Answered step by step

Verified Expert Solution

Question

1 Approved Answer

36. Asset ALLOCATION A financier plans to invest up to $500,000 in two projects. Project A yields a return of 10% on the investment, whereas

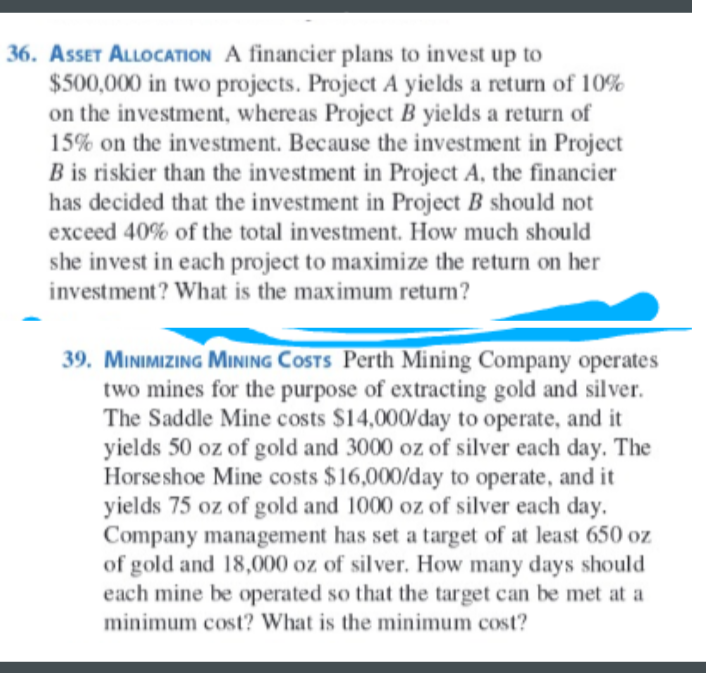

36. Asset ALLOCATION A financier plans to invest up to $500,000 in two projects. Project A yields a return of 10% on the investment, whereas Project B yields a return of 15% on the investment. Because the investment in Project B is riskier than the investment in Project A, the financier has decided that the investment in Project B should not exceed 40% of the total investment. How much should she invest in each project to maximize the return on her investment? What is the maximum return? 39. MINIMIZING MINING Costs Perth Mining Company operates two mines for the purpose of extracting gold and silver. The Saddle Mine costs $14,000/day to operate, and it yields 50 oz of gold and 3000 oz of silver each day. The Horseshoe Mine costs $16,000/day to operate, and it yields 75 oz of gold and 1000 oz of silver each day. Company management has set a target of at least 650 oz of gold and 18,000 oz of silver. How many days should each mine be operated so that the target can be met at a minimum cost? What is the minimum cost

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started