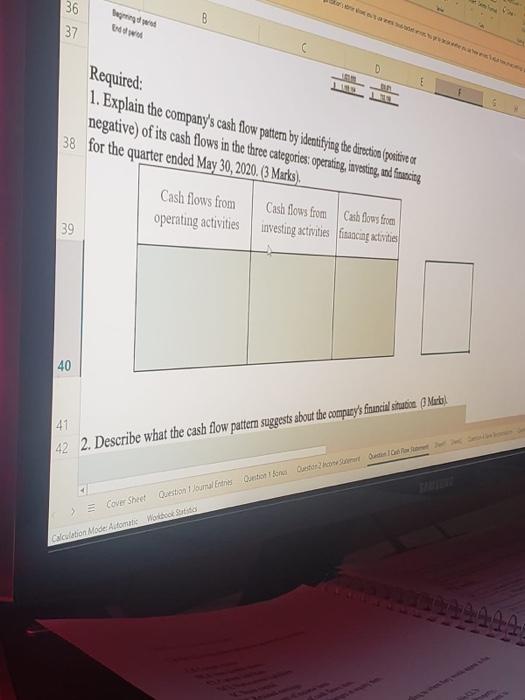

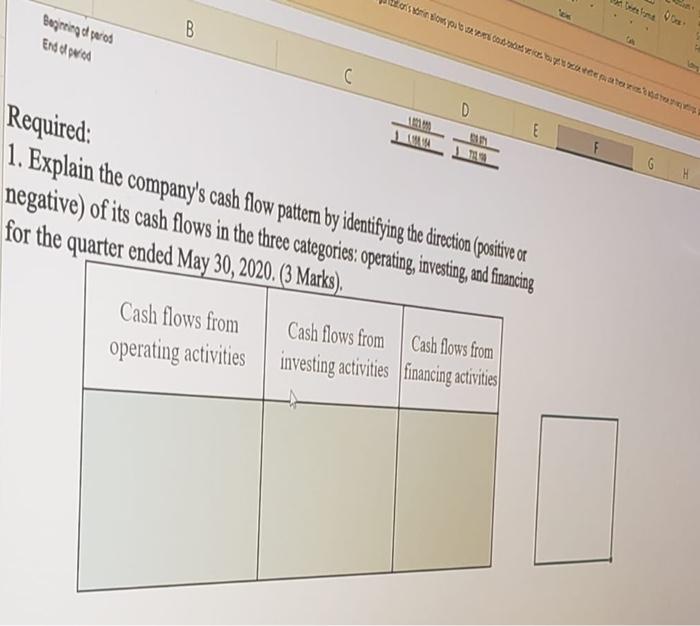

36 ng parody, w B 37 D Required: 1. Explain the company's cash flow pattern by identifying the direction (positive or negative) of its cash flows in the three categories: operating, investing, and financing 38 for the quarter ended May 30, 2020. (3 Marks) Cash flows from Cash flows from Cash flows from operating activities investing activities financing activities 39 40 41 42 2. Describe what the cash flow pattern suggests about the company's financial statica ( Murthy > Cover Sheet Qeta urtal Eestorom Calculation Mode: A Wordo Stato 41 42 2. Describe what the cash flow pattern suggests about the company's financial station. Bute). 0 43 44 45 46 47 48 49 50 51 52 53 54 55 > CowerSheer Question Journer Questo che culation Mode Automate Windo doris operate materi Begreind period Endere B B C D E G Required: 1. Explain the company's cash flow pattern by identifying the direction (positive or negative) of its cash flows in the three categories: operating, investing, and financing for the quarter ended May 30, 2020. (3 Marks). Cash flows from operating activities Cash flows from Cash flows from investing activities financing activities 36 ng parody, w B 37 D Required: 1. Explain the company's cash flow pattern by identifying the direction (positive or negative) of its cash flows in the three categories: operating, investing, and financing 38 for the quarter ended May 30, 2020. (3 Marks) Cash flows from Cash flows from Cash flows from operating activities investing activities financing activities 39 40 41 42 2. Describe what the cash flow pattern suggests about the company's financial statica ( Murthy > Cover Sheet Qeta urtal Eestorom Calculation Mode: A Wordo Stato 41 42 2. Describe what the cash flow pattern suggests about the company's financial station. Bute). 0 43 44 45 46 47 48 49 50 51 52 53 54 55 > CowerSheer Question Journer Questo che culation Mode Automate Windo doris operate materi Begreind period Endere B B C D E G Required: 1. Explain the company's cash flow pattern by identifying the direction (positive or negative) of its cash flows in the three categories: operating, investing, and financing for the quarter ended May 30, 2020. (3 Marks). Cash flows from operating activities Cash flows from Cash flows from investing activities financing activities