Answered step by step

Verified Expert Solution

Question

1 Approved Answer

36. Is it better to buy shares of a company or its assets? 37. Does the expected value of the sales and of the

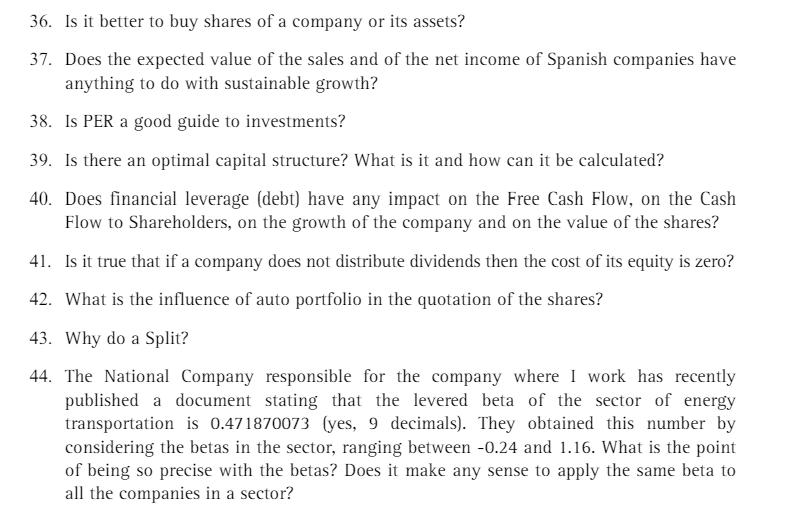

36. Is it better to buy shares of a company or its assets? 37. Does the expected value of the sales and of the net income of Spanish companies have anything to do with sustainable growth? 38. Is PER a good guide to investments? 39. Is there an optimal capital structure? What is it and how can it be calculated? 40. Does financial leverage (debt) have any impact on the Free Cash Flow, on the Cash Flow to Shareholders, on the growth of the company and on the value of the shares? 41. Is it true that if a company does not distribute dividends then the cost of its equity is zero? 42. What is the influence of auto portfolio in the quotation of the shares? 43. Why do a Split? 44. The National Company responsible for the company where I work has recently published a document stating that the levered beta of the sector of energy transportation is 0.471870073 (yes, 9 decimals). They obtained this number by considering the betas in the sector, ranging between -0.24 and 1.16. What is the point of being so precise with the betas? Does it make any sense to apply the same beta to all the companies in a sector?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started