Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3-6 in a google doc or excel sheet 3-6 in a google sheet or excel doc please LE D/2001 ISA SOUTH ner gabore Job Order

3-6 in a google doc or excel sheet

3-6 in a google sheet or excel doc please

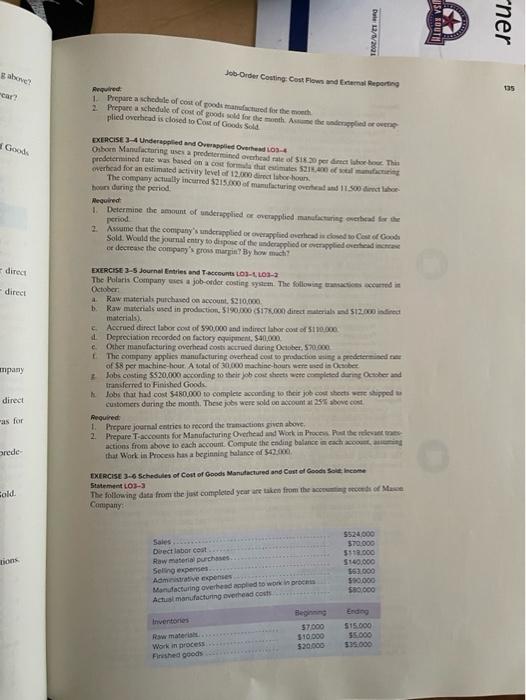

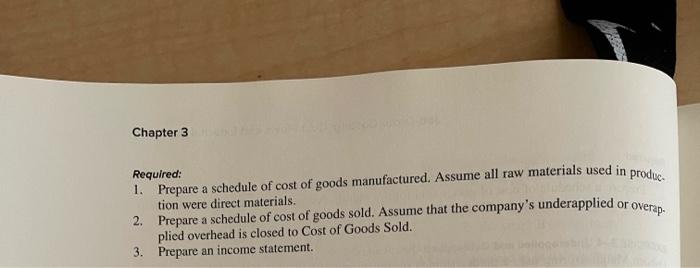

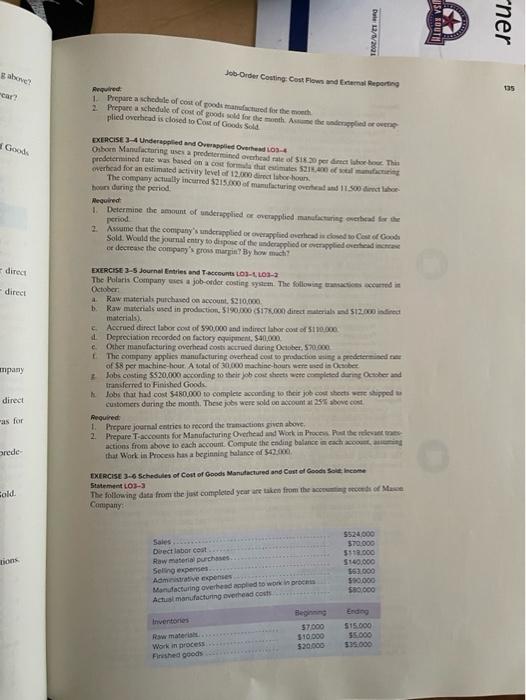

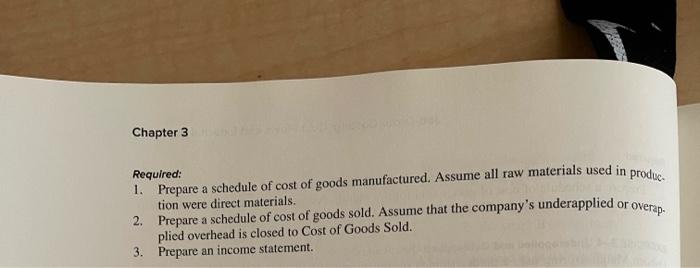

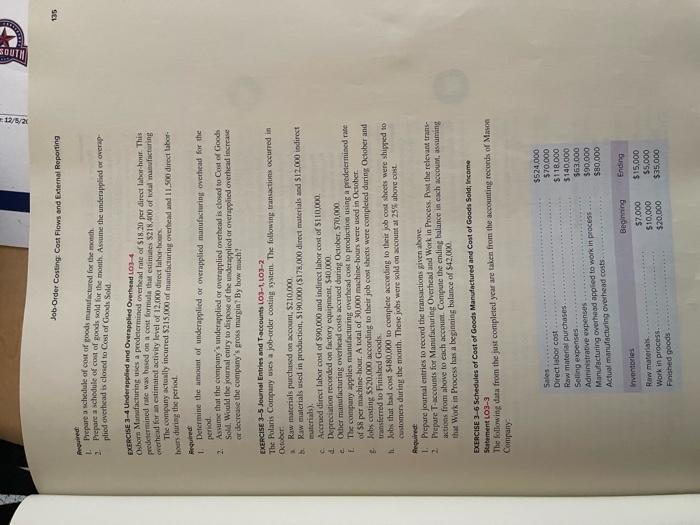

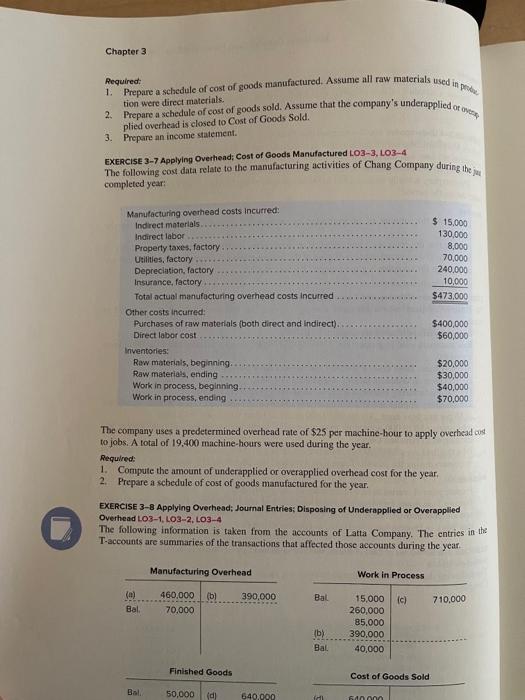

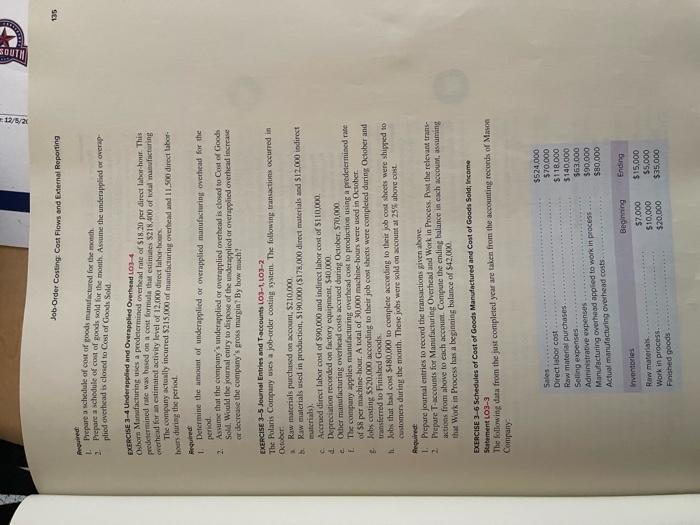

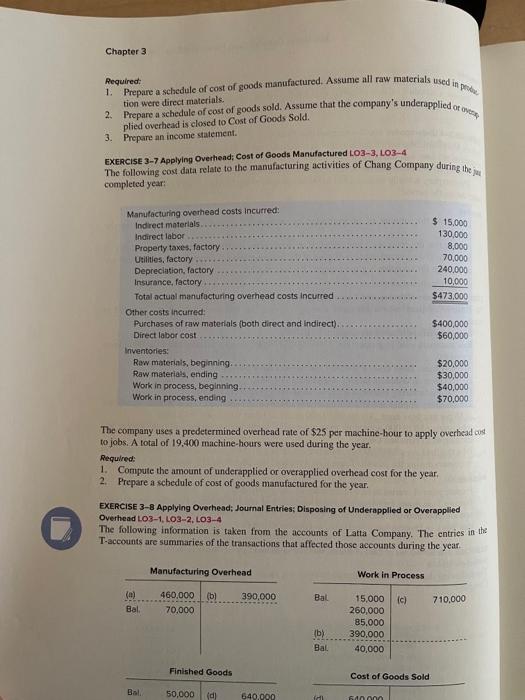

LE D/2001 ISA SOUTH ner gabore Job Order Couting Cost Flowed Reporting Required tas car? 1. for month Prepare a schedule of cost of goods sold for the trueth Arde undergoed er ovene plied overhead is closed to Cos of Goods Sold Gods BERCISE 3-4 Underaged and reached 104 Osborn Manufacturing wes a perdere vertade of 518 permet la bout. This predetermined rate was based on a coa formatum 21.00 overhead for an estimated activity level of 12.000 de litroen The company actually incurred $215.000 of manufacturing ocean 11.500 lb hours during the period Hequired 1 period Determine the amount of underapplied or overapplied man wheat for 2. Assume that the company's underapplied or overapplied overhead is too Sold. Would the journal entry to dispose of the underapplied or appliance er decrease the company's gross maria? By how much direct -direct mpany EXERCISE 3-5 Journal Entries and account LO-LON- The Polaris Company uses a job order costing system. The following credit October Raw materials purchased on account. $210,000 Raw materials used in production 5190.000 SITK.000 direct materials and 12.000 indired materials Accrued direct labor cost of $90,000 and indirect or cow of 110.000 Depreciation recorded on factory crimen, 500,000 Other manufacturing overhead costs accrued during October. 