Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3.6 2. Fill in the blanks: paid/received recognize revenue and decreaseot recognize revenue and increase overstated/understated overstated/understated overstatment/understatment overstatment/understatment overstated/understated Deferred Revenue Adjusting Entries Oiney

3.6

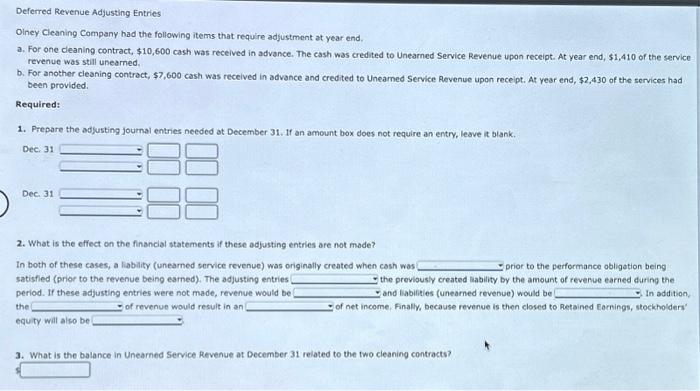

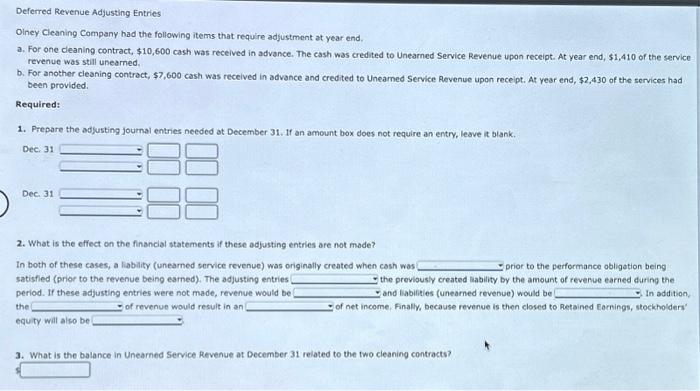

Deferred Revenue Adjusting Entries Oiney Cleaning Company had the following items that require adjustment at year end. a. For one cleaning contract, $10,600 cash was received in advance. The cash was credited to Unearned Service Revenue upon receipt. At year end, $1,410 of the service revenue was still unearned. b. For another cleaning controct, $7,600 cash was recelved in advance and credited to Uneamed Service Revenue upon receipt. At year end, $2,430 of the services had been provided. Required: 1. Prepare the ad/usting journal entries needed at December 31. If an amount box does not require an entry, leave it biank. Dec. 31 Dec. 31 2. What is the effect on the financial statements if these adjusting entries are not made? In both of these cases, a lablity (unearned service revenue) was originally created when cash was prior to the performance obligation being satisfied (prior to the revenue being eamed). The adjusting entries the previously created lability by the amount of revenue earned during the period. If these adjusting entries were not made, revenue would be and Eabilities (unearned revenue) would be In addition. the of revenue would result in an of net income. Finally, because revenue is then closed to Retained Earnings, stockholdens" equity will also be 3. What is the balance in Unearned Service Revenue at December 31 related to the two cleaning contracts

2. Fill in the blanks:

paid/received

recognize revenue and decreaseot recognize revenue and increase

overstated/understated

overstated/understated

overstatment/understatment overstatment/understatment

overstated/understated

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started