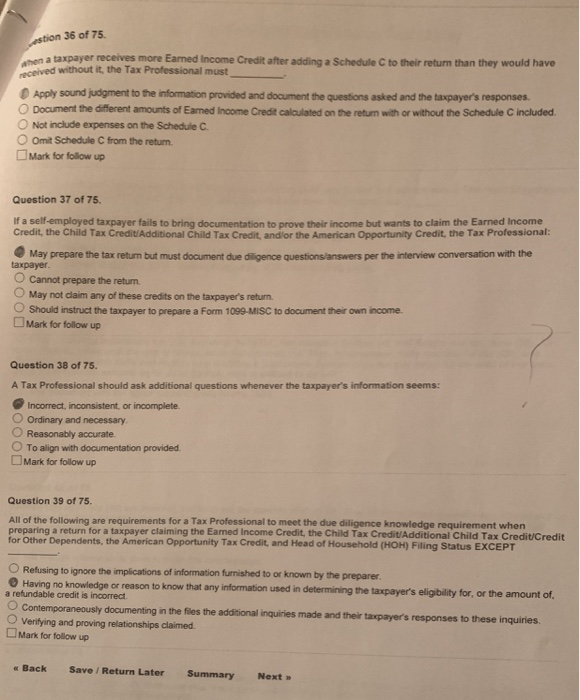

36 of 75 men a taxpayer receives more Earned Income Credit after adding a Schedule C to their return than they would have received without it, the Tax Professional must Apply sound judgment to the information provided and document the questions asked and the taxpayer's responses O Document the different amounts of Eamed Income Credit calculated on the return with or without the Schedule C included. O Not include expenses on the Schedule C 0 Omit Schedule Cfrom the return. Mark for follow up Question 37 of 75. If a self-employed taxpayer fails to bring documentation to prove their income but wants to claim the Earned Income Credit, the Child Tax Credit/Additional Child Tax Credit, and/or the American Opportunity Credit, the Tax Professional: May prepare the tax returm but must document due diligence questions/answers per the interview conversation with the taxpayer O Cannot prepare the return O May not dlaim any of these credits on the taxpayer's return O Should instruct the taxpayer to prepare a Form 1099-MISC to document their own income. Mark for follow up Question 38 of 75. A Tax Professional should ask additional questions whenever the taxpayer's information seems: Incorrect, iconsistent or incomplete O Ordinary and necessary O Reasonably accurate. O To align with documentation provided Mark for follow up Question 39 of 75 All of the following are requirements for a Tax Professional to meet the due diligence knowledge requirement when preparing a return for a taxpayer claiming the Earned Income Credit, the Child Tax Credit/Additional Child Tax Credit/Credit for Other Dependents, the American Opportunity Tax Credit, and Head of Household (HOH) Filing Status EXCEPT O Refusing to ignore the implications of information furnished to or known by the preparer O Having no knowledge or reason to information used in a refundable credit is incorrect. O Contemporaneously documenting in the files the additional inquiries made and their taxpayers responses to these inquiries know that any information used in determining the taxpayer's eligibility for, or the amount of, OVeritying and proving relationships claimed. Mark for follow up BackSave /Return Later Summary Next 36 of 75 men a taxpayer receives more Earned Income Credit after adding a Schedule C to their return than they would have received without it, the Tax Professional must Apply sound judgment to the information provided and document the questions asked and the taxpayer's responses O Document the different amounts of Eamed Income Credit calculated on the return with or without the Schedule C included. O Not include expenses on the Schedule C 0 Omit Schedule Cfrom the return. Mark for follow up Question 37 of 75. If a self-employed taxpayer fails to bring documentation to prove their income but wants to claim the Earned Income Credit, the Child Tax Credit/Additional Child Tax Credit, and/or the American Opportunity Credit, the Tax Professional: May prepare the tax returm but must document due diligence questions/answers per the interview conversation with the taxpayer O Cannot prepare the return O May not dlaim any of these credits on the taxpayer's return O Should instruct the taxpayer to prepare a Form 1099-MISC to document their own income. Mark for follow up Question 38 of 75. A Tax Professional should ask additional questions whenever the taxpayer's information seems: Incorrect, iconsistent or incomplete O Ordinary and necessary O Reasonably accurate. O To align with documentation provided Mark for follow up Question 39 of 75 All of the following are requirements for a Tax Professional to meet the due diligence knowledge requirement when preparing a return for a taxpayer claiming the Earned Income Credit, the Child Tax Credit/Additional Child Tax Credit/Credit for Other Dependents, the American Opportunity Tax Credit, and Head of Household (HOH) Filing Status EXCEPT O Refusing to ignore the implications of information furnished to or known by the preparer O Having no knowledge or reason to information used in a refundable credit is incorrect. O Contemporaneously documenting in the files the additional inquiries made and their taxpayers responses to these inquiries know that any information used in determining the taxpayer's eligibility for, or the amount of, OVeritying and proving relationships claimed. Mark for follow up BackSave /Return Later Summary Next