570.000 The company applies manufacturing overhead cost to proga predetermined of $8 per machine hour. A total of 30,000 machine-hours were used in cober Jobs costing $520,000 according to their job coches were completed during sober and transferred to Finished Goods lobs that had cost $180.000 to complete according to their job cochots were hipped customers during the month. These jobs were sold at 256 boveco Required 1. Prepare journal entries to record the transactions proven above 2. T-accounts for Manufacturing Overhead and Work in Process the relevant actions from above to each account. Compute the ending balance in each com that Work in Process has a beginning balance of 50.000 EXERCISE 3-6 Schedules of Cost of Goods Manufactured and cost of Good Son Income Statemet L03-5 The following data from the just completed you are taken from the code of Me Company direct as for anede fold tion Sales. Dect labor cost Raw material purchases Selling expenses Administrative expenses Manufacturing overhead eplied to w proces Actus manufacturing overhead costs 5524 000 370.000 $110.000 $140.000 153.000 500.000 580,000 57.000 $10.000 520000 Erdog $15.000 55.000 $35.000 Work in process Frushed goods Chapter 3 or overap Required: 1. Prepare a schedule of cost of goods manufactured. Assume all raw materials used in produc. tion were direct materials. 2. Prepare a schedule of cost of goods sold. Assume that the company's underapplied plied overhead is closed to Cost of Goods Sold. 3. Prepare an income statement. 12/5/2 Winos Job Order Costing Cost Flows and External Reporting 135 Pro 2 Prepare a schedule of cost of poods manufactured for the month Prepare a schedule of cost of goods sold for the month. Assume the underapplied or over plied overhead is closed to Cost of Goods Sold. EXERCISE 3-4 Underapplied and Overappled Overhead 103-4 Osborn Manufacturing uses predetermined overhead rate of $18.20 per direct lahor hour. This predetermined rate was based on a cost formula thu estimates $218.400 of total manufacturing ewerhead for an estimated activity level of 12.000 direct lahor hours The company actually incurred $215.000 of manufacturing overhead and 11.00 