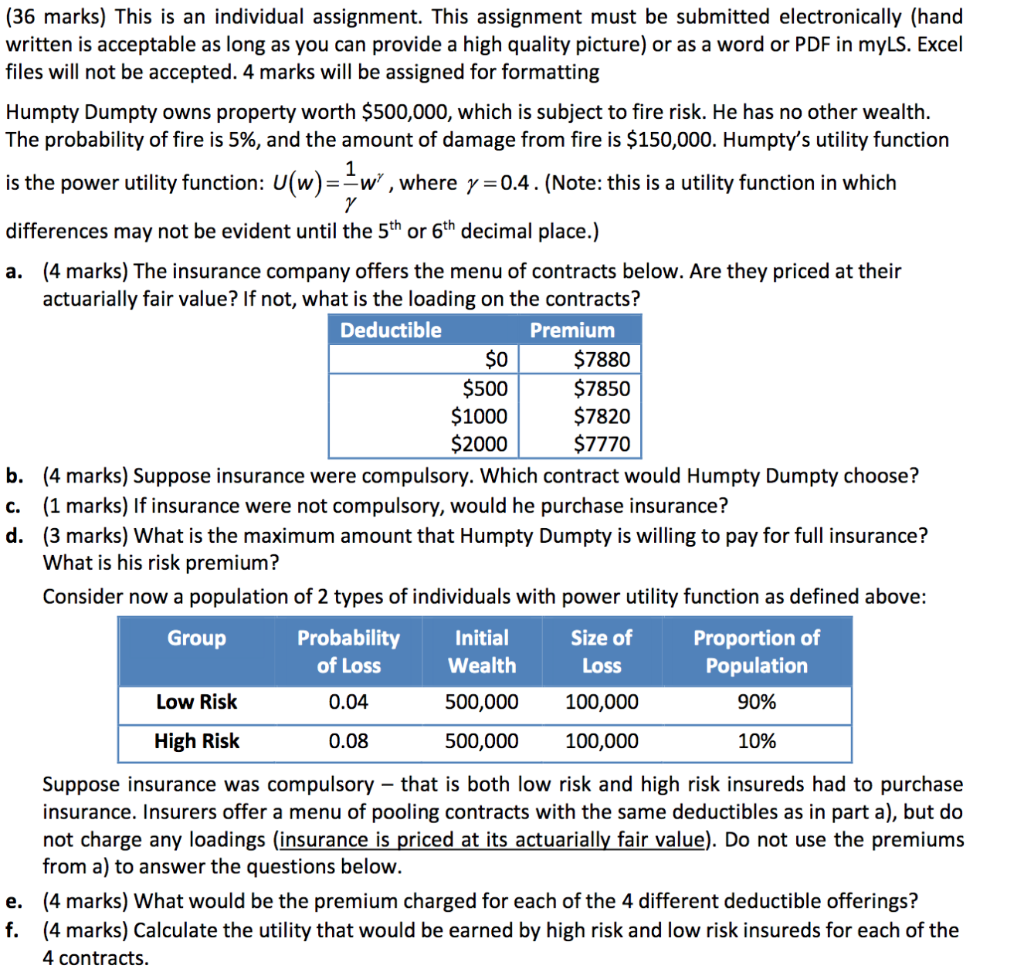

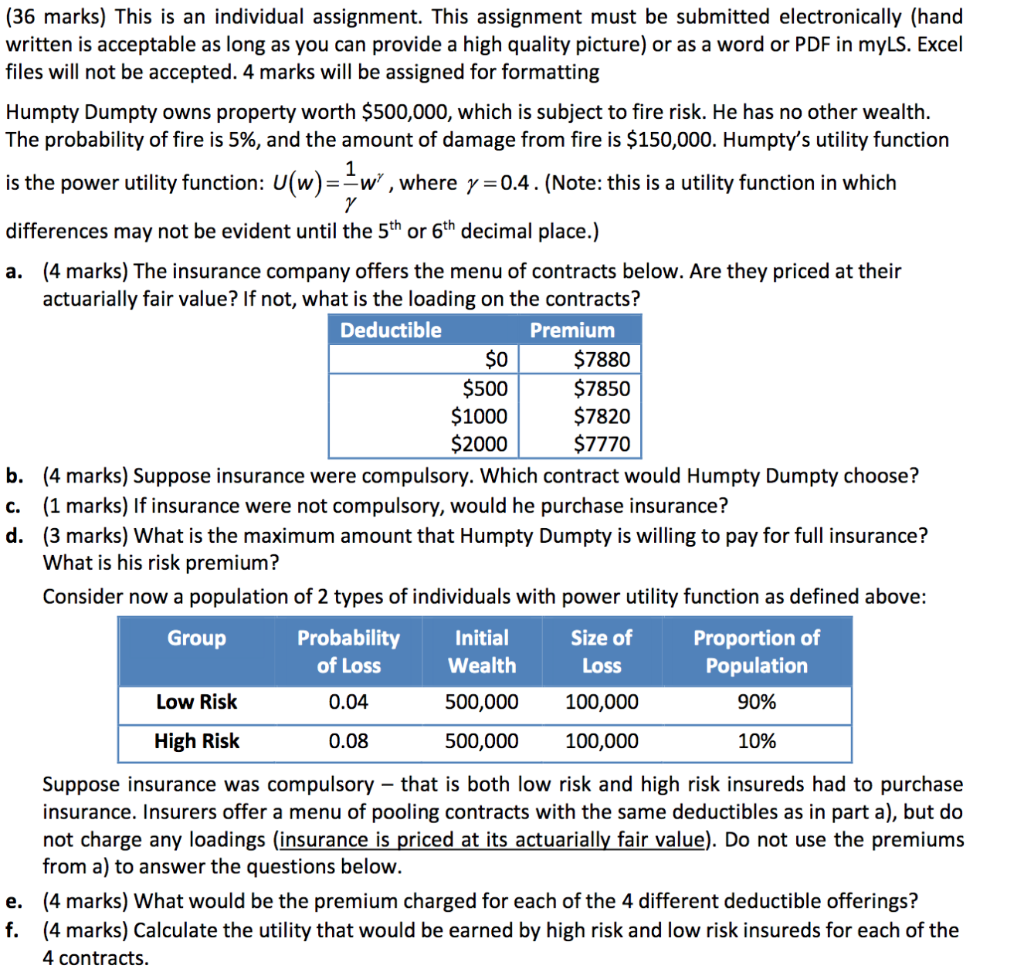

(36 marks) This is an individual assignment. This assignment must be submitted electronically (hand written is acceptable as long as you can provide a high quality picture) or as a word or PDF in myLS. Excel files will not be accepted. 4 marks will be assigned for formatting Humpty Dumpty owns property worth $500,000, which is subject to fire risk. He has no other wealth. The probability of fire is 5%, and the amount of damage from fire is $150,000. Humpty's utility function is the power utility function: U(w)=2w, where y=0.4. (Note: this is a utility function in which 1 differences may not be evident until the 5th or 6th decimal place.) a. (4 marks) The insurance company offers the menu of contracts below. Are they priced at their actuarially fair value? If not, what is the loading on the contracts? Deductible Premium $0 $7880 $500 $7850 $1000 $7820 $2000 $7770 b. (4 marks) Suppose insurance were compulsory. Which contract would Humpty Dumpty choose? c. (1 marks) If insurance were not compulsory, would he purchase insurance? d. (3 marks) What is the maximum amount that Humpty Dumpty is willing to pay for full insurance? What is his risk premium? Consider now a population of 2 types of individuals with power utility function as defined above: Group Probability Initial Size of Proportion of of Loss Wealth Loss Population Low Risk 0.04 500,000 100,000 90% High Risk 0.08 500,000 100,000 10% Suppose insurance was compulsory that is both low risk and high risk insureds had to purchase insurance. Insurers offer a menu of pooling contracts with the same deductibles as in part a), but do not charge any loadings (insurance is priced at its actuarially fair value). Do not use the premiums from a) to answer the questions below. e. (4 marks) What would be the premium charged for each of the 4 different deductible offerings? f. (4 marks) Calculate the utility that would be earned by high risk and low risk insureds for each of the 4 contracts. (36 marks) This is an individual assignment. This assignment must be submitted electronically (hand written is acceptable as long as you can provide a high quality picture) or as a word or PDF in myLS. Excel files will not be accepted. 