measures of liquidity, Solvency and Profitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall Inc, common stock was $ 63 on December 31, 2012 Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 2012 and 2041 2012 2011 Retained earnings, January 1 $ 1,646,825 $ 1,390.775 Net Income 395,200 284,900 Total $ 2,042,025 $ 1,675,675 Dividends On preferred stock $ 6,300 $ 6,300 On common stock 22,550 22,550 Total dividends $ 28,850 $ 28,850 Retained earnings, December 31 $ 2,013, 175 $ 1,646,825 Marshall Inc. 2011 $ 2,210,110 874,420 $ 1,335,690 Comparative Income Statement For the Years Ended December 31, 2012 and 2041 20Y2 Sales $ 2,398,780 Cost of goods sold 950,460 Gross profit $ 1,448,320 Selling expenses $ 457,320 Administrative expenses 389,560 Total operating expenses 846,880 Income from operations $ 601,440 Other income 31,660 $ 633,100 Other expense interest) 184,000 Income before income tax $ 449,100 $ 589,450 346,180 935,630 $ 400,060 25,540 $ 425,600 101,600 $ 324,000 Income tax expense 53,900 39,100 Net income $ 395,200 $ 284,900 Marshamn Comparative Balance Sheet December 31, 2012 and 2041 Dec 31, 2012 Assets Dec. 31, 2011 Current assets $ 627,270 949,380 467,200 $427,200 707,920 438,000 350,400 262,800 118,677 85,440 $ 1,921,360 73,881 Cash Marketable securities Accounts receivable (net) Inventories Prepaid expenses Total current assets Long-term Investments Property, plant, and equipment (net) Total assets Liabilities Current liabilities Long-term liabilities Mortgage note payable, 8 % Bonds payable, 8 % Total long-term liabilities $2,512,927 341,741 2,990,000 $5,844,668 2,691,000 $ 4,686,241 $ 761,493 $999,416 $ 1,030,000 $0 1,270,000 1,270,000 $ 2,300,000 $ 1,270,000 Total liabilities $ 3,061,493 $ 2,269,416 Stockholders' Equity Stockholders' Equity Preferred $ 0.70 stock, $ 40 par $.360,000 $360,000 Common stock, $10 per 410,000 410,000 Retained earnings 2,013, 175 1,646,825 Total stockholders' equity $ 2.783,175 $2,416,825 Totaltabilities and stockholders equity $5,844,668 $ 4,686,241 Requiredi Determine the following measures for 2012, rounding to one decimal place, except for dollar amounts, which should be rounded to the nearest cnnt. Ute the rounded answer of the requirement for subsequent requirement, if required. Assume 365 days a year, 1. Working 1,751,434 2. Current ratio 3.3 3. Quick ratio 4. Accounts receive turnover 53 5. Number of days sales in receivables days 6. Inventory tumover 7. Number of days sales in inventory days 8. Ratio of fixed asset to long termes 1.30 9. tio of bestosters quity 1.10 10.Times interest earned 3.4 11. Autumn 0.45 7.51 12. um total assets 13. Return stockholders' equity 15.2 Required: Determine the following measures for 2012, rounding to one decimal place, except for dollar amounts, which should be rounded to the nearest cent. Use answer of the requirement for subsequent requirement, if required. Assume 365 days a year 1. Working capital 1,751,434 2. Current ratio 3.3 5.3 days 3. Quick ratio 4. Accounts receivable turnover 5. Number of days sales in receivables 6. Inventory turnover 7. Number of days sales in Inventory 8. Ratio of fixed assets to long-term liabilities 9. Ratio of liabilities to stockholders' equity days 1.30 1.10 10. Times interest earned 3.4 11. Asset turnover 0.45 7.51 15.2% 17.36 % 12. Return on total assets 13. Return on stockholders' equity 14. Return on common stockholders equity 15. Earnings per share on common stock 16. Price-camnings ratio 17. Dividends per share of common stock 18. Dividend yield 9.49 6.64 0.55 0.879 if someone wouldnt mind reviewing the other ones as well, ive had some mixed answers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started