direct labor hours during the period Required 1 Determine the amount of underapplied or overapplied manufacturing overhead for the period 2. Assume that the company's underapplied or overapplied overhead is closed to Cos of Goods Sold. Would the journal entry to dispose of the underapplied or overapplied overhead increase or decrease the company's gross margin? By how much! EXERCISE 3-5 Journal Entries and T-accounts 103-1, LOJ-2 The Polaris Company uses a job order costing system. The following transactions occurred in October Raw materials purchased on account. $210,000 b. Raw materials used in production, S190.000 (5178,000 direct materials and S12.000 indirect muterials). Accrued direct labor cost of $90,000 and indirect labor cost of $110,000 d Depreciation recorded on factory equipment, $40.000 e Other manufacturing overhead costs accrued during October, S70,000 1. The company applies manufacturing overhead cost to production using a predetermined rate of 58 per machine hour. A total of 30,000 machine-hours were used in October Johs casting 5520.000 according to their job cost sheets were completed during October and transferred to finished Goods 1. Johs that had cost $180,000 to complete according to their job cost sheets were shipped to customers during the month. These jobs were sold on account at 25% above cost Required 1. Prepare journal entries to record the transactions given above 2. Prepare T accounts for Manufacturing Overhead and Work in Process Post the relevant trans- actions from above to each account Compute the ending balance in each account, assuming That Work in Process has a beginning balance of $42.000 EXERCISE 3-6 Schedules of Cost of Goods Manufactured and cost of Goods Sold Income Statement LO3-3 The following data from the just completed year are taken from the accounting records of Mason Company Sales Direct labor cost Raw material purchases Selling expenses Administrative expenses Manufacturing overhead applied to work in process Actual manufacturing overhead costs $524,000 $70,000 $118.000 $140,000 563.000 590.000 $80,000 Inventories Raw materials Work in process Finished goods Beginning $7.000 $10,000 $20,000 Ending $15,000 $5,000 $35.000 Chapter 3 Required: 1. Prepare a schedule of cost of goods manufactured. Assume all raw materials used in tion were direct materials. 2. Prepare a schedule of cost of goods sold. Assume that the company's underappliedot plied overhead is closed to Cost of Goods Sold. 3. Prepare an income statement. EXERCISE 3-7 Applying Overhead: Cost of Goods Manufactured LO3-3, LO3-4 The following cost data relate to the manufacturing activities of Chang Company during the completed year: $ 15.000 130,000 8,000 70,000 240.000 10,000 $473,000 Manufacturing overhead costs incurred: Indirect materials Indirect labor Property taxes, factory Utilities, factory Depreciation, factory Insurance, factory Total actual manufacturing overhead costs incurred Other costs incurred: Purchases of raw materials (both direct and indirect). Direct labor cost Inventories: Raw materials, beginning. Raw materials, ending Work in process, beginning Work in process, ending $400,000 $60,000 $20,000 $30,000 $40,000 $70,000 The company uses a predetermined overhead rate of $25 per machine-hour to apply overhead cost to jobs. A total of 19.400 machine-hours were used during the year. Required: 1. Compute the amount of underapplied or overapplied overhead cost for the year, 2. Prepare a schedule of cost of goods manufactured for the year. EXERCISE 3-8 Applying Overhead: Journal Entries; Disposing of Underapplied or Overapplied Overhead LO3-1, LO3-2. LO3-4 The following information is taken from the accounts of Latta Company. The entries in the T-accounts are summaries of the transactions that affected those accounts during the year. Manufacturing Overhead Work in Process (b) 390,000 Bal 460,000 70.000 c) 710,000 Bal 15.000 260.000 85.000 390,000 40,000 (b) Bal Finished Goods Cost of Goods Sold Bal 50,000 (d) 640,000 fal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started