Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3-6 please (3) The higher an investor's indifference curve (a) the lower is the expected return (b) the higher is the level of risk (c)

3-6 please

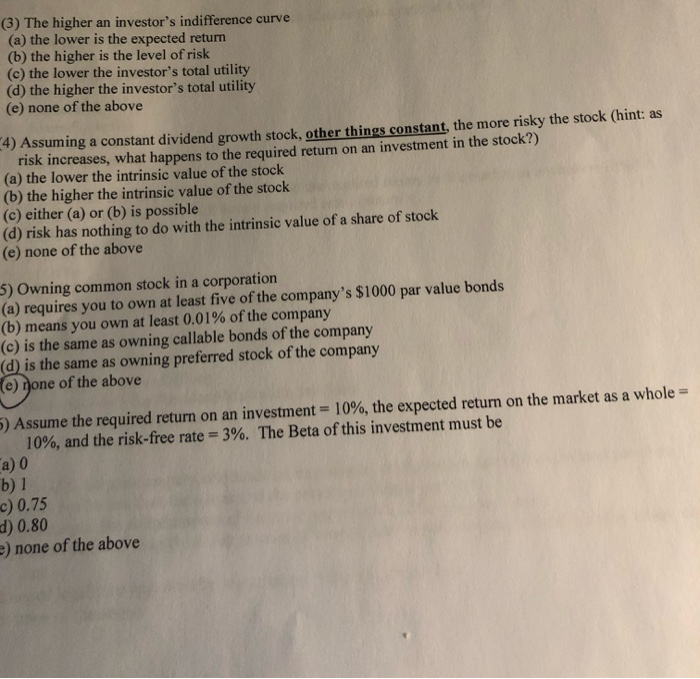

(3) The higher an investor's indifference curve (a) the lower is the expected return (b) the higher is the level of risk (c) the lower the investor's total utility (d) the higher the investor's total utility (e) none of the above 4) Assuming a constant dividend growth stock, other things constant, the more risky the stock (hint: as risk increases, what happens to the required return on an investment in the stock?) (a) the lower the intrinsic value of the stock (b) the higher the intrinsic value of the stock (c) either (a) or (b) is possible (d) risk has nothing to do with the intrinsic value of a share of stock (e) none of the above 5) Owning common stock in a corporation (a) requires you to own at least five of the company's $1000 par value bonds (b) means you own at least 0.01% of the company (c) is the same as owning callable bonds of the company (d) is the same as owning preferred stock of the company e) none of the above 5) Assume the required return on an investment = 10%, the expected return on the market as a whole 10%, and the risk-free rate = 3%. The Beta of this investment must be a) 0 b) 1 c) 0.75 d) 0.80 e) none of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started