4 marks will be assigned for formatting Humpty Dumpty owns property worth $500,000, which is subject to fire risk. He has no other wealth. The probability of fire is 5%, and the amount of damage from fire is $150,000. Humpty's utility function is the power utility function: U(w)=2w, where y=0.4. (Note: this is a utility function in which 1 differences may not be evident until the 5th or 6th decimal place.) a. (4 marks) The insurance company offers the menu of contracts below. Are they priced at their actuarially fair value? If not, what is the loading on the contracts? Deductible Premium $0 $7880 $500 $7850 $1000 $7820 $2000 $7770 b. (4 marks) Suppose insurance were compulsory. Which contract would Humpty Dumpty choose? c. (1 marks) If insurance were not compulsory, would he purchase insurance? d. (3 marks) What is the maximum amount that Humpty Dumpty is willing to pay for full insurance? What is his risk premium? Consider now a population of 2 types of individuals with power utility function as defined above: Group Probability Initial Size of Proportion of of Loss Wealth Loss Population Low Risk 0.04 500,000 100,000 90% High Risk 0.08 500,000 100,000 10% Suppose insurance was compulsory that is both low risk and high risk insureds had to purchase insurance. Insurers offer a menu of pooling contracts with the same deductibles as in part a), but do not charge any loadings (insurance is priced at its actuarially fair value). Do not use the premiums from a) to answer the questions below. e. (4 marks) What would be the premium charged for each of the 4 different deductible offerings? f. (4 marks) Calculate the utility that would be earned by high risk and low risk insureds for each of the 4 